Three of our best promotions ever to kick off your New Year

You know what they say… goals are good. Plans are better. So if you’ve got financial goals for the year, these promotions may help you…

Master your financial future with expert planning resources. Learn financial wellness, goal-setting, and retirement strategies for long-term prosperity.

You know what they say… goals are good. Plans are better. So if you’ve got financial goals for the year, these promotions may help you…

Purchasing a home is often considered a milestone in one’s financial journey. While the benefits of home ownership are well-known, many first-time buyers are caught…

As a homeowner, you’ve achieved a significant milestone in your financial journey. However, with great property comes great responsibility. One of the most crucial aspects…

Imagine Alex, a first-time home buyer, scrolling through real estate listings and feeling concerned about current interest rates. If you’re like Alex and many other…

The consistent favorite headline of March Madness is how nearly impossible it is to pick a perfect bracket, yet millions of fans decide to fill…

Publicly traded real estate investment trusts (REITs) are companies that hold portfolios of various types of real estate. And just like traditional real estate investing,…

Being wealthy isn’t a prerequisite to being the president of the United States, but as they say: fortune favors the bold. Presidents George Washington and…

We all know Valentine’s Day (or Singles Awareness Day) is this week, and it can evoke a myriad of emotions ranging from excitement to dread…

2023 was the year of resurgence for car manufacturers and the adoption of electric vehicles in the United States. About 15.5 million new vehicles were…

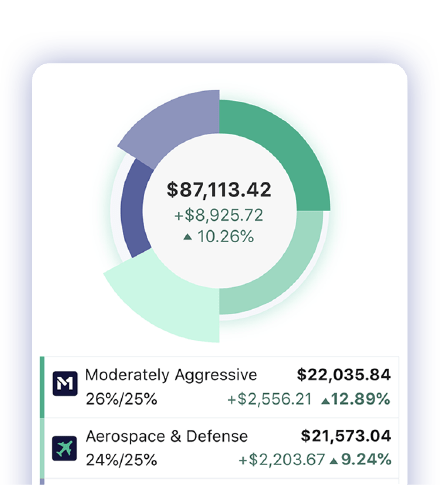

Invest, borrow, and spend on one intuitive platform. Customize your strategies, automate the big picture, and let The Finance Super App®️ take care of the day-to-day. M1 gives total control for your wealth today and tomorrow.

Check the background M1 Finance LLC with FINRA’s BrokerCheck

Disclosures

By using this website, you accept our Terms of Use and Privacy Policy and acknowledge receipt of all disclosures in our Disclosure Library. All agreements are available in our Agreement Library. M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information.

M1 is a technology company offering a range of financial products and services. “M1” refers to M1 Holdings Inc., and its wholly-owned, separate affiliates M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC.

All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using M1 Borrow’s margin account can add to these risks, and you should review our margin account risk disclosure before borrowing. Nothing in this informational site is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.

Brokerage products and services are not FDIC insured, no bank guarantee, and may lose value. Brokerage products and services are offered by M1 Finance LLC, an SEC registered broker-dealer, Member FINRA / SIPC.

M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. For a complete list of fees M1 may charge visit M1’s Fee Schedule.

M1 is not a bank. M1 High-Yield Savings Accounts and Personal Loans are furnished by B2 Bank NA, Member FDIC and Equal Opportunity Lender, and serviced by M1 Spend LLC, a wholly-owned operating subsidiary of M1 Holdings, Inc.

M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

Credit Card not available for US Territory Residents. Review Cardholder Agreement and Rewards Terms for important information about the Owner’s Rewards Card by M1. The Owner’s Rewards Card by M1 is Powered by Deserve and issued by Celtic Bank.

M1 Digital LLC is a wholly separate affiliate of M1 Finance LLC, and neither are involved with the execution or custody of cryptocurrencies. Cryptocurrencies are not FDIC or SIPC insured. For relevant crypto disclosures and risks, visit Crypto Disclosures.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

M1 Finance LLC

200 N LaSalle St., Ste. 810, Chicago, IL 60601

© Copyright 2025 M1 Holdings Inc.