Free guide: Investing in your 20s, 30s, 40s, 50s and 60s

Summary:

- Investing goals and strategies should change as you age – and go well beyond setting aside money for retirement.

- Educating yourself about financial tools and programs available to you is essential to maximizing your returns.

- Financial Independence, Retire Early (FIRE) is a popular movement, but the reality often means living simply to stretch your funds.

Table of contents

- Part 1: Investing in your 20s

- Part 2: Investing in your 30s

- Part 3: Investing in your 40s

- Part 4: Investing in your 50s

- Part 5: Investing in your 60s

- Part 6: Retirement planning for everyone

- Part 7: When to retire? A look at retirement ages and Social Security retirement ages

- Part 8: Wealth building and how to retire early

- Part 9: Retirement calculations

- Part 10: Build your dream retirement with M1 Finance

Introduction: Saving and investing your way to a happy retirement

In this guide, we’ll offer detailed suggestions for setting yourself up for a happy retirement by making strategic retirement saving and investing decisions in your 20s, 30s, 40s, 50s, and 60s to help you be a content retiree down the road. We’ll look at retirement savings by age, along with some other telling retirement statistics to give you a sense of what you can expect on the long road to retirement.

And if the idea of going down a long road before you become a retiree doesn’t appeal to you, don’t worry: we’ll also offer some insight into the FIRE movement – Financial Independence, Retire Early.

Very few people in the US are prepared to retire

First, though, a little background on the state of retirement and retirees in the United States. Statistics on retirement savings from the St. Louis Fed show that many Americans aren’t on track for a comfortable retirement:

- Only 56 percent of households currently have money in an employer-sponsored retirement account (including pensions, 401(k)s, and others).

- Of those who don’t have employer-sponsored accounts, only 20 percent have an individual retirement account (like an IRA or Keogh) – that’s only 8.8 percent of the total population.

- Fully 35 percent of Americans don’t participate in any retirement savings plan at all.

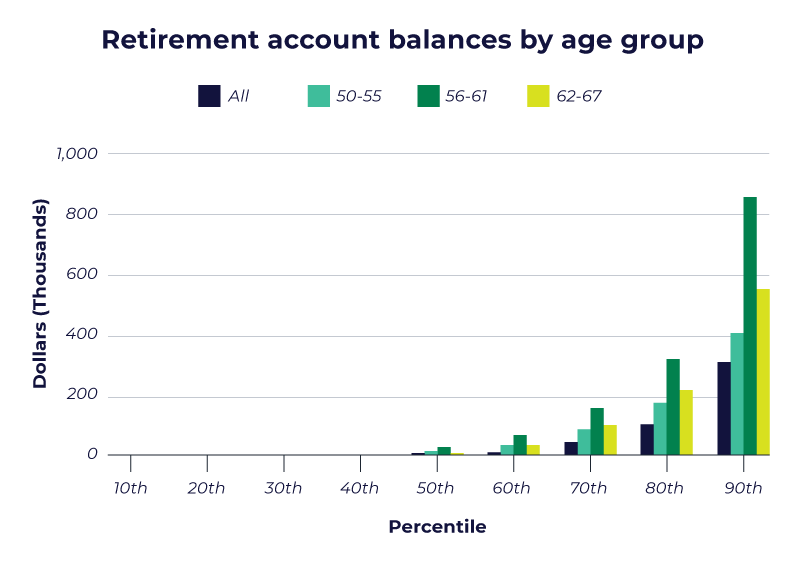

But that last number isn’t the only reason many analysts have claimed the US is approaching a “retirement crisis.” Even among future retirees who are actively saving for retirement, account balances are often shockingly low – the median account balance among all ages, according to the St. Louis Fed, is just $1,100.

And that brings us to our next point: in this guide, we’ll talk about both average savings numbers and medians. Here’s how they’re different and why it’s useful to look at both:

- Average retirement savings is a measure of what every person would have if we distributed everyone’s savings equally. So if there are 100 US citizens with a total of $1,000 in retirement savings, the average savings would be $10.

- Median retirement savings is a measure of what the person in the middle of the savings distribution has socked away. So if there are 100 US citizens with a total of $1,000 in retirement savings, but three people have $300 each and the other 97 have about $1.03, the median savings would be just $1.03.

Both measures are interesting and important for understanding the state of retirement in the US – in part because our reality is a lot closer to the second example. While the median account has just $1,100 in savings, accounts in the 95th percentile have about $612,000.

Here’s what that looks like:

If you’re reading these words right now, though, you’ve already taken the first step toward becoming a happy retiree and living a fulfilling retirement. The most powerful tool you have toward building the retirement you want is knowledge: the more you know, the better you can plan your retirement savings at any age – regardless of what the statistics show about the rest of the country.

Without further ado, here’s your guide to saving for retirement in your 20s, 30s, 40s, 50s, 60s, and beyond.

Part 1: Investing in your 20s

- Savings strategy: Start saving regularly; start an emergency fund

- Investing strategy: Start investing in at least one retirement account

- Retirement strategy: Set aside 15 percent of your income in retirement funds OR at least enough to get the full employer match

Investing in your 20s is all about getting started – unless you started investing at a very young age, in which case it’s about continuing on the right track. Many 20-somethings want to know what the best ways to invest money in your 20s are, and the short answer is that, if you’re in your 20s and engaged in your financial future – retirement savings, emergency savings, etc. – you’re already on the right track.

Of course, there’s always more to the story. So here are a few tips for beginners that can benefit you whether you’re starting your investment journey in your 20s or a little later. First, you can think of your investing journey in four parts:

- Budgeting: Setting a budget is a crucial first step for any investing goal, whether that’s to buy a house or retire at 40. Your budget is the tool that helps you take control of where you spend money so you have enough left over for the things you want (like being a 30-year old retiree).

- Saving: Saving is the next step: once you have a budget outlining where your money goes each month, it’s time to direct some of it into a savings account. Most financial experts recommend striving for three to six months’ worth of expenses in an emergency fund as a start. The average Millennial (born 1981 through 1998, the younger half of whom are currently in their 20s) has just $2,430 in savings, which is well short of a six-month emergency fund for most people.

- Borrowing: Borrowing money can take many forms; used strategically, borrowing can help you build wealth. For example, taking on a mortgage loan to finance purchasing a home.

- Investing: Investing is the final component of establishing financial security. It involves putting your money in places where it grows. Ideally, your budget will include funds put into investment vehicles like retirement accounts, real estate, and brokerage accounts.

So what’s the secret of how to invest in your 20s? Let’s look at some tips for beginners.

