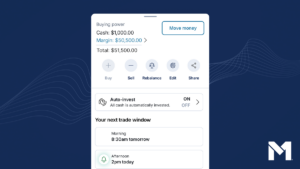

Margin investing just got simpler: Introducing M1’s margin buying power

Sophisticated wealth building, simplified Today, we’re excited to unveil our latest feature: Margin buying power. This advancement streamlines how you leverage margin in your investment…