M1 Launches High-Yield Savings Account

The wait is over.

As of today, we’re starting rollout of the M1 High-Yield Savings Account to existing M1 users.

And we’re excited to announce that the M1 High-Yield Savings Account will have 5.00% APY1 for M1 Plus members and be FDIC-insured for up to $5 million* in coverage.

5.00% APY1, an industry-leading rate

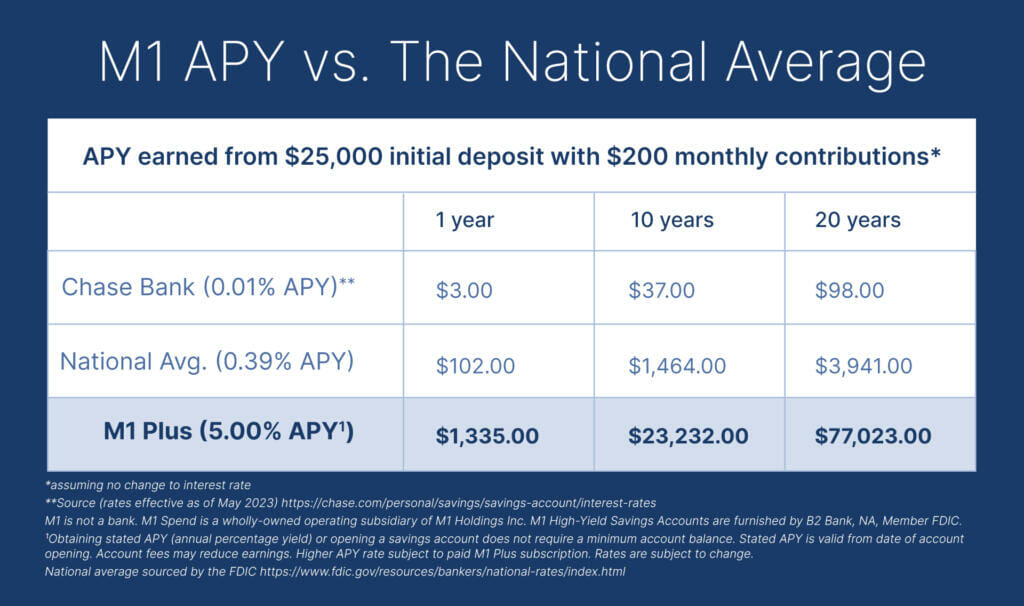

At 5.00% APY1, M1 Plus clients are getting an industry-leading rate. The M1 High-Yield Savings Account offers nearly 13 times the national average2, and it far exceeds rates at major financial institutions like Chase and Bank of America, where rates can be as low as 0.01%.3

Use our savings calculator below to estimate how much you’ll earn with the M1 High-Yield Savings Account.

$5 million in FDIC insurance coverage

Your cash is protected at M1. The new M1 High-Yield Savings Account is insured for up to $5 million*.

Here’s how it works: Our partner bank, B2 Bank NA, Member FDIC, provides FDIC coverage over $250,000 through its Insured Deposit Network Program involving other FDIC-insured depository institutions. You don’t need to do a thing and you’ll have FDIC coverage up to $5 million.

The M1 High-Yield Savings Account could help you save more

At M1, we believe the best way to build and manage wealth is by thinking long-term and consistently practicing smart financial habits. By announcing a savings account with one of the highest interest rates on the market— a designation we hope to maintain even as rates fluctuate— we’re taking another step toward being the best place to save money.

The M1 High-Yield Savings Account is designed to help you reach your savings goals, fast.

Create an emergency fund

Many financial experts recommend having an emergency fund to cover unexpected expenses such as medical bills, car repairs, or job loss. The M1 High-Yield Savings Account can be a great place to stash your emergency fund, as it offers a high interest rate while keeping your money easily accessible.

Meet your short-term savings goals

If you have a specific savings goal in mind that you’d like to achieve within a year or two, the M1 High-Yield Savings Account can help you get there. Because it grows faster than a traditional savings account, the M1 High-Yield Savings Account can bring your goals that much closer to reality.

Save for a large purchase

Whether you’re saving for a dream vacation or a down payment on a house, the M1 High-Yield Savings Account’s industry-leading rate means you’ll be able to afford more of what you need when the time comes. You deserve the best, so why not save with one of the best rates?

Build long-term wealth

If you’re looking to build long-term wealth, the M1 High-Yield Savings Account can be a good place to start. Because bank accounts aren’t affected by volatility the way brokerage accounts are, the M1 High-Yield Savings Account offers a low-risk way to earn a guaranteed return on your money. In some quarters, the 5.00% APY1 might even beat the market.

Use the M1 High-Yield Savings calculator below to see how much you’ll earn.

The M1 bottom line

With M1,

- If you save, your money will earn a market-leading interest rate;

- If you spend using our credit card4, you will earn rich cash back rewards—between 2.5% and 10% at over 70 of the most popular retailers and brands and 1.5% on everything else;

- If you invest, all your deposits will go to work in a diversified portfolio of your choosing for free, and

- If you borrow, you will get low rates and flexible terms.

M1 lets you maximize your money no matter how you prefer to go about it.

Learn more about the M1 High-Yield Savings Account.

Disclosures:

M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 High-Yield Savings Accounts are furnished by B2 Bank, NA, Member FDIC.

*B2 Bank is a member FDIC institution and does not itself provide more than $250,000 of FDIC insurance per legal category of account ownership as described in FDIC regulations. Additional FDIC insurance coverage is provided through B2’s Insured Deposit Network Program involving other FDIC insured depository institutions. Deposits may be insured up to $5,000,000 through B2’s Insured Deposit Network Program. Full terms of the Program can be found at m1.com/legal/agreements/HYSA_Agreement and a complete list of participating banks in the program can be found at m1.com/legal/agreements/depositnetwork

1Obtaining stated APY (annual percentage yield) or opening a savings account does not require a minimum account balance. Stated APY is valid from date of account opening. Account fees may reduce earnings. Higher APY rate subject to paid M1 Plus subscription. Rates are subject to change.

2Based on a 0.39% interest rate obtained from the FDIC on May 5, 2023. (Source: https://www.fdic.gov/resources/bankers/national-rates/index.html)

3Sources: Chase interest rate: https://www.chase.com/personal/savings/savings-account/interest-rates

Bank of America interest rate: https://www.bankofamerica.com/deposits/savings/savings-accounts/

41.5% – 10% Owner’s Rewards cash back earned on eligible purchases subject to a maximum of $200 cash back per calendar month. Cash back rates of 2.5% – 10% require an active M1 Plus subscription (billed at $36 annually or at $3 monthly).

20230508-2883892-9179217

- Categories

- Earn