Understand the power of compound interest

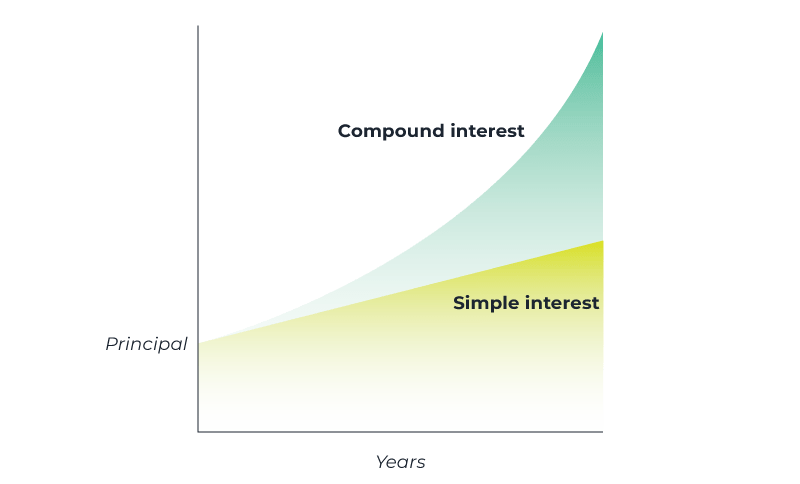

Once you’ve got a handle on budgeting and saving, one of the most important concepts you can learn while investing in your 20s is that of compound interest.

First, the concept of “simple interest:” when you invest a principal sum, say $5,000, that sum earns interest, say five percent per year. Here’s how your money would grow with simple interest:

- Year 1: $5,250

- Year 5: $6,250

- Year 10: $7,500

Compound interest means that both your principal and any interest you’ve already earned earn interest. So in the above example, for an account with compound interest compounded annually, your money would grow as follows:

- Year 1: $5,250

- Year 5: $6,381.41

- Year 10: $8,144.47

When your interest can earn interest, your money has the potential to grow much faster. When interest is calculated more often than annually, the growth potential is even greater.

Try this compound interest calculator to run a few simulations. If you’re more visually minded, the chart below is a simple representation of how money can grow with compound versus simple interest:

Over time, compound interest can turbo-charge your retirement savings and make it possible to become a retiree.

“Compound interest is the 8th wonder of the world”

Albert Einstein

Understand the matching 401(k) Plan

Another powerful tool available to those investing in their 20s (and beyond) is the matching 401(k). As you’re probably aware, a 401(k) plan is an employer-sponsored retirement savings vehicle that can help you set aside pre-tax dollars (in a traditional plan) or post-tax earnings (in a Roth 401(k) plan) to fund your retirement.

At many workplaces, employers incentivize 401(k) investments by offering what’s called a match: if you, the employee, direct money into your 401(k), your employer will match it – usually up to a certain percentage of your income, up to certain levels. You should be sure to speak to a tax advisor or professional if you have questions about the tax benefits and implications.

If your employer offers to match up to three percent of your 401(k) investment, it makes sense to set aside at least three percent of your income in that 401(k). It’s one of the most effective ways to save for retirement in your 20s – and it’s also essentially free money. The best part? Because that money is being invested, it can grow until you retire.

Set investment goals

Saving for retirement is an obvious goal for many investors – and your 20s is not too early to start. But remember that investing in your 20s doesn’t have to be all about retirement. Now is also a great time to set aside money for shorter-term goals like a down payment for a large purchase like a car or a home, a wedding or even a vacation.

Having both short- and long-term investment goals will help keep you engaged and motivated to contribute to your investments on a regular basis.

Look into robo advisors to power automated investing

Robo advisors are platforms that do the work once handled by human advisors, typically for less money than humans charge. By relying on algorithmic models created by financial professionals rather than individual human advisors, robo advisors are able to automate money management for many investors.

A great feature of robo advisors for beginners is that they offer automated investing options and minimize or completely eliminate the fees that would otherwise be associated with maintaining an investment account.

The ideal robo advisor for beginners is one that offers an automated investing option – that is, the ability to make automatic deposits every month from a bank account so that your investment can grow steadily with as little effort as possible.

Bottom line in your 20s: Start investing now

There may not be a single best investment for 20-somethings, but your 20s are an excellent time to start educating yourself about how to invest money. If you’re reading this, then you’re already on the right track. Onward!

Part 2: Investing in your 30s

- Savings strategy: Build an emergency fund of three to six months’ worth of expenses

- Investing strategy: Increase retirement contributions

- Retirement strategies:

- Set aside at least 15 percent of income in retirement funds

- Have the equivalent of your annual salary saved by age 30

- Have twice your annual salary by age 35

Investing in your 30s is less about getting started and more about fine-tuning your investment strategy to match your short- and long-term goals. By their 30s, most people have a little more income, which can mean more savings and investing options.

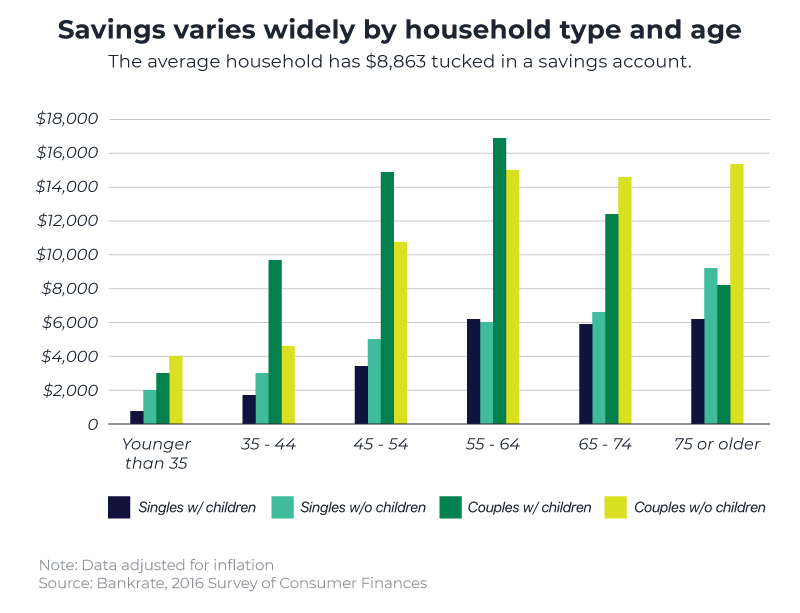

The average American has a little more in savings in their 30s, too: a median amount of $3,800 in liquid assets for those 34 to 45, according to the Federal Reserve Bank. According to the TransAmerica Center for Retirement the average thirtysomething has about $45,000 in retirement funds. But average savings varies by life stage (see chart): 30-something couples with children are on the high end, with more than $10,000 in savings. Younger 30-somethings who are single and have children have far less – closer to $2,000.

Wherever you fall on the savings spectrum, investing in your 30s can shift focus to being serious about saving for retirement. If the 20s are about building the practice of saving and investing, the 30s are about focusing your effort toward the longer-term goals that typically matter most: buying a home, retiring happy, sending your kids to college, and so on.

