It’s been two years since the meme stock was born. Here’s what we’ve learned.

In early 2021, as the pandemic raged into its second year, there was a David vs. Goliath war being waged online and in the stock market. Many everyday Americans, flush with Covid stimulus cash and quarantine-induced boredom, opened up their investment apps and, one tap at a time, banded together to nearly take down hedge funds.

Many of these investors were trading for the first time, and they weren’t interested in just any old stocks. Instead, they traded shares of companies whose stock prices had been declining for some time, and through the sheer force of collective online shitposting, these investors managed to send their stock values to the moon.

This group of people created a “short squeeze” of hedge funds that the internet celebrated and which even caught the eyes of regulators and Capitol Hill. But when the meme-stock boom came crashing down, retail investors learned difficult lessons — with some suffering life-altering losses.

Here’s how meme stocks came to be, what the end results were, and a few lessons we’ve learned since.

The wave of new investors

The initial economic shutdown due to the Covid-19 pandemic roiled markets, and investors felt the pain. The S&P 500, considered a leading indicator of overall market health, fell a whopping 34% from its height to March of 2020. Stocks in highly affected industries like travel and dining took major hits that sent industry stock prices plummeting.

As pandemic-related shutdowns remained and layoffs shot up, Americans started receiving economic assistance from both state and federal governments, such as unemployment assistance and economic stimulus checks. But with a lack of places to spend this extra cash and looking for remote ways to make money, millions started putting their money to work into the stock market. According to the FINRA Investor Education Foundation, 66% of those polled who opened a new taxable brokerage account in 2020 were first- time investors.

But after the drastic fall of the market came a historic bull market, leading to the S&P 500 soaring 41% at the end of 2020 from the March 2020 bottom. Investors both new and seasoned saw the market skyrocket and wanted a piece of the action. And for many of these new investors, they weren’t looking for stable investments for the long term. They wanted a way to get rich quickly, and to do it in an unconventional way — like investing millions of dollars into struggling companies that most people wouldn’t have ordinarily considered.

What are meme stocks?

But which stocks are considered meme stocks? Well, it started on internet communities like Reddit and YouTube. Both platforms, specifically accounts focused on investing, exploded in popularity during the shutdowns. Those who began investing during the pandemic flocked to these forums to exchange information and comical banter about the stock market. But for the few company stocks that were identified as ‘meme’ stocks, they generally follow these descriptions:

- The company is losing money and isn’t performing well on fundamental metrics like total sales

- The stock is also heavily shorted by hedge funds

The now infamous stocks targeted by hedge funds were GameStop (GME), BlackBerry (BB), AMC Theatres (AMC), Bed Bath & Beyond (BBBY) and Nokia (NOK).

But why did hedge funds short these stocks? Shorting a stock means you believe that a company stock price is going to go down, so you borrow shares from a brokerage and sell them when the price is high, then buy them back when the price is low before returning them to the brokerage.

If your strategy works and things go according to plan, you pocket the difference, the brokerage gets their shares back, and everyone is happy.

But if the brokerage wants their shares back and the price hasn’t gone down yet, you might be obligated to buy them back before you’ve made a profit. And if, hypothetically, vast online communities worked together to generate demand for the stock, they could theoretically cause the price to inflate well beyond what you can afford to buy back. This is one example of a “short squeeze.”

And in 2020, shorts seemed to make sense, especially when no one was going to the mall or the movie theater. The stock price of most companies took a beating during the pandemic, and investors were profiting on their short bets. But as retail investors gathered together, they began to collectively gather information that is publicly available — including the amount of shares that were sold short. GameStop specifically had 140% of their shares shorted, meaning there were more shares shorted than actual stock issued.

These online communities saw this and banded together for a common purpose: buy as many shares of the stock as possible, run the price up, and put pressure on the hedge funds.

The meme stock boom, and the results of it

As investors piled money into markets throughout 2020 amid a bull market rally, community momentum began to increase around two meme stocks in particular — GameStop and AMC Theatres. More investors began buying shares as an online collective, driving the stock price upward. They rooted each other on with humorous memes and telling one another to keep buying and holding their positions.

And as the stock price continued to soar, it created a short squeeze. Melvin Capital, a hedge fund that had a significant short position in GameStop, lost billions from it and ultimately filed for bankruptcy in 2022.

