Benchmarks: Why Choosing the Right One Matters

When someone asks, “How’s your portfolio performing?” many investors compare their returns to the S&P 500. It’s a natural instinct – after all, the S&P…

Build wealth through smart investing. Learn about diverse investment options and strategies to maximize returns and achieve financial goals.

When someone asks, “How’s your portfolio performing?” many investors compare their returns to the S&P 500. It’s a natural instinct – after all, the S&P…

You know what they say… goals are good. Plans are better. So if you’ve got financial goals for the year, these promotions may help you…

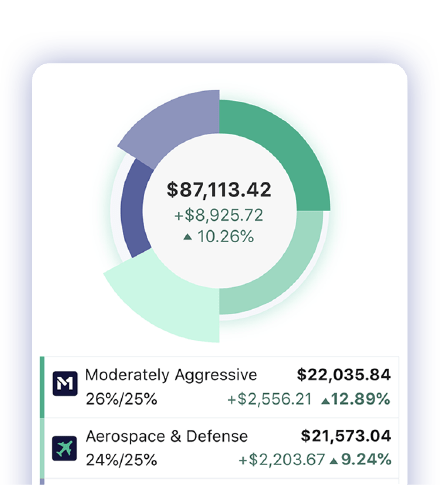

M1’s innovative approach to portfolio automation In today’s investing landscape, investors have a wealth of options for portfolio management. Gone are the days when traditional…

I grew up in a family with very little money, and no one ever found the time to understand how money works. There was no…

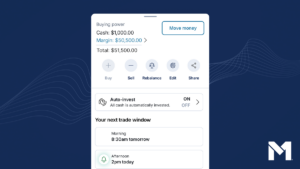

Sophisticated wealth building, simplified Today, we’re excited to unveil our latest feature: Margin buying power. This advancement streamlines how you leverage margin in your investment…

Five years ago, I took the leap of faith and started talking openly about my pursuit for a different life on my YouTube channel Dividend…

The stock market has been a whirlwind throughout the first four months of the year. Entering the year, stocks were firing on all cylinders as…

As of today, we’re starting the rollout of the M1 High-Yield Cash Account to existing M1 clients. We are excited to launch this feature and…

April showers bring May flowers, but rather than rain, let’s hope for a shower of positive stock market gains. In fact, April is one of…

Invest, borrow, and spend on one intuitive platform. Customize your strategies, automate the big picture, and let The Finance Super App®️ take care of the day-to-day. M1 gives total control for your wealth today and tomorrow.

Check the background M1 Finance LLC with FINRA’s BrokerCheck

Disclosures

By using this website, you accept our Terms of Use and Privacy Policy and acknowledge receipt of all disclosures in our Disclosure Library. All agreements are available in our Agreement Library. M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information.

M1 is a technology company offering a range of financial products and services. “M1” refers to M1 Holdings Inc., and its wholly-owned, separate affiliates M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC.

All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using M1 Borrow’s margin account can add to these risks, and you should review our margin account risk disclosure before borrowing. Nothing in this informational site is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.

Brokerage products and services are not FDIC insured, no bank guarantee, and may lose value. Brokerage products and services are offered by M1 Finance LLC, an SEC registered broker-dealer, Member FINRA / SIPC.

M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. For a complete list of fees M1 may charge visit M1’s Fee Schedule.

M1 is not a bank. M1 High-Yield Savings Accounts and Personal Loans are furnished by B2 Bank NA, Member FDIC and Equal Opportunity Lender, and serviced by M1 Spend LLC, a wholly-owned operating subsidiary of M1 Holdings, Inc.

M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

Credit Card not available for US Territory Residents. Review Cardholder Agreement and Rewards Terms for important information about the Owner’s Rewards Card by M1. The Owner’s Rewards Card by M1 is Powered by Deserve and issued by Celtic Bank.

M1 Digital LLC is a wholly separate affiliate of M1 Finance LLC, and neither are involved with the execution or custody of cryptocurrencies. Cryptocurrencies are not FDIC or SIPC insured. For relevant crypto disclosures and risks, visit Crypto Disclosures.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

M1 Finance LLC

200 N LaSalle St., Ste. 810, Chicago, IL 60601

© Copyright 2025 M1 Holdings Inc.