Saving for retirement at 30

Part of investing in your 30s should be taking part in whatever employer-sponsored retirement programs you have available, whether that’s a 401(k), a 403(b), or something else. Many financial planners recommend setting aside about 10 to 15 percent of your income toward retirement starting in your 20s, which means you should have firmly established this habit in your 30s.

(It’s important to note, though, that the 10-to-15 percent guideline is just that – a guidelines. Everyone’s individual retirement needs are different.)

In addition, you may also want to look into other investment options, like IRAs and Roth IRAs. Why open an IRA? Here are two key reasons:

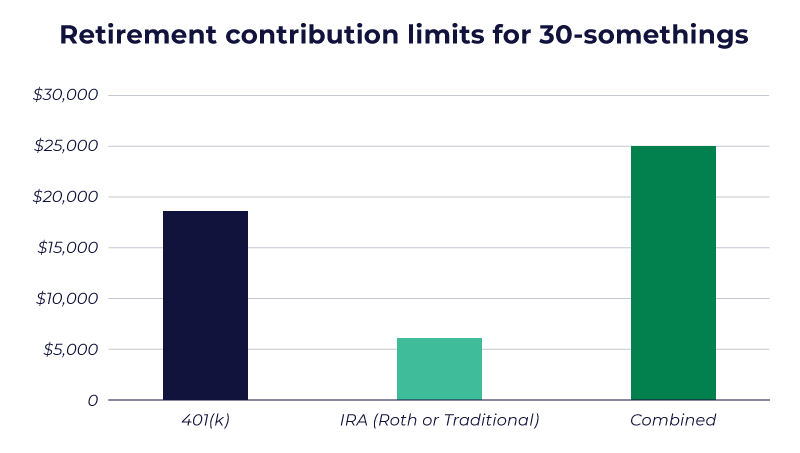

- A traditional individual retirement account (IRA) lets you set aside pre-tax money and lets it grow tax free. While the IRA is similar to a 401(k), it offers some additional benefits: first, with an IRA, you have access to more types of investments, whereas your 401(k) is limited to whatever your employer’s plan offers. Second, if you open an IRA, you can increase your total pre-tax contributions. If you max out your 401(k) by contributing $19,000, you can set aside an additional $6,000 pre-tax in an IRA.

- A Roth IRA lets you set aside after-tax money toward retirement. Like a traditional IRA, a Roth can increase your total retirement contribution. The Roth IRA also lets you pull out your principal at any time, penalty-free, and even lets you pull out your principal plus interest for certain approved expenses (including funding college, buying a first home, and a few others). As a retiree, having a Roth IRA can give you some tax flexibility if your income fluctuates.

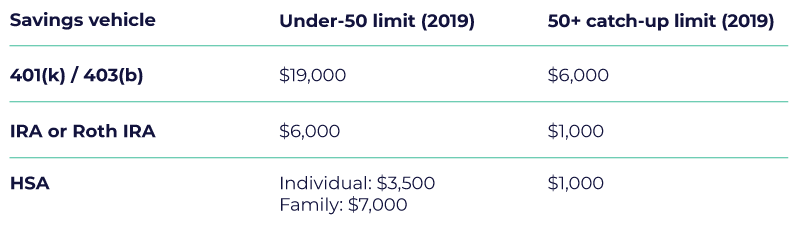

Here’s a quick glance at the retirement count contribution limits for those investing in their 30s, as of 2019.

How to invest in your 30s

Besides doing your best to max out your retirement savings in your 30s, what are some other strategies for investing in your 30s? Now may be the right time to consider higher-risk investments, as you’ve got plenty of time before becoming a retiree (unless you want to retire at 40 – more on that below).

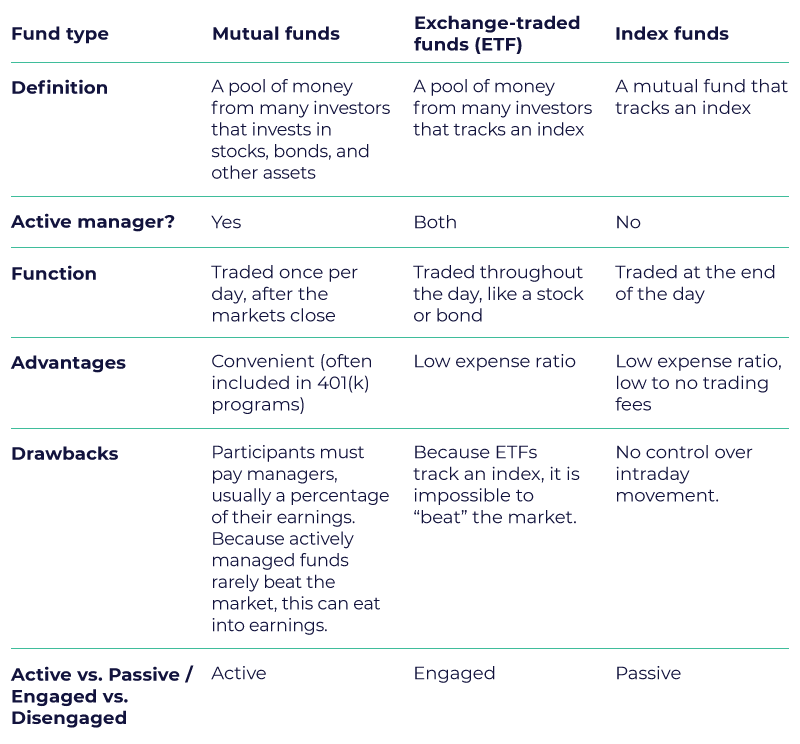

It may also be the right time to start understanding the differences between the various types of investment funds that can help you diversify your retirement accounts, including mutual funds, ETFs, and index funds. Here’s a breakdown:

For most 30-something investors, it can make sense to include all three in a retirement fund, balancing various types to match your risk tolerance.

Emergency funds in your 30s

We mentioned emergency funds in the 20-something section, and we’ll say it again here: if you haven’t yet, make sure to include an emergency fund as one of your saving and investing goals in your 30s.

