JOINT BROKERAGE ACCOUNTS

Invest together, grow together

Work as a team to invest in your future with a Joint Brokerage Account on M1.

One account, two partners

A joint brokerage account can be a good fit for:

- Married couples and long-term partnerships

- A parent and adult child (over 18)

- Family members with shared financial goals

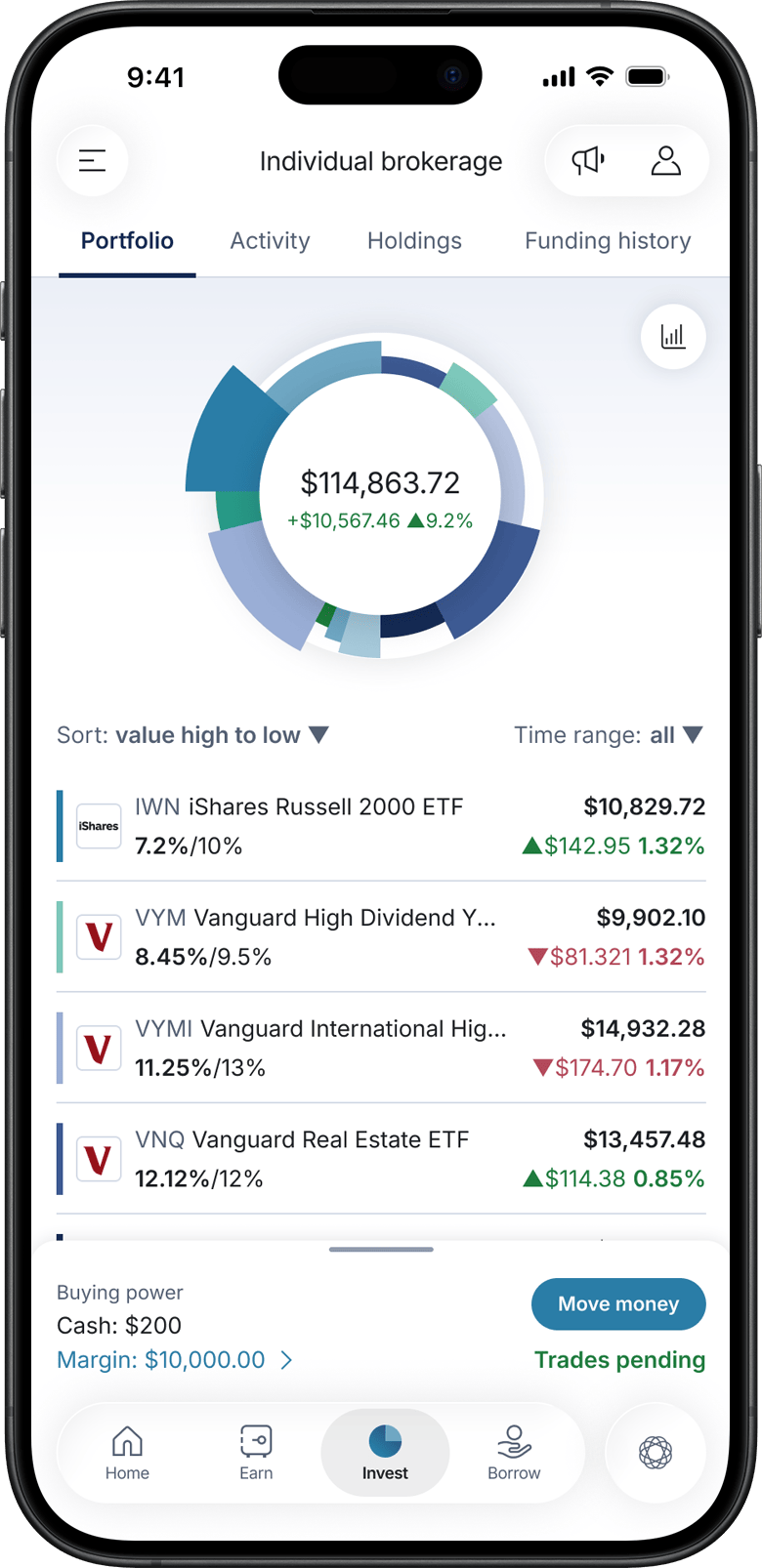

You’ll both be owners on the account—so you can each contribute, withdraw and make changes to your portfolio at any time.

Why invest together?

Share responsibility

Work with a partner to build a strong financial foundation for you both.

Build healthy habits

Share your financial wisdom with your children as they come of age.

