M1 vs. TD Ameritrade

You’re building a better financial future, but is TD Ameritrade as powerful and flexible as you need? See how M1 does more to help you push each dollar further.

Featured in:

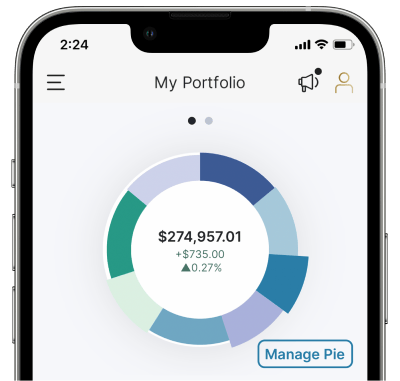

Invest in a new way

M1 Pies help organize and drive your investing strategy. Each Slice can contain an individual investment, another Pie, or even a group of Pies.

Visual clarity

See how much of your overall portfolio a certain Slice takes up and adjust as needed. You can even rebalance with one click.

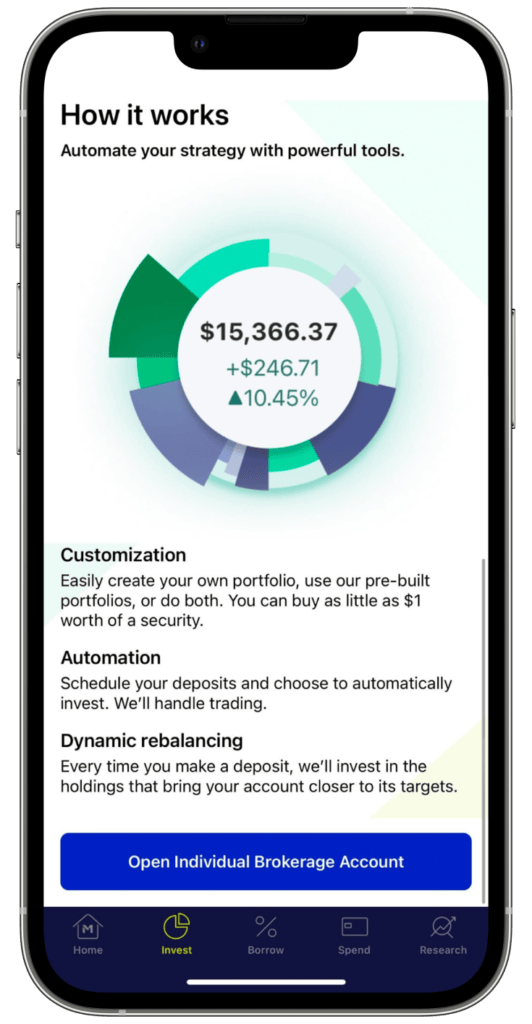

Automation

Contributions are allocated according to targets you set, helping you save time, stay balanced, and dollar-cost-average with more discipline.

Always commission-free

Commission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Other fees may apply such as regulatory, M1 Plus membership, account closures, and ADR fees. For complete list of fees, visit m1.com/legal/disclosures/misc-fees

Add stocks and ETFs (or crypto) to your Pie and automate commission-free trading.

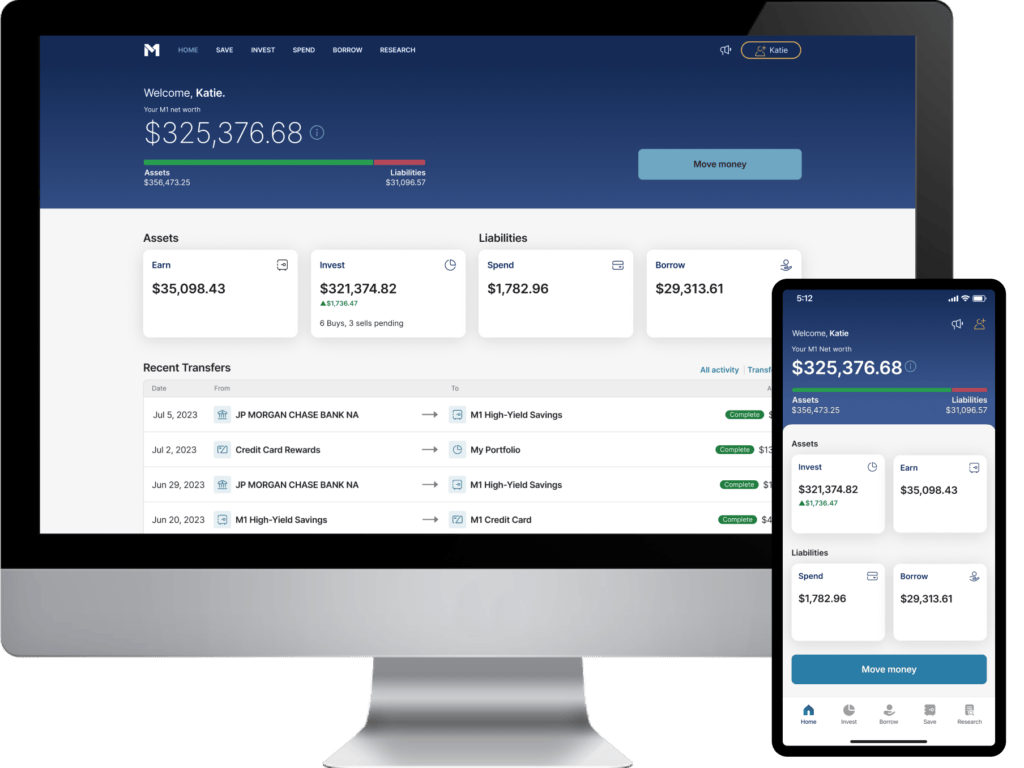

Beyond powerful investing

Investing is only part of the long game. M1 offers a holistic approach to wealth-building.