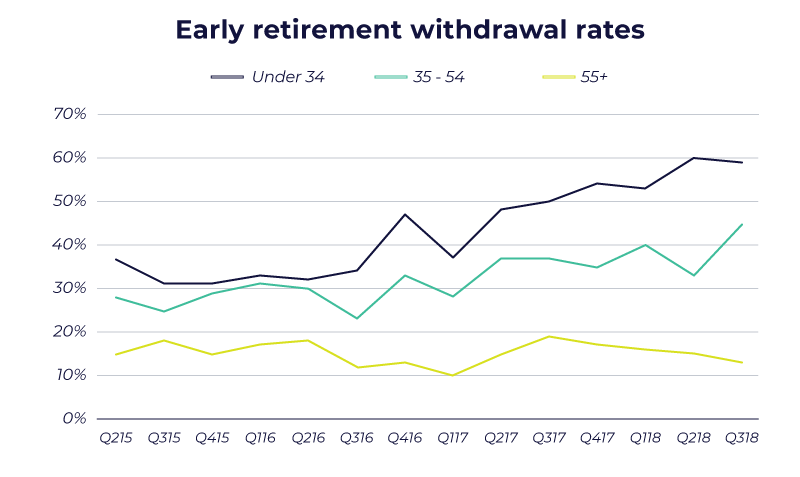

Saving for retirement is important, but if you don’t have any emergency savings, you may have to tap into your retirement funds early if something goes wrong. A lot of investors in their 30s do this – and those rates have been rising in recent years (see chart).

A recent survey found that a quarter of investors in the under-34 group have taken early withdrawals specifically to pay for education – a big no-no for investing in your 30s. While student loans can be burdensome, paying them with retirement funds can come at a high cost: 10 percent of the amount you withdraw (the early-withdrawal penalty), plus income tax.

This can come back to bite you when you’re a retiree: you lose the principal, the penalty, and whatever returns the principal would have earned.

The nice thing about investing in your 30s: most people have rising income. To make sure your retirement saving stays on track, be sure to set aside some of that income in an emergency account. For tips on how to make that work, check out this guide to building an emergency fund.

Part 3: Investing in your 40s

- Savings strategy: Maintain emergency fund, save for other expenses as needed

- Investing strategy: Diversify, keep fees low, reduce debt

- Retirement strategies:

- Have 3x your annual salary saved by 40

- Have 4x your annual salary saved by 45

Investing in your 40s is all about diversification, keeping fees low, reducing debt, and staying on track for retirement. In addition, many 40-somethings have other concrete investing goals, like saving for their children’s college education.

In their 40s, the average American has around $4,000 in liquid savings and $63,000 in retirement funds, which means most people are behind the goals laid out above. Still, most 40-somethings often have at least a couple decades before becoming retirees, which means there’s time to make up lost ground and get retirement funds on track.

There’s no single right way of investing in your 40s, but this is generally a good phase of life to take the following into account:

Diversification

Your 40s are an excellent time to think about diversification of your investments. In addition to diversifying your 401(k) and IRA, it’s wise to diversify the big-picture strategies you use to maximize your wealth now and as a retiree.

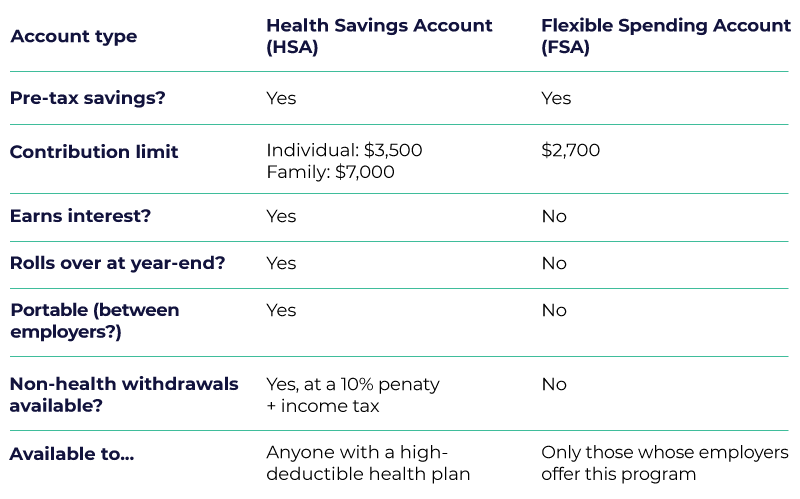

If you haven’t already, now is a good time to consider adding a health savings account (HSA) or flexible spending account (FSA) to your savings and investment mix. Depending on several factors, including the type of health insurance coverage you have, they can help minimize the amount of money you pay on healthcare, but they work a little differently. Work with your personal tax advisor to make sure you are making the choice that’s best for your situation.

Here’s how each can benefit your finances in your 40s:

Because of its ability to roll over and earn interest indefinitely, the HSA can be a powerful part of a retirement plan, especially because many retirees’ healthcare costs rise in retirement.

Funding college

Another major consideration for investing in your 40s is paying for your kids’ college education. It’s no secret that college is expensive. For the 2019 – 2020 school year, average costs in the US were as follows:

- Private college: $36,801

- Public college, out of state: $22,577

- Public college, in state: $10,116

Those costs reflect tuition and fees but not room and board, which students living away from home would also have to cover.

Luckily, there are many ways to save for college. Opening a 529 college savings plan, for example, lets you set aside funds in a tax-advantaged way toward educational expenses. There are two types of 529 plans:

- Prepaid tuition plans: The less flexible of the two, this plan lets you prepay tuition and fees at certain colleges (usually those in state). Prepaid tuition plans cannot be used to fund primary or secondary education, and they can’t pay for room and board at college.

- Educational savings plans: These plans let you save in a tax-advantaged way toward any educational expenses, including those for private primary and secondary schooling, college tuition and fees, and room and board.

If one child doesn’t end up needing the funds in a 529 account, you may transfer the funds to another eligible child. But if none of your children ends up needing the funds, you will face penalties for withdrawing it.

Other options for saving for college include…

- Roth IRA: While Roth IRAs are technically retirement accounts, they can offer some benefits as a college savings vehicle.

- Coverdell ESA: The Coverdell education savings account (ESA) (formerly called an education IRA) offers a tax-advantaged way to save for the education expenses of children younger than 18. Funds in a Coverdell ESA can be used to pay for K–12 educational costs as well as college costs.

- Brokerage accounts: While brokerage accounts don’t offer any special tax benefits for college savers, they do offer a way to grow wealth to help you cover your child’s college costs.

Investment fees

One focus of investing in your 40s should be lowering the fees you pay on your investments. If you’re not sure whether you’re paying fees on your retirement accounts, you’re not alone: about a third of Americans think they’re not paying any fees on their 401(k)s, despite the fact that 95 percent of these accounts charge fees.

The first step to lowering fees is to figure out what you’re paying, which you can do by asking your plan manager or someone at your company’s HR department.

One thing to note: if you have a 401(k) from a former employer that you never rolled over into an IRA, you may be paying higher fees than you did as an employee. If you’re in that situation, now’s a great time to roll old 401(k)s into your current 401(k) or to a single IRA on a low- or no-fee platform like M1.

