Hi, it’s Marcie, Director of Clearing and Brokerage Operations at M1.

I’m excited to share this High-Yield Cash Account offer with you.

The platform for wealth-builders with a long-term vision.

Earn Earn 3.60% APY1 on your uninvested cash.

Invest Put your investing strategy on cruise control.

Borrow Flexible, convenient, low-cost loans.

The Midwest fintech unicorn

Born and raised in Chicago, M1 proves tech innovation isn’t confined to the coasts.

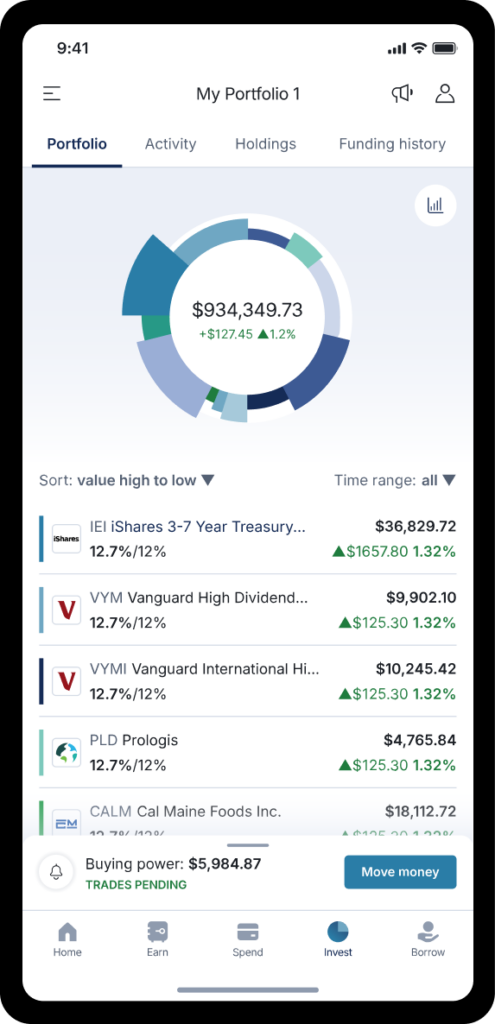

We pioneered Pie-based investing with fractional shares. And we’re still the only platform with Dynamic Rebalancing, which gently rebalances your portfolio over time, without selling.

Giants like Schwab and Fidelity have followed our lead, but there’s no substitute for the original.

Excited to be part of an organization that provides an array of products and user friendly technology to empower personal financial growth and well being.

Marcie

Director of Clearing and Brokerage Operations

Integrate & automate

Borrow up to half your account value at just 6.15%2

Brokerage Accounts have built-in margin access to use on or off platform.

Accounts can automatically find and transfer extra cash

Create rules to fund your investments, keep your cash reserve full, and more.

¹ Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

2 M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not all securities are available for M1 Margin Loans and the amount that may be borrowed against a security is subject to change without notice. Available margin amount(s) of M1 Margin Loans may require greater than $2,000 per Brokerage Account. Not available for Retirement and Custodial accounts. Margin rates may vary.