Placing bets and breaking sweats for March Madness

The consistent favorite headline of March Madness is how nearly impossible it is to pick a perfect bracket, yet millions of fans decide to fill…

Explore market and finance trends with insightful thought pieces from industry experts.

The consistent favorite headline of March Madness is how nearly impossible it is to pick a perfect bracket, yet millions of fans decide to fill…

Publicly traded real estate investment trusts (REITs) are companies that hold portfolios of various types of real estate. And just like traditional real estate investing,…

If someone in your life is an educated investor, fanatic of a publicly traded company or even brand new to the idea of investing — they could really appreciate the gift of company ownership. Here’s everything you need to know about buying stocks for someone else.

Personal finance is just that – personal – but the goals remain the same: To protect and grow your wealth. It’s also a journey of…

As 2022 comes to a close, we suggest some last minute ways to make the most out of your tax bill and set yourself up for next year.

As the Federal Reserve continues raising interest rates, we discuss three strategies you could include in your financial plan.

FTX, one of the largest cryptocurrency exchanges in the world, experienced a cascade of events that culminated in a run on deposits and the subsequent…

Through midterms, earnings, and interest rates we explore what we do know about the market in these times of uncertainty.

As earnings, rate hikes, and the jobs report loom for investors, we explain the impacts they could have on the fourth quarter.

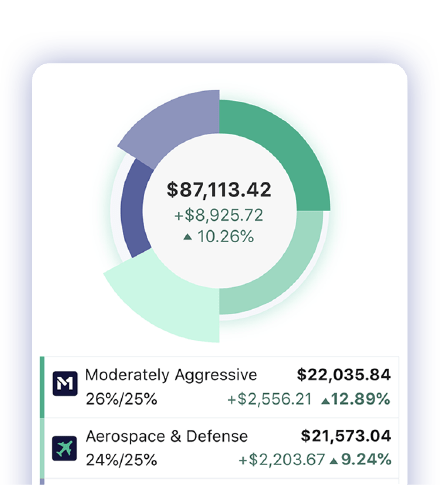

Invest, borrow, and spend on one intuitive platform. Customize your strategies, automate the big picture, and let The Finance Super App®️ take care of the day-to-day. M1 gives total control for your wealth today and tomorrow.