Insurance

We spend a lot of time talking about retirement funds, but investment accounts aren’t the only way to save for your life as a retiree. According to the CFP Board, “Proper financial planning will usually involve obtaining some type of insurance.” Your 40s are a good time to consider adding life insurance policies to the mix:

- Whole life insurance replaces your income if you die, which helps ensure your family maintains financial security. Like all permanent life insurance policies, whole life provides lifelong coverage and includes an investment component known as the policy’s cash value. The cash value grows slowly, tax deferred, meaning you won’t pay taxes on its gains while they’re accumulating. You can borrow money against the account or surrender the policy for the cash. But if you don’t repay policy loans with interest, you’ll reduce your death benefit. If you surrender the policy, you’ll no longer have coverage.

- Term life insurance offers a cash payout if you die within a fixed period. Outside of that benefit, it offers no other value.

Debt reduction

Finally, reducing debt should be part of your retirement savings plan in your 40s. Make a point to pay down student loans, credit card debt, personal loans, car loans, and mortgages, and otherwise reduce debt. You may not emerge from your 40s debt-free, but focusing on eliminating as much debt as possible will free up more of your money to put toward retirement as the decade wears on and your retirement goal approaches.

Part 4: Investing in your 50s

- Savings strategy: Avoid taking on new debt

- Investing strategy: Take advantage of retirement catch-ups if necessary

- Retirement strategy: Have 6x to 8x your annual salary saved

The average 50-something has just over $5,000 in liquid savings and about $117,000 in retirement funds. This is far short of the goals outlined above, and can be a source of stress for would-be retirees: at 50, retirement is no longer a distant goal. It’s just around the corner.

The good news about investing in your 50s is that you can take advantage of several “catch-up” opportunities to bolster your retirement savings. If you’re behind when you turn 50, consider these:

If you max out contributions throughout your 50s, you end up funding your retirement accounts to the tune of $320,000 (which will be earning interest the whole time), plus set aside $80,000 for medical expenses.

While it’s true that most people don’t have the kind of income that makes that kind of saving possible – or may have too many expenses to make it happen – many pre-retirees can probably ratchet up retirement contributions at least somewhat.

As far as deciding how to invest your retirement funds in your 50s, keep a few principles in mind:

- Favor stocks. You may be getting closer to retiree status, but you probably have a lot of living ahead of you. A fund targeted to a retirement date 15 years away typically has about 78 percent of assets in stocks, and just 22 percent in more conservative bonds, and that may be an appropriate allocation for you in this stage.

- Diversify like crazy. Manage risk by making sure those investments are adequately diversified among industry, company size, global region, your tolerance for risk and more. This strategy can help you maximize your earning potential while minimizing the risk you face should any single part of the economy suffer.

- Focus on taxes. As outlined in the table above, there are several ways to reduce your taxable income by boosting your retirement savings. But think beyond this year, too, as you consider potential taxes on assets you might sell (like a home, if you downsize) and any inheritance you might leave (Roths tend to be easier to inherit than traditional IRAs).

In addition to investing for retirement in your 50s, you’ll want to start actually planning what your life will look like when you’re a retiree.

Planning for retirement in your 50s

If you’re still feeling young and fit in your 50s, you’re in the ideal space to plan for your retirement. Beyond your monthly and yearly cash flow, be sure to consider the following:

- Your home: A family-size house and yard can be more than some retirees care to manage in their golden years. Will you want to worry about shoveling snow or mowing if you plan to travel? What about heating, cooling, and cleaning rooms you rarely use? And how about accessibility? Will you be comfortable in the shower and on the stairs in 10 or 20 years? Now is a good time to consider these questions so you can either start hunting for a new home while moving is still easy or adapt your current home to make it last forever.

- Work: Many retirees work part-time, either out of financial necessity or because they enjoy their work but want more leisure time. If you plan to work in retirement, now is the time to start building the connections that might turn into projects after you retire. Consider taking on small projects to establish a work history you can point to down the road.

- Your health: Poor health can make for a much less happy – and much more expensive – retirement. Establishing healthier habits in your 50s can set you up for a more active and enjoyable retirement.

- Hobbies: The transition to retirement can be hard even if you’re financially ready. Your 50s are a good time to make sure you’re participating in non-work hobbies and communities you can enjoy after you punch your last time card.

Part 5: Investing in your 60s

- Savings strategy: Stay the course!

- Investing strategy: Finish strong & start enjoying retirement

- Retirement strategies:

- Have 8x annual salary saved by 60

- Have 10x annual salary saved by 67

The average 60-something American has about $8,000 in liquid savings and a median retirement fund of $172,000. Unfortunately, that may not be enough to fund a comfortable retirement, even with the average Social Security benefit of $1,413 per month.

Still, if you’ve been saving and investing strategically for the last several decades, you’re entering the home stretch when you hit 60. At this point, you’ll want to master a few important saving, spending, and investing concepts to set yourself up for a happy retirement.

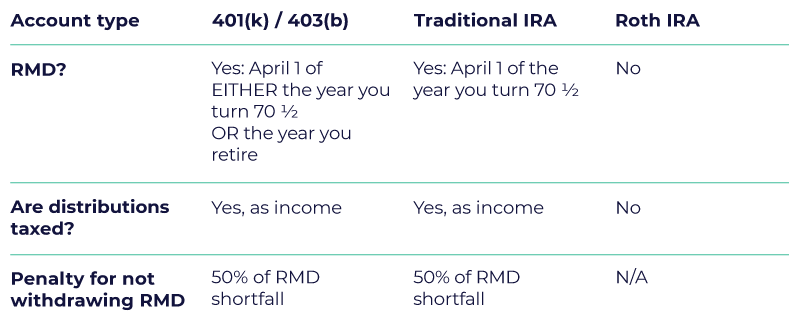

Required minimum distributions (RMDs)

If you have a tax-advantaged retirement account like a 401(k) or IRA, it comes with required minimum distributions (RMDs). RMDs mandate that you must withdraw a certain amount of money each year, starting either when you’re 70½ or when you retire.

The dollar amount of required minimum distributions depends on the specifics of your situation, but here’s how they’re handled for three common types of retirement accounts.

In other words: once you retire in your 60s or hit 70½, be sure you understand your RMDs and are taking them. Retirees who don’t understand these requirements can face steep tax penalties and may not have the full benefit of the funds they worked so hard to save. Again, you should work with your personal tax professional to make sure you fully understand these and other tax issues.

Risk (and lower-risk investments)

The Social Security Administration estimates that a woman nearing age 65 today can expect to live to about 86.5 and a man approaching 65 can expect to live to 84. So if you retire at the standard age of 66 or 67, you’ll need enough money to fund about two more decades.

For many people in their 60s, that means shifting to low-risk investments to ensure that your nest egg continues to grow modestly to beat inflation. One strategy, called the “glide-path” strategy, is to subtract your current age from 100, turn the difference into a percentage, and invest that percentage of your retirement savings in stocks and the remainder in bonds, CDs, and money market funds.

Spending control

Just as important as managing how much your retirement nest egg is earning is making sure you adjust your lifestyle to make sure your spending is under control so that you don’t run out of money as a retiree.