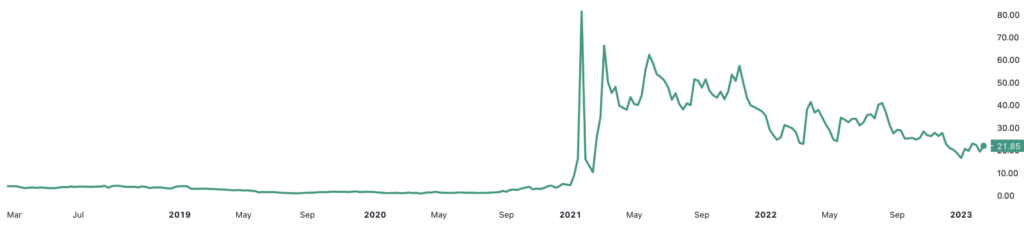

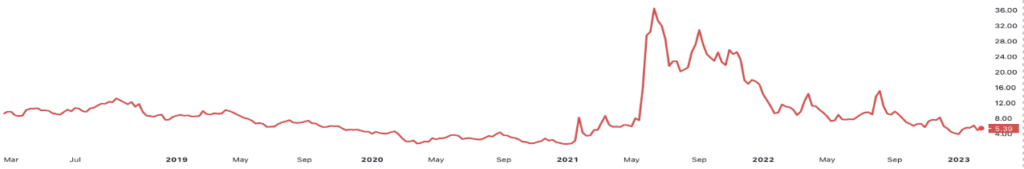

The peaks of each chart below show what the short squeeze looked like for GameStop and AMC, respectively:

The aftermath of meme stock mania

GameStop stock is still slightly elevated from before the rapid short squeeze, but the stock lost a large amount of the gains it had. AMC’s shares have basically returned to pre-squeeze levels. Other meme stocks haven’t seen the same luck, like Bed Bath and Beyond, which has flirted with potential bankruptcy in recent months.

As for the retail investors, some made out with large short-term profits. And on the other side of things, many novice investors’ losses mounted as the stock market softened in 2022. The Wall Street Journal recently reported on a retail trader who amassed nearly $1.5 million, and lost it all. In 2022 alone, retail investors were down an estimated $350 billion — with large losses coming in options trading. However, not all hedge funds lost big — with one namely bringing in $700 million in profits.

After the squeeze, lawmakers held several hearings to understand what had happened, later publishing a 138-page report titled Game Stopped: How the Meme Stock Market Event Exposed Troubling Business Practices, Inadequate Risk Management, and the Need for Regulatory and Legislative Reform. But for the Wall Street Bets community on Reddit, there was a strange kind of validation than seeing the internet-famous GameStop investor Keith Gill, known as u/TheRoaringKitty, sitting alongside the CEOs of Reddit and Robinhood. Gill, who allegedly made tens of millions trading GameStop stock during the craze, had gone from an anonymous Redditor to infamous kingmaker in the span of a few months. The uprising of the community seemed like a success.

But that the meme-stock era has faded, we can look back with clarity to what happened. It was a collision of the pandemic, boredom, cash injection from government programs, and collaboration of online communities to amass quick wealth in a time of economic uncertainty.

But given the results from the entire event, here’s what investors can take away from it.

Speculative investing could be risky

Picking individual stocks while trying to beat market averages is a tall task — even for professionals. According to the American Enterprise Institute, roughly 90% of financial professionals can’t expect to beat the overall market.

It can be tempting to engage in the excitement of buying and selling stocks for a profit, but it’s simply not a game many can win over the long term.

Diversification could be essential

The old saying of “don’t put all your eggs in one basket” is important to remember when it comes to investing. If you put all of your eggs (money) in one basket (single stock or sector), and it happens to suffer significant losses — it can put your financial goals in jeopardy.

One way to potentially minimize the risk of losses like this is to invest in a diversified portfolio that includes a variety of companies and industries, and our Model Portfolios are already crafted for varying financial goals. These Pies help you stay diversified across different stocks without the hassle or stress of selecting stocks yourself.

Time is the best asset to have on your side

You may have heard the saying: time in the market beats timing the market. It’s a bit of a tongue-twister, but it means that consistently investing without trying to time your investments perfectly could potentially result in higher returns.

Moreover, the GameStop surge was almost impossible to predict. The company has notably struggled for years, and the pandemic put even more hardship on the company. And the entire meme-stock hysteria created a tricky situation for many — the need to be right twice: you would have to know both when to buy and when sell. If the vast majority of people can’t do it profitably, then a strategy of buying and holding may potentially be a better option.

And with a variety of accounts to invest in like an IRA or taxable brokerage, there are several ways you can begin investing for the future.

The M1 bottom line

The meme stock era is largely over, but the uprising of retail investors is here to stay. Retail investors continue to pile in billions of dollars into markets each day, and it doesn’t look to be slowing down. In fact, as of this writing, #AMCSqueeze is a trending topic on Twitter.

However, the ride of the meme stocks was an entertainment spectacle and an anomaly. Investing based on internet trends is probably not a way to build foundational, sustainable wealth for the long-term. If you’re looking to invest for the future, a diversified portfolio and buying into the market without trying to time it are tried-and-true methods that could potentially give investors the best shot at growing their wealth.

20230310-2769831-8835705

- Categories

- Invest