What are ETFs?

ETFs, or exchange-traded funds, are securities that hold a variety of stocks in a singular ‘bucket’. This gives investors the opportunity to put capital towards a group of companies, rather than purchasing a handful of stocks one-by-one.

For example, if you purchase a share of an ETF containing holdings of 100 companies, you will be invested in each of those 100 companies. This is a great way to have your investments diversified. However, the amount of investment within each company typically isn’t equal. An ETF typically focuses its capital into a few stocks, while spreading the remaining capital across a long list of companies. For example, QQQ is heavily weighted towards tech, with Apple and Microsoft having roughly 20% of the total investment.

This streamlined way of investing has brought in trillions of dollars from investors. But as convenient and effective as they can be, there are several factors to be mindful of before hitting the ‘buy’ button.

Here’s what you need to know.

What are ETFs?

ETFs, generally speaking, track a specific index. An index is a list of companies that represent a segment of the stock market as a whole. There is a nearly endless list of indices that track all sorts of various parts of the economy. So if you enjoy following a specific industry or index, there is likely an ETF you can invest in.

For example, if you want to invest in the technology sector, you would likely think of companies like Amazon, Google, Apple and several others. But instead of individually investing in each one of these companies, you can purchase shares in an ETF like QQQ that tracks the Nasdaq-100 index, which contains a swath of technology companies. Additionally, if you want to focus specifically into tech, there are ETFs like Invesco S&P 500 Equal Weight Technology ETF(RSPT) and the Technology Select Sector SPDR Fund (XLK). And the capital you invest in an ETF will track the value of the companies within it.

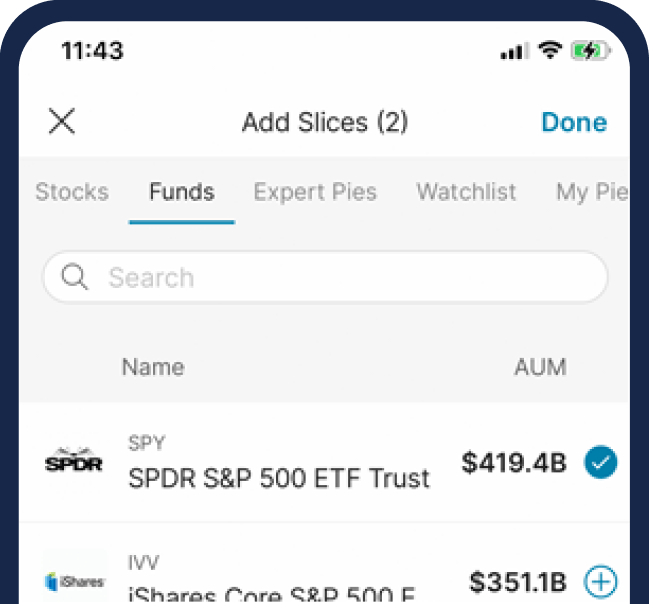

Using M1, you can build your own investment portfolio and have full control over how much of your cash goes toward ETFs.

Along with diversification, another great feature of ETFs is their versatility. Specifically, if there’s an investing strategy you’re seeking out, it’s likely that there is an ETF that aims to accomplish those goals. If you’re interested in investing in the S&P 500, there’s an abundance of ETFs to choose from. However, each one has a slightly different expense ratio, so be sure to select the one that works best for you. If you want to invest in cryptocurrencies, there’s several ETFs available for investors looking for exposure to multiple coins. If investing in commodities is interesting to you, there are ETFs for that, including the Bloomberg All Commodity ETF (BCD). Or if energy is appealing to you, you can look at the Energy Select Sector SPDR Fund (XLE) as an investment option. And even at a comedic level, there are ETFs you can invest in tracking meme stocks, people’s ‘vices’, and even one for those who mock the often questionable predictions of CNBC host Jim Cramer.

In addition, there are also bond ETFs, inverse ETFs for shorting stocks, leveraged ETFs, dividend ETFs, currency ETFs, real estate ETFs and more! So if there’s a specific investing goal or strategy you have in mind, it’s very likely you can find an ETF reflecting those goals.

History of ETFs

The first ETF launched just over 30 years ago, creating a new way for investors to have diversified portfolios without the hassle of buying individual stocks. Since then, ETFs have skyrocketed in popularity. In 2003, there were 123 publicly traded ETFs. As of 2022, there are over 3,000 to choose from with a combined investment of over $6.5 trillion.

But before ETFs came to the limelight, mutual funds gave investors a similar option to invest in a large basket of equities. However, there are a few differences between the two options, including that they are traded differently, have different minimum investment requirements and cost structures associated with each. But the appealing factors that make ETFs more appealing than a traditional mutual fund are their tax advantages and low expense ratios.