Managing your expenses can take many forms; in your 60s, here are some strategies to try to keep your cost of living modest:

- Eliminate debt: Paying interest every month eats into your ability to save for retirement. When you retire, interest can strain your fixed income. In your early 60s, while you’re still working, make every effort to pay off existing debts to eliminate interest payments in retirement.

- Embrace senior discounts: Starting at age 55, you may be eligible for senior discounts on everything from movie tickets to phone bills to groceries to vacations. Taking advantage of senior discounts can help keep your monthly spending in check in your 60s.

- Downsize: If maintaining a large home will cost more than you care to spend as a retiree, consider selling and opting for a smaller house or condo. If you’re adventurous (or in serious need of savings options), consider moving to a less-expensive part of the country.

- Review your life insurance: If your dependents are all now independent, you may not need as much life insurance coverage as you once did. Review your policy in your 60s with an insurance professional to make sure monthly premiums aren’t eating away at your nest egg.

That brings us to one final consideration for near-retirees.

Working and supporting adult children

Working in retirement can be both rewarding and necessary. But what about continuing other habits, like supporting children? Fully 79 percent of parents of adult children provide some financial support, and 72 percent say they’ve done so at the expense of their own retirement savings.

In your 60s, as retirement gets closer, it may become more difficult or even impossible to continue offering that support. If you’re going to have to cut off funds your children have come to expect, you’ll probably want to have a frank conversation with them so they can adapt their own finances.

Part 6: Retirement planning for everyone

While the specifics of retirement planning look different in your 20s, 30s, 40s, 50s, and 60s, there are some basic retirement planning strategies that can help prepare anyone for a happy, healthy retirement.

The first rule of retirement planning is simply to do it. Seek out information about different types of retirement plans to see which might work best for you. Be realistic about your spending and saving and how you can adjust the balance to set yourself up to be a successful retiree.

While the ideal retirement will look a little different for everyone, here’s a pre-retirement checklist of things to do to help make sure you’re on the right path to retire happy.

- Take a snapshot of your finances. Whether you’re 20, 30, 40, 50, 60, or older, you can’t plan for retirement if you don’t know exactly what your financial situation is today. Set aside time on your next day off to look at your financial profile: income, expenses, debts, and investments. Figure out when you want to retire, how much you’ll need to cover expenses each month (try this inflation calculator to get a ballpark idea), and how much you’ll need to save to reach that sum with typical rates of return (a safe bet is to assume six percent return on stock market investments). When you know how much you need to set aside each month to fund your retirement, you can work backwards to see how to fund your bills, pay off your debts, and enjoy yourself in the present.

- Make a retirement plan. Don’t worry about figuring out the best plan. Just make a workable plan. You should revisit it every year or so when you’re younger and more often when you’re approaching retiree status to make sure it still makes sense and you’re still on track to fund your retirement.

- Get or stay healthy. Healthcare expenses tend to balloon for retirees, especially those with chronic diseases. But because so many chronic diseases are preventable with lifestyle adjustments, adopting healthy habits today can translate to incredible financial savings in your retirement – not to mention the quality of life improvement. As you plan your pre-retirement budget, keep in mind that purchasing healthy foods and making time to sleep, be active, and engage with loved ones are all crucial investments in your long-term wellness.

- Educate yourself about retirement. Your retirement saving options are nearly endless, as are the strategies you use to fund your retirement. And they’ll keep evolving: think of all the ways the launch of the internet changed the investment tools available to the average person. Thirty years ago, people had far fewer options for low-fee and even free investing platforms; those who have ignored these options may be paying far more than they need to in fees.

- Increase your income. One of the simplest ways to turbo-charge your retirement savings is to potentially earn more money and funnel the excess into retirement accounts. But simple doesn’t always mean easy. As you plan your retirement, be proactive about opportunities to increase your income, whether that’s by asking for a raise, investing in training that will qualify you for higher-paid work, moving to an area with higher-paid jobs, or taking on a part-time or side gig. Not all of these options are practical or even possible for everyone, but if it is possible to potentially earn more today, the power of compound interest could turn that to a substantial increase in retirement savings.

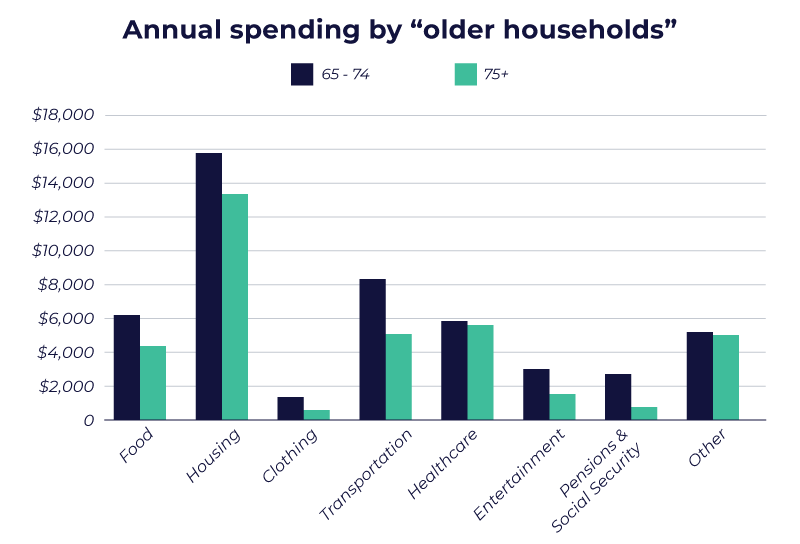

To make things a little more concrete, it may help to know what the average retirement budget looks like. According to the Bureau of Labor Statistics, the average “older” American households of people aged 65 to 74 have yearly income of $52,366. Those age 75+ have yearly income of $35,467. Here’s how their spending breaks down:

Worth noting: healthcare accounts for nearly $6,000 per year in retiree expenses – more than triple what the 75-plus group pays in entertainment. We’re not kidding about adopting a healthy lifestyle now.

Part 7: When to retire? A look at retirement ages and Social Security retirement ages

Of course, your retirement planning depends a lot on when you want to stop working and when you want to start collecting Social Security benefits. These decisions can have a major impact on your income in retirement.

First, a look at Social Security benefits.

Social Security is a national pension system that provides income in retirement. The Social Security taxes that come out of every paycheck you get fund the program; that’s what will make it possible for you to collect a check every month in retirement.

