M1 Retirement ACCOUNTS

Automate your IRA. Simplify your tomorrow.

Invest in your future with a simple, automated IRA that helps you focus on living life well.

Cruise toward

retirement

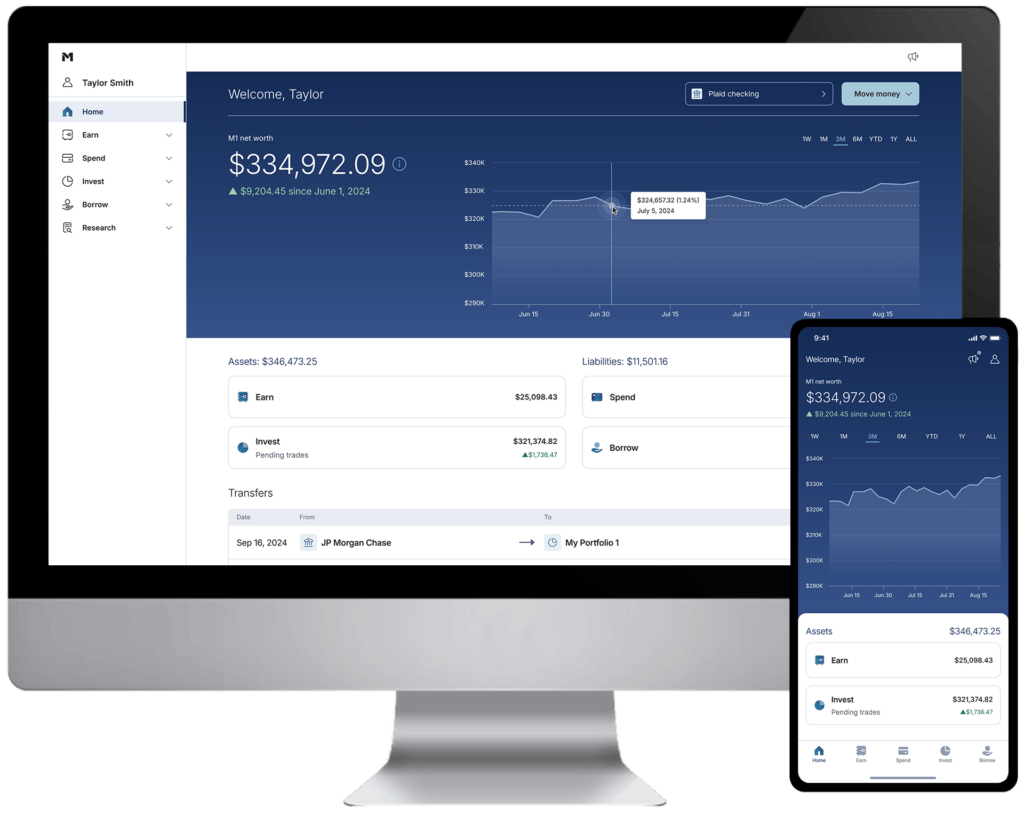

Our self-directed platform has the tools you need to invest thoughtfully, without much effort.

Know your IRAs

An individual retirement account (IRA) is an investment account that can help you save money for retirement with tax-free growth or on a tax-deferred basis.

Hypothetical example for illustrative purpose only. Calculations assuming the following constraints: (a) an initial investment of $1000, (b) an annual rate of return of 10%, (c) no taxes, fees, inflation, or withdrawals. The assumed rate of return is not guaranteed as investing involves risk of loss. Source: Investopedia.com

Use time to

your advantage

Investing for retirement sooner, rather than later, can help you compound your earnings.

Move your retirement account to M1

Have an existing 401(k) or IRA that needs a new home? It’s easy to transfer these accounts and begin managing them on the M1 platform. Transfer an IRA or Transfer a 401(k)

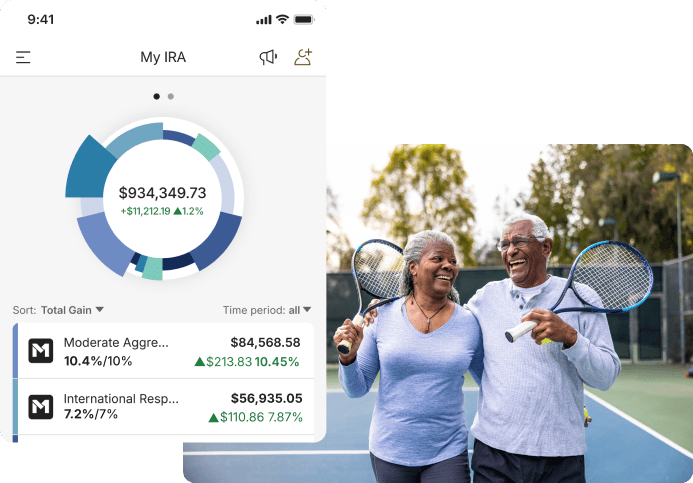

Transfer your IRA

Take advantage of platform automation that makes it easy to contribute to, grow, and withdraw your retirement money.

Rollover your 401(k)

Want more control over your retirement planning? Start your 401(k) rollover in minutes.

Your Retirement Account

questions, answered

Get more answers in our Help Center.