Sophisticated wealth building, simplified

At M1, we think a balanced portfolio shouldn’t be taxing. Invest for the years ahead without stressing day-to-day.

4.5 on Google Play store*

Founded in 2015

1,000,000+ users

$12B+ in client assets as of September 2025

4.7 on Apple App Store*

4.5 on Google Play store*

Founded in 2015

1,000,000+ users

$12B+ in client assets as of September 2025

4.7 on Apple App Store*

4.5 on Google Play store*

Founded in 2015

1,000,000+ users

$12B+ in client assets as of September 2025

4.7 on Apple App Store*

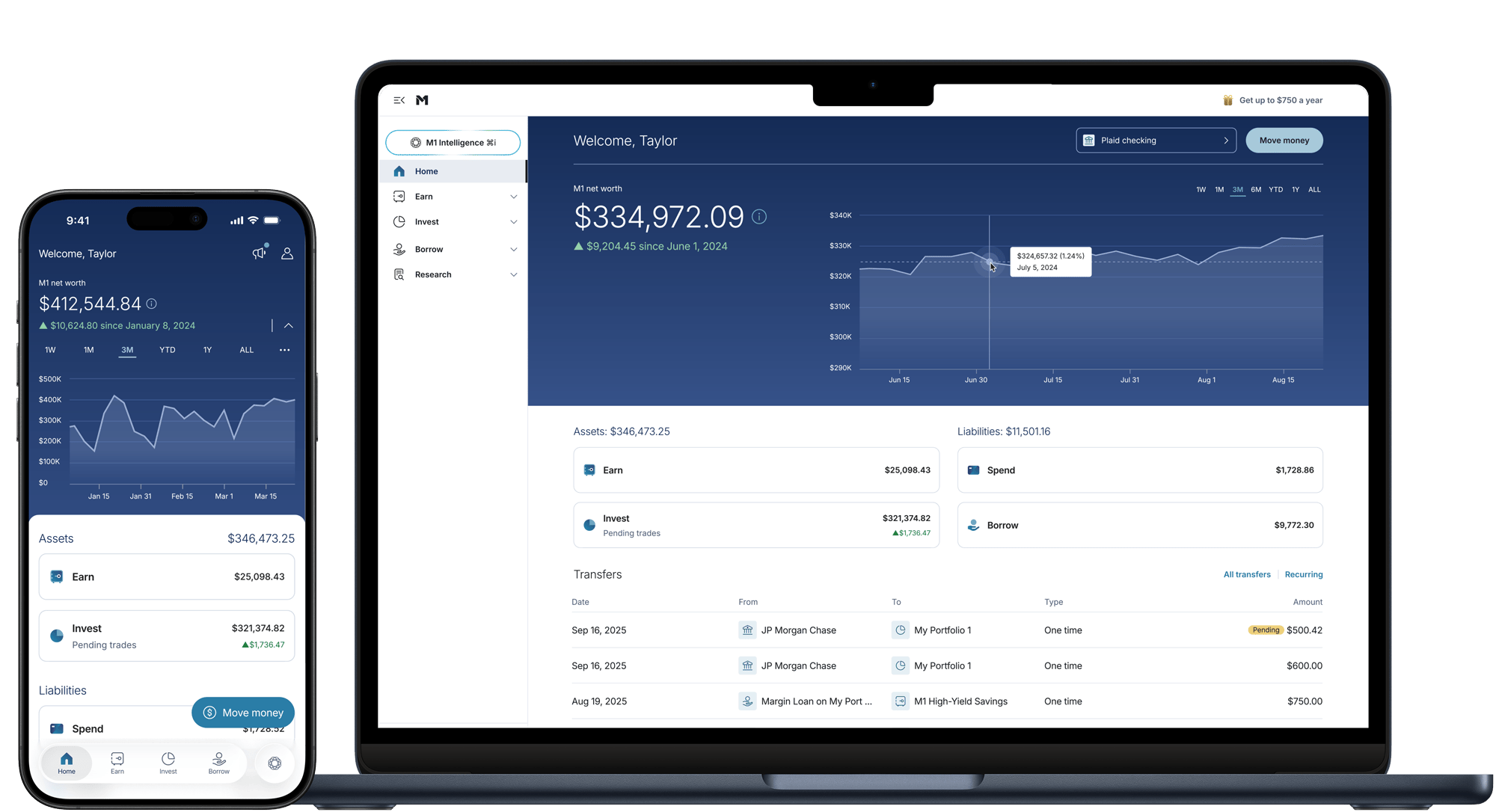

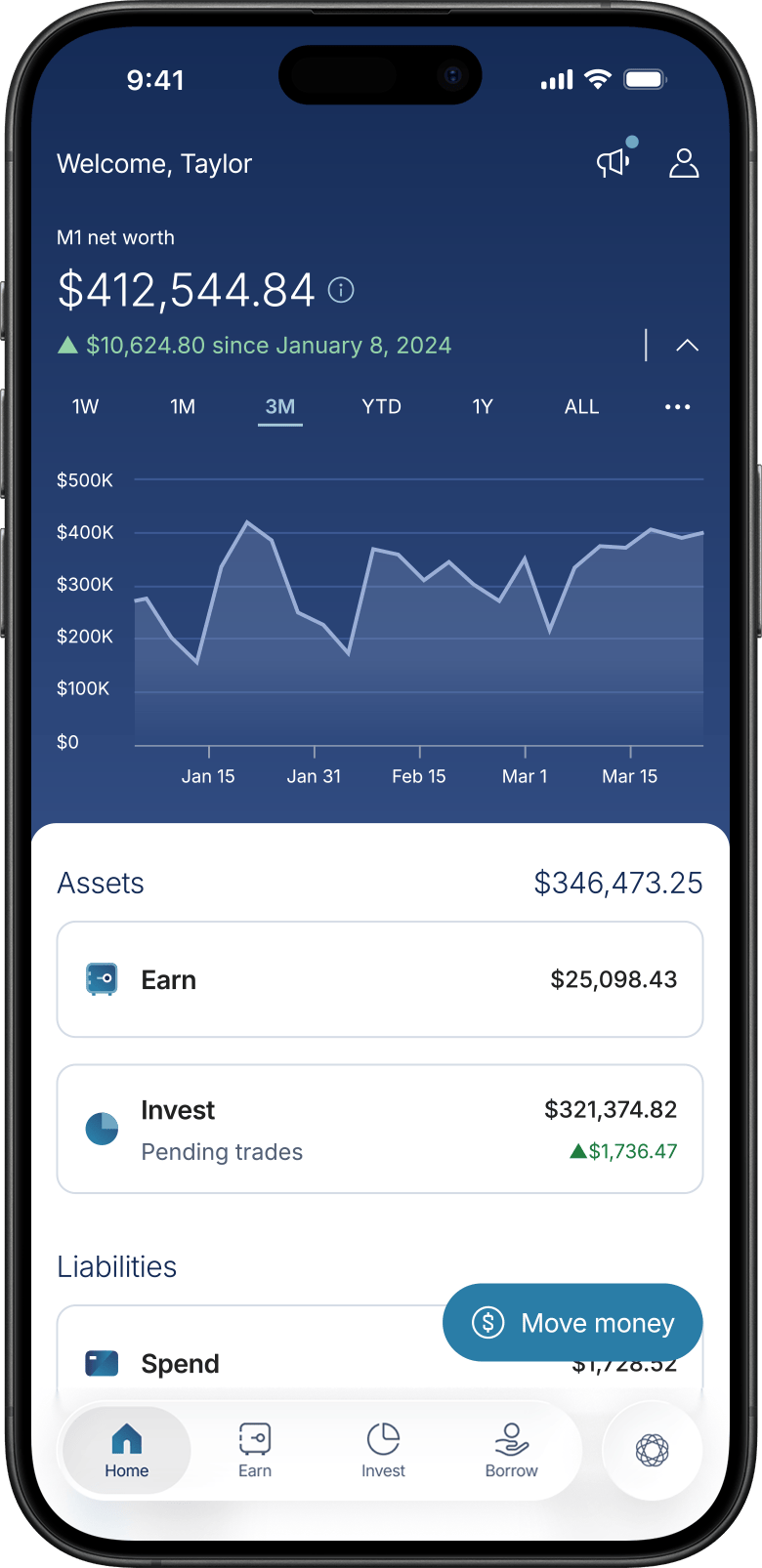

A money management hub in your pocket

See M1 in action

Your strategy meets M1’s intelligence

Account protections you can count on

Member of SIPC. Securities in your account protected up to $500,000. For details, please see www.sipc.org.

All M1 High-Yield Cash Accounts deposits are FDIC-insured up to an aggregate total of $4.75 million.4

M1 protects your private data with the latest information security technology.

As featured in

Rethink your wealth-building experience today

*Sources: https://apps.apple.com/us/app/m1-investing-banking/id1071915644 & https://play.google.com/store/apps/details?id=com.m1finance.android&hl=en_US&gl=US&pli=1

^M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. For a complete list of fees M1 may charge visit M1’s Fee Schedule.

1Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

2M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not all securities are available for M1 Margin Loans and the amount that may be borrowed against a security is subject to change without notice. Available margin amount(s) of M1 Margin Loans may require greater than $2,000 per Brokerage Account. Not available for Retirement and Custodial accounts. Margin rates may vary.

3The cash balance in your Cash Account is eligible for FDIC Insurance once it is swept to our partner banks and out of your brokerage account. Until the cash balance is swept to partner banks, the funds are held in a brokerage account and protected by SIPC insurance. Once funds are swept to a partner bank, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.

SAIF-04292025-t4lhaghj