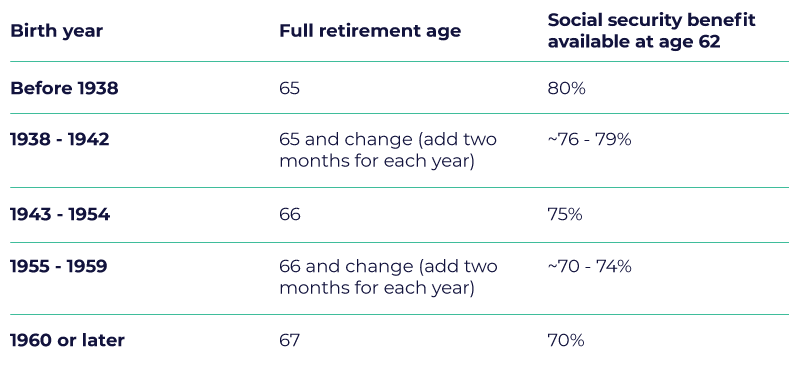

While Americans are eligible to start collecting Social Security benefits at age 62, doing so doesn’t always make financial sense. That’s because 62 is below “full retirement age” in the USA.

So what is full retirement age? It actually depends on when you were born.

Here’s a breakdown of who can collect how much Social Security when.

The takeaway here is that, if at all possible, it’s best to wait until you reach full retirement age to start collecting Social Security benefits. This will ensure that you get the maximum amount per month, which can help ensure financial security in your retirement.

Of course, if it’s not feasible to wait until you reach full retirement age, you can collect benefits earlier; eligibility still begins at 62, though Americans, moving forward, will be eligible for less and less of their full Social Security benefits at that age.

On the flip side, though, the gradually increasing full retirement age in the USA reflects Americans’ longer life expectancy. While it’s not always possible to continue working in your 60s, the ideal scenario would be to work full time until you reach full retirement age.

This lets you spend more time earning money and funding retirement accounts and also sets you up to collect a greater Social Security benefit each month when you do retire.

Of course, if you hope to retire at 40 or even at 35, working well into your 60s doesn’t sound like a happy retirement at all (unless you love your job, in which case, you’ll never work a day in your life, as they say).

The FIRE movement (financial independence, retire early) has gained steam in recent years, and there are many bloggers and professional inspirers online documenting their journeys to retiring at 40 and otherwise gaining financial independence so they can kiss the working world goodbye.

FIRE enthusiasts are passionate about retiring by 40 (or 30 or 50). If this appeals to you, read on.

Part 8: Wealth building and how to retire early

Throughout this guide, we’ve cited average savings numbers and average retirement account balances for various age groups. Those numbers reflect the reality that the United States is a country of great inequality: while many people have little to nothing in savings, others have more than enough.

The important thing to know if you want to retire early is that you don’t have to be a billionaire. That’s not to say that it’s an easy goal to achieve, but if you’d like to retire by 40 or 50 (and you still have a few years until you reach that age), you may be able to make it a reality.

How? FIRE enthusiasts typically follow some or all of these principles to retire early (and enjoy a happy retirement):

- Save 75 percent of income for about 10 years. This is not a perfect formula for how to retire early, but it’s close to what many early retirees do. While working a typical nine-to-five job, those wishing to retire in their 40s or 50s live on just 25 percent of what they earn.

- Live frugally. Obviously, most people can’t save 75 percent of income without scaling back their lifestyle. The tradeoff many early retirees make is accepting a less-extravagant lifestyle in exchange for fewer years working. One common criticism of the early retirement movement is that it forces people to sacrifice quality of life; if you enjoy the finer things, FIRE is probably not the right plan for you.

- Save and invest. A typical goal for a FIRE adherent is to save 25 times their annual expenses. Of course, that money doesn’t sit in a savings account. Key to making early retirement work is figuring out how to invest your savings so that you can live off the growth of those investments for 70 or so years.

- Have a plan. Early retirement may sound wonderful, but it’s also challenging. Before quitting your job, spend a lot of time crunching the numbers: how much will you live on? How often will you reassess your investments? Where will your health insurance come from? Will you continue working in early retirement? Some FIRE adherents do, taking on part-time work to pay current expenses and cushion their savings.

Another thing to think about if you decide to retire young: your Social Security benefits will be significantly lower than if you worked until full retirement age. That’s because the Social Security Administration (SSA) calculates monthly benefits based on your 35 highest-earning years in the workforce.

If you have fewer than 35 years in the workforce, the SSA tallies 0 for any years you didn’t work, then averages your earnings. Obviously, that will translate to lower Social Security checks. But if your happy retirement is an early retirement, you’re probably invested in funding it independently anyway.

Another important consideration: for most people, early retirement is not the same as getting rich. More often, the FIRE movement is about building wealth and achieving financial freedom – not becoming rich.

This is an important difference. Early retirement advocates typically seek…

- Financial independence.

- Freedom from the typical workforce.

- Time to pursue personal relationships and hobbies.

- Fulfillment through non-material and non-monetary avenues.

Further, they are willing to live frugally to avoid being dependent on a nine-to-five job. For most who adopt the FIRE lifestyle, getting rich is not part of the equation. While they focus on building wealth, the goal is not to use that wealth to fuel a high-caliber lifestyle but rather to make it possible to live according to their own rules.

So what might it take to retire at 30, 40, or 50? And for that matter, what might it take to retire at 67? For a general idea of what you may have to save to achieve a happy retirement, let’s look at some sample retirement calculations. It’s important to note that these are sample calculations only and may not be indicative of your particular situation.

Part 9: Retirement calculations

Statistics about average retirement savings are nice, but when it comes down to it, most people want to know the hard facts:

- How much do I need to retire?

- When can I retire?

- How can I know if I’m on track with my retirement savings?

These are complex questions. Luckily, there are several retirement calculators available to help us answer them, but here are two that some of our investment experts like to use: the SmartAsset retirement calculator and the AARP retirement calculator.

Let’s use them to run a few scenarios based on the average savings rate we identified earlier in this piece.

Retirement scenario 1: Typical 20-something

Name: Tina Twentysomething

Age: 26

Salary: $36,610

Retirement age: 67

Retirement account balance: $16,000

Tina is your average 20-something. She’s got savings and retirement accounts that are typical for her age, and she earns the average income. The SmartAsset retirement calculator asks for all this information to make an estimate about when Tina can retire and how much she’ll need to do so.

For this calculation, we assumed Tina’s annual expenses during retirement will be $50,000.

SmartAsset projects that Tina will need $1,907,448 for a happy retirement, meaning she’ll have to save at least $1,126 per month, which is roughly half of her take-home salary.

The good news: While Tina may not be able to save 50 percent of her income right now, she’s at the beginning of her career and so is likely to potentially earn more and more as she gets older. As long as she increases her monthly savings whenever her income rises, she increases the chances that she will be able to meet her retirement goals.

The better news: Because Tina did these calculations in her 20s, she has a clear sense of what her monthly retirement savings should be and can start budgeting to meet them.

The bottom line: Tina has a good chance of reaching her retirement goals assuming she increases her monthly retirement savings.

