M1 releases dashboard updates with expanded data and charts

Part of M1’s mission is giving our clients excellent data through easy-to-use tools to make their own investing decisions. Today, M1 launched an upgraded chart…

Part of M1’s mission is giving our clients excellent data through easy-to-use tools to make their own investing decisions. Today, M1 launched an upgraded chart…

Whether you find this article days before the filing deadline or months before, filing taxes can feel like a race to the finish line. Once…

Spring is right around the corner. In no time, baseball will be back, the sun will be shining, and it will be tax season. Well,…

You asked for it. We’re delivering. M1 is pleased to announce the long-awaited expansion of our Plaid integration service. Over the coming weeks, we’ll be…

Interviewed by Chandra Jong, Project Coordinator at M1 In honor of Asian American & Pacific Islander Heritage Month at M1, we sat down with Simon…

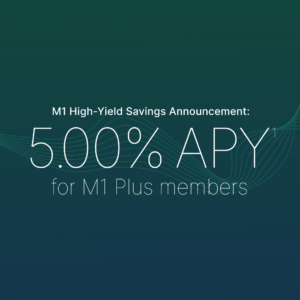

The wait is over. As of today, we’re starting rollout of the M1 High-Yield Savings Account to existing M1 users. And we’re excited to announce…

M1 is closely following the situation with Silicon Valley Bank and Signature Bank. Our clients’ funds are safe. M1 has no exposure to SVB or…

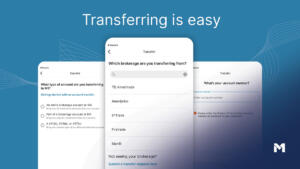

Get rewarded with up to $10,000 bonus when you switch to M1 from TD Ameritrade. Personalized portfolios, intelligent automation, and the best rates await you. Switching is easy.

As the Federal Reserve continues raising interest rates, we discuss three strategies you could include in your financial plan.