How to roll over a 403(b) to an IRA

If you’re changing jobs or retiring from the public sector, you may be considering what to do with your 403(b) retirement account.

One option is to roll it over into an IRA, or individual retirement account. There are several reasons to consider rolling over a 403(b) into an IRA such as consolidation, more investment choices, and little to no fees. All of these can potentially give you greater control over your retirement savings.

In addition, you may be required to transfer your 403(b) account after you leave your employer, and an IRA could potentially be the most advantageous option.

In this post, we’ll explain what a 403(b) and IRA are, the reasons behind a roll over, and the information you’ll need to conduct one.

What is a 403(b)?

A 403(b) is a type of retirement savings plan that is similar to a 401(k) but is available only to employees of certain non-profit organizations including schools, universities, churches, and hospitals.

In other words, a 403(b) is for some public-sector employees and employees of some tax-exempt organizations.

Rollovers on M1 are easy, allowing you to seamlessly transfer funds from your 403(b) account into an IRA and simplify your retirement plan.

A 403(b) plan allows employees to take payroll deductions to contribute a portion of their pre-tax income to the plan, which grows tax-free until it is withdrawn in retirement. Employers may also match employee contributions.

For the 2023 tax year, the maximum contribution you can make to a 403(b) plan is $22,500, up from $20,500 in 2022. There may be penalties for withdrawing money from the account before age 59 ½, although you won’t pay a penalty for a 403(b) rollover.

What is an IRA?

An IRA, or individual retirement account, is a retirement savings account that you can open with a brokerage firm or other financial platform.

On M1, we offer traditional IRAs, Roth IRAs, and SEP IRAs.

What is a 403(b) to IRA rollover?

A 403(b) to IRA rollover is the process of transferring funds from a 403(b) retirement plan to an IRA.

Why roll over a 403(b) to an IRA?

There are several reasons why you might want to roll over a 403(b) to an IRA, including the following:

New job or retirement: You may have left your public-sector job that was offering a 403(b) and now need to explore other retirement options.

Consolidation: If an individual has multiple retirement accounts from previous employers, consolidating them into a single IRA can simplify their retirement savings strategy and make it easier to manage.

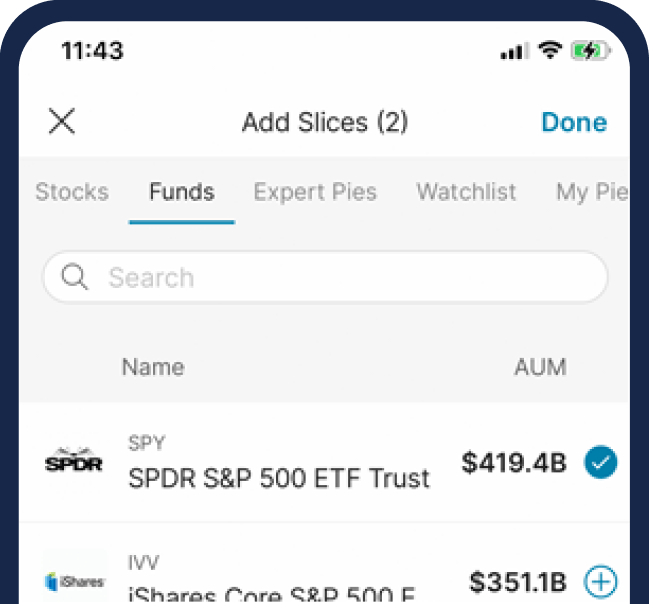

More investment choice: 403(b) plans may have limited investment options, as they can only contain mutual funds and annuities, which are chosen by your employer. On the other hand, IRAs typically offer a wider range of investment choices, including stocks and exchange-traded funds (ETFs).

Lower to no fees: Some 403(b) plans may have higher fees and expenses than IRA accounts, which can potentially diminish investment returns over time. By rolling over to an IRA, an individual may be able to reduce their fees and potentially earn more on their investments. Check your plan documents to see how much you’re paying in fees and determine whether a 403(b) rollover could help you save.

Direct vs. Indirect transfers

When it comes to rolling over your 403(b) to an IRA, there are two transfer methods: direct and indirect transfers. In some cases, clients may not have a choice in transfer method as it is dependent upon the employer the 403(b) is coming from and the financial platform it is going to.

Direct transfer

In a direct transfer, your plan administrator handles the transfer of the account. The assets are transferred directly from your 403(b) to your IRA account. Direct transfers may be easier since it avoids any potential penalties that could occur if you were to make a mistake handling the transfer yourself.

Indirect transfer

An indirect transfer is when you receive a distribution from your 403(b) account and then deposit it into an IRA account within 60 days. In this method, you will need to handle the money yourself and could be subject to taxes and penalties if you don’t complete the rollover within the 60-day time limit. It’s also important to note that you can only make one indirect transfer in a 12-month period.

Potential penalties for an indirect transfer of a 403(b) to an IRA

In certain situations, penalties and income taxes may apply when rolling over your 403(b) to an IRA.

If you chose for an indirect transfer and fail to complete the rollover in the 60-day window, you may subject to a 10% penalty if you are below 59 ½.

The IRS may waive the 60-day deadline if the deposit was delayed by circumstances beyond your control.

The 403(b) plan may also withhold 20% of your savings for federal income taxes in the case of an indirect rollover, although this does not apply to direct rollovers.

The M1 line

Whether you’re changing jobs or retiring, a rollover can offer some benefits, such as consolidation, more investment choice, and little to no fees. However, it’s important to understand the transfer process and potential risks involved before making any decisions.

Rolling over a 403(b) retirement account to an IRA can potentially help maximize your retirement income and achieve your long-term financial goals.

Visit our help center, for a step-by-step guide in rolling over your 403(b) to an IRA on M1.

Disclosures:

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

20230403-2820227-8970282