Retirement scenario 2: Early retirement

Name: FIRE Freddy

Age: 35

Salary: $75,000

Retirement age: 50

Retirement account balance: $100,000

Freddy recently learned about the FIRE movement and it’s lit a fire under him: he’s now fully committed to the goal of retiring early – at 50. Right now, he’s in the 75th percentile of earners his age, pulling in about $75,000 per year.

The good news is that he’s been fairly diligent about saving for retirement up until now and has about $100,000 in his various accounts – but he was planning to retire at 67. To figure out what it will take to retire 17 years early, we ran his numbers through the AARP’s retirement calculator.

AARP estimates that Freddy will need $1.274 million to retire, assuming he commits to a more modest lifestyle once he stops working.

At his current rate of saving, setting aside just 15 percent of his earnings each year, he’ll only have $544,453 at age 50 – a shortfall of nearly $730,000.

So with 15 years until retirement can Freddy still manage to start a happy retirement at 50? Maybe, if he…

- Increases his current income.

- Maxes out his 401(k) and IRA contributions.

- Saves 75 percent of his taxed income.

If Freddy stays in the 75th percentile of earnings, he’ll average about $80,000 per year in income for the next 15 years. Now let’s get into the math:

- Maxed-out 401(k) contributions will mean $19,000 saved per year.

- Maxed-out IRA contributions will mean $6,000 saved per year.

- Because the above comes out pre-tax, Freddy’s taxable income is reduced to $55,000, which puts him in the 22 percent tax bracket, meaning his take-home pay is about $48,400 (we won’t worry about state taxes right now). To achieve the goal of saving 75 percent of income, Freddy has to set aside $35,000 of that.

- Over 15 years of this plan, he’ll have put away $900,000. Along with the $100,000 he already has, that’s $1 million even for retirement – still a shortfall of about $274,000.

To get to his retirement savings goal, Freddy could…

- Work an additional five years, saving 75 percent of his income.

- Find ways to increase his income about $18,300 per year until retirement and save the entire amount.

- Retire from full-time work at 50 but continuing working part time to cover expenses while his retirement savings keeps growing.

The bottom line: Freddy’s FIRE dream is possible, but not without a lot of hard work and sacrifice. As it is, we’ve left Freddy just $13,400 to live on each year, which may not be enough to cover rent in much of the country.

Retirement scenario 3: Forties Fran

Name: Forties Fran

Age: 47

Salary: $49,000

Retirement age: 67

Retirement account balance: $375,000

Fran has been earning median wages for 25 years now, putting away 15 percent of her earnings each year. She’s 47 and hoping to retire at 67. She’s married and her husband has a similar amount of savings.

According to the SmartAsset calculator, Fran and her husband are right on track. Saving at their current rate will yield leave them with $1,082,852 when they hope to retire at 67, which is plenty to provide $50,000 per year of living expenses.

The bottom line: Slow and steady wins the race. Fran and her husband aren’t high earners, but because they started saving early and did it consistently, they’re should be track to retire comfortably.

Retirement calculation takeaways

If these retirement calculations were eye-opening, that’s good. Running the numbers is an excellent way to remind yourself what it takes to earn and save enough money to quit working altogether.

A few takeaways if you’re wondering when you can retire:

- Run your numbers to get a realistic sense of what your retirement situation will be based on your current behaviors.

- Visualize yourself in retirement: where will you live? What will you do each day? Research shows that visualizing retirement in detail is one of the most effective ways to motivate yourself to prepare for it financially.

- Commit to your health and wellness. Retiring at 67 can be rewarding if you’re still energetic at that age. Maximize your odds of making that happen by taking time for your health now. Bonus: you’ll probably also enjoy the years between now and then more.

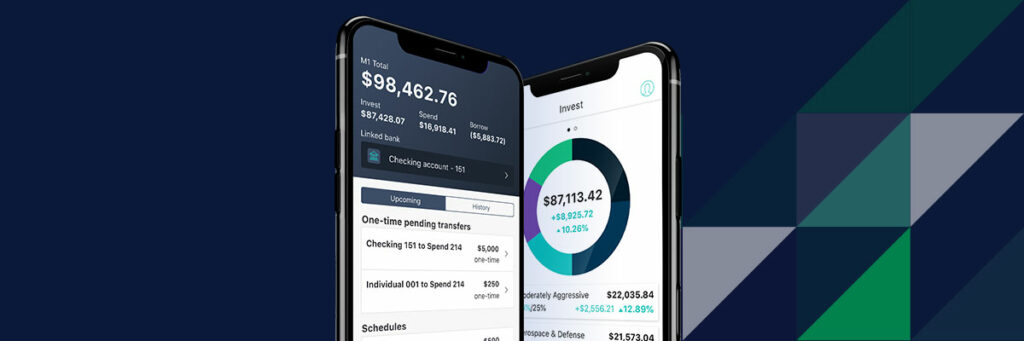

Part 10: Build your dream retirement with M1 Finance

Whether you’re in your 20s, 30s, 40s, 50s, 60s, or beyond, maximizing your retirement savings by minimizing the fees you pay is one of the surest paths to a happy retirement. M1 Finance is an ideal investment platform for those saving for retirement because it’s completely free to use, which means you keep the money you earn.

That makes M1 a particularly compelling alternative for people who have retirement accounts with financial advisors, which charge average management fees of one to two percent of assets under management.. Over the years, those seemingly small fees can eat away tens of thousands of dollars of your retirement money.

Luckily, rolling over an existing IRA is easy; simply follow the instructions here.

And it’s even easier to start a new IRA or Roth IRA: just create an account, create investment “slices” to fill your investment pie, and set up transfers from your bank.

M1 Finance makes it easy to set yourself up for a happy and well-funded retirement with features like…

- Automated contributions: Set up a recurring deposit from your bank account so your investment grows without your having to think about it.

- Automatic rebalancing: Our algorithms keep your portfolio balanced to your specifications, which means you don’t have to worry about market fluctuations over-exposing you to one type of investment or risk.

- Model Portfolios: Tap into the knowledge of expert investors by using their “Pies” (aka investment portfolios) for your investments. You can even use an Model Portfolio as a slice of your Pie!

- Fractional shares: You can invest in stocks regardless of their share price even if you don’t want to buy a full share (or can’t afford to, based on your risk tolerance). Fractional shares make it possible to invest the exact dollar amount you want in the companies you admire.

- Integrated cash account: Take advantage of M1 Spend to tie a debit card directly to your investment accounts so you can access your money as easily as you would through a checking or savings account.

Ready to get started? Open an account today. It’s free and it’s a smart way to set yourself up for a happy future.

Download this infographic on Investing in your 20s, 30s, 40s, 50s and 60s.

Check out these other investment and retirement articles:

M1 Borrow portfolio loans program

How does automatic investing in stocks work?