Important factors to consider within an ETF

As you’re researching various ETFs to purchase, there are several factors to consider. While all investors ought to do their own due diligence, here’s how to understand what each ETF contains and the costs associated with each one:

Expense ratio

The operating expense ratio is the cost associated with purchasing and holding a share of a security. These costs are used to pay for administrative and operating costs. So the lower the expense ratio, the lower the fees you will have to pay.

For example, SPLG is an ETF that tracks the S&P 500 and carries a mere 0.02% expense ratio. This means that if you invest $10,000, you will be charged $2 for buying those shares paid over an entire year. However, BIZD, which tracks the Business Development Companies Index, has a 10.92% expense ratio — leaving you with a $1,029 fee per year on the same $10,000 investment.

These fees are important to calculate into your investment strategy as high-fee ETFs don’t always mean higher returns, and could even potentially eat into your net gains as well.

ETF holdings

Each ETF will tell you what exactly it contains, similar to ingredients in a recipe. The easiest way to find this out is to search the ETF ticker and its holdings. As an example, you can search VOO holdings or QQQ holdings.

Net asset value (NAV)

The net asset value represents the value of each share’s portion of the fund’s underlying assets and cash at the conclusion of each trading day, less any liabilities. This figure is used to compare the performance of different funds and report proper numbers for accounting purposes.

Dividend yield

Some ETFs reward investors If the ETF pays dividends, its dividend yield is the amount investors will earn based on the amount of shares they hold of a specific stock. Dividends can be paid out monthly, quarterly or yearly, and they may also be on irregular schedules, so be sure to check how often a specific ETF pays out. Also, keep in mind that the amount that each dividend pays can fluctuate. You can figure out a range of how much you can expect to make from a dividend by looking up the historical payouts of an individual ETF. As an example, investors who have shares of VOO were paid out about $1.58 per share they held in their last quarterly dividend distribution. Between September 2022 and June 2023, VOO investors earned about $6.20 per share, which nets out to be a 1.5% dividend yield.

ETF vs. mutual funds tax advantages

ETFs and mutual funds are similar in bringing together a large amount of equities into one bucket for people to invest in. But they each handle their assets differently, resulting in slightly different taxes for each — with ETFs potentially ending up with a slight edge. Here’s how:

For the manager of the fund, an ETF’s shares are generally redeemable “in-kind.” This means that the fund manager use creation units, large blocks of shares purchased at the same cost, to purchase and sell assets in bulk, avoiding further taxable events. Whereas mutual fund shareholders must consistently rebalance their position as people buy and sell their shares, which creates taxable events.

Keep in mind though that these advantages could potentially be negligible. The Securities and Exchanges Commission says in an investor bulletin that: “very generally, the federal income tax consequences of investing in ETFs and mutual funds are comparable.”

Read more: How to potentially lower your taxes before year-end

ETF vs. mutual funds expense ratios

Like mentioned above, ETF and mutual funds have similar concepts, but differ in their approaches. ETFs are generally passively managed, meaning they don’t need a ton of work from fund managers as long as they’re following the ETF’s objectives. This results in lower administrative costs passed on to you as the investor. However, there are actively traded ETFs available, but will come with a higher cost.

But with mutual funds, they’re mostly actively managed and can also come with higher fees. These can include a load fee, along with an expense ratio.

Passive vs. active ETFs

While ETFs were generally designed for passive investment, more and more investors are seeking out actively traded ETFs. Here’s the difference between the two:

- An active ETF is managed by portfolio managers who actively make investment decisions, with the goal of outperforming a specific benchmark or index. The managers use their expertise and research to select a portfolio of securities they believe will generate higher returns than a passive ETF.

- Passive ETFs aim to replicate the performance of a specific market index, such as the S&P 500 or the FTSE 100. Instead of relying on active management decisions, passive ETFs follow an objectives-based approach set by an asset manager, holding the same securities in similar proportions as the underlying index. Since passive ETFs do not require constant portfolio adjustments, they typically have lower operating expense ratios, which include management fees, compared to active ETFs.

Bottom line

ETFs can be a potentially efficient way for investors to put their money to work in a diversified way. With M1, you can invest in ETFs and create your own portfolio based on your investing goals, along with using automation to invest on a consistent basis on your wealth building journey — all in one platform. You can do this in your individual brokerage, and even within a retirement account like a Roth IRA.

However, before burying any of your money into an ETF or any other security, be sure to do your own research and create an investing strategy that aligns with your financial goals.

M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance.

20230814-3047824-9710844