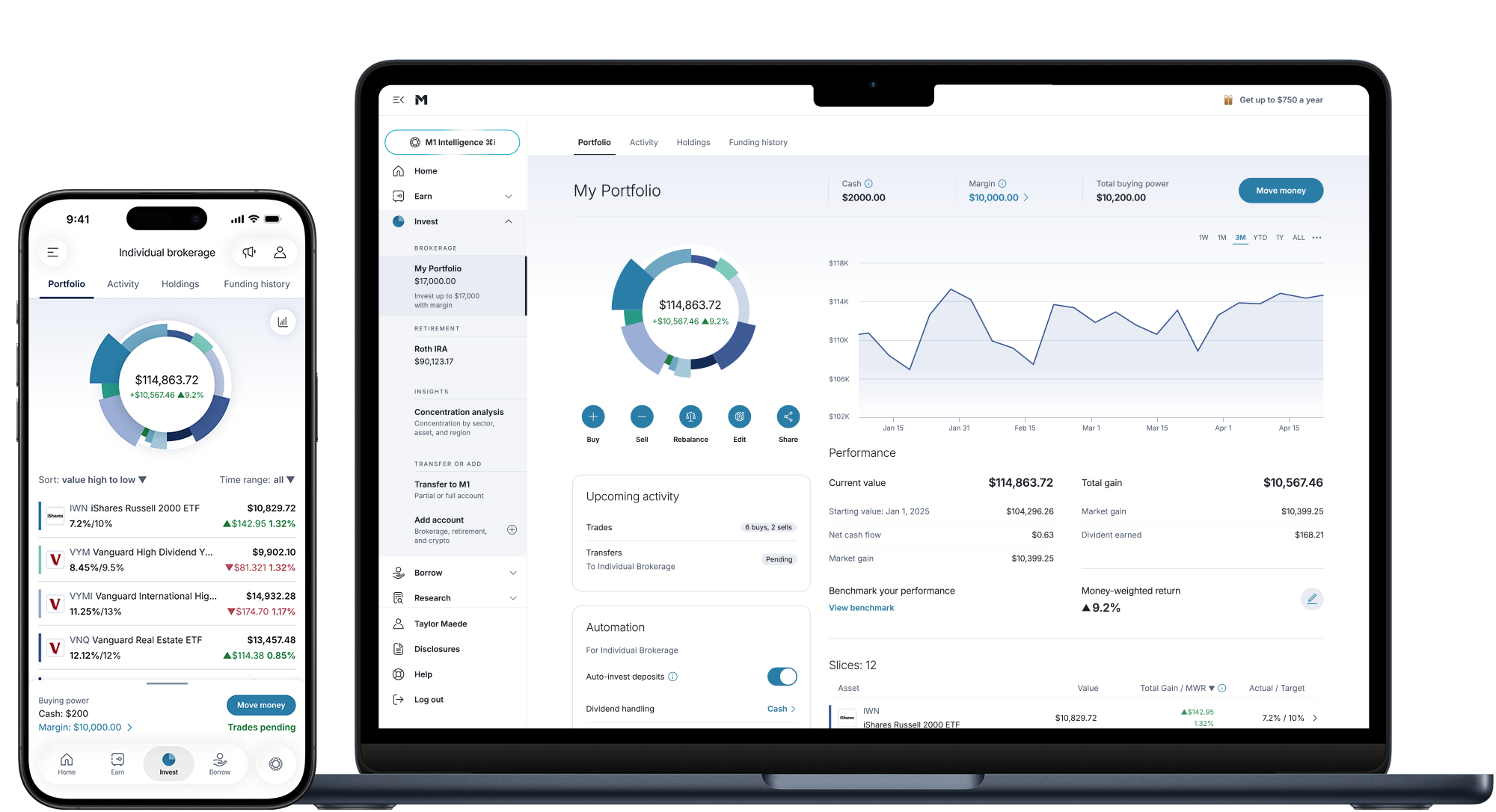

Invest with transparency

Be aware of money in and out and how your joint portfolio is performing.

Plan your legacy

Easily transfer assets after a co-owner of the account passes away.

Build your shared future with a Joint Account

¹ Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

2 The cash balance in your Cash Account is eligible for FDIC Insurance once it is swept to our partner banks and out of your brokerage account. Until the cash balance is swept to partner banks, the funds are held in a brokerage account and protected by SIPC insurance. Once funds are swept to a partner bank, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.

SAIF-04212025-bx5bepc9