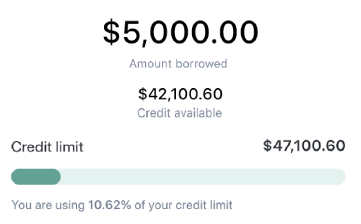

Margin Loans

Access a flexible line of credit with a few taps at just 8.75% interest. 7.25% with M1 Plus.3

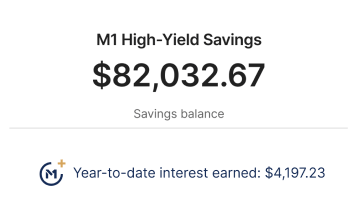

High-Yield Savings

With M1 Plus, you earn 5.00% APY1 with an M1 High-Yield Savings Account—more than 12x the national average2.

How M1 Stacks up

M1

Dynamic Rebalancing, investing schedules, Smart Transfers

Yes, on stocks and ETFs

7.25% – 8.75%3

5.00% APY1 with M1 Plus

Commission-free, Commission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Other fees may apply such as regulatory, M1 Plus membership, account closures, and ADR fees. For complete list of fees, visit m1.com/legal/disclosures/misc-fees M1 Plus is $3/month or $36/year5

TDameritrade

Yes, and only with Robo Advisor and associated fees and minimum investments

No

12.50% – 14.50%

No, with Schwab there is

Commission-free, but some options carry fees

TDameritrade

M1

Automation

Yes, and only with Robo Advisor and associated fees and minimum investments

Dynamic Rebalancing, investing schedules, Smart Transfers

Fractional shares

No

Yes, on stocks and ETFs

Fees

Commission-free, but some options carry fees

Commission-free, Commission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Other fees may apply such as regulatory, M1 Plus membership, account closures, and ADR fees. For complete list of fees, visit m1.com/legal/disclosures/misc-fees M1 Plus is $3/month or $36/year5

M1 rates are current as of May 2023. Information on competing brokerages was accessed from each brokerage’s website in May 2023.

Join hundreds of thousands

who trust us with $8 billion

Information as of April 24, 2023

Best for Sophisticated Investors and Low Costs

(Investopedia, 2023

Best Investment

App for Portfolio Customization

(Insider, 2023)

One of the best robo-advisors of 2023

(Bankrate, 2023)

One of the best

Roth IRAs one

(Fortune, 2023)

Over 60,000 users left 5-star reviews*

Testimonials may not be representative of the experience of other customers. Not a guarantee of future performance or success.

Thousands have transferred to M1

to the tune of $2.1 billion

Ready to join them?

*Sources: https://apps.apple.com/us/app/m1-finance/id1071915644 , https://play.google.com/store/apps/details?id=com.m1finance.android&hl=en_US&gl=US

1 Obtaining stated APY (annual percentage yield) or opening a savings account does not require a minimum account balance. Stated APY is valid from date of account opening. Account fees may reduce earnings. Higher APY rate subject to paid M1 Plus subscription. Rates are subject to change.

2 National average is 0.39% APY as of April 2023. Obtained from the FDIC.

3 M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not all securities are available for M1 Margin Loans and the amount that may be borrowed against a security is subject to change without notice. Available margin amount(s) of M1 Margin Loans may require greater than $2,000 per Brokerage Account. Not available for Retirement and Custodial accounts. Margin rates may vary.

4 1.5%-10% credit card cash back rewards earned on eligible purchases subject to a maximum of $200 cash back per calendar month. APR ranges from 19.49% – 29.49% based on creditworthiness of the applicant. APR will vary with the market based on the Prime Rate. There is no Annual Fee for the Owner’s Rewards Card. Rates as of March 1, 2023.

5 M1 Plus is a paid annual membership that confers benefits for products and services offered by M1 Finance LLC, M1 Spend LLC and M1 Digital LLC, each a separate, affiliated, and wholly-owned operating subsidiary of M1 Holdings Inc. “M1” refers to M1 Holdings Inc., and its affiliates.

M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 High-Yield Savings Accounts are furnished by B2 Bank, NA, Member FDIC.

Credit Card not available for US Territory Residents. The Owner’s Rewards Card by M1 is Powered by Deserve and issued by Celtic Bank, a Utah-Chartered Industrial Bank, Member FDIC. Review Cardholder Agreement and Rewards Terms for important information about the Owner’s Rewards Card by M1.