The drink in your hand isn’t always an easy pour

The morning cup of joe and end-of-day cold beer are simple pleasures for many. I’m an iced latte and IPA kind of guy personally. While…

Improve your financial well-being with tips and frameworks for building long-lasting habits.

The morning cup of joe and end-of-day cold beer are simple pleasures for many. I’m an iced latte and IPA kind of guy personally. While…

Rate chasing between high yield savings accounts several times may not be worth it. It may be worth it to simply pick one and move forward with it.

Home solar can be a great way to cut costs on your home energy bill. But is it worth the investment?

You can potentially reduce your tax liability by continuing to invest. Here are a few ideas to get started.

The M1 high yield savings account can be a great part of your financial strategy for both short-term and long-term planning.

The M1 HYSA can be a great addition to your financial toolbelt. Whether its for an upcoming home purchase or a simple emergency fund, the high yield savings account may be worth considering.

Building wealth is a long-term commitment, not something that happens overnight. Here’s a few steps to help you build that plan.

Analysts are debating the possibility of a recession in 2022, so we’re sharing recession facts and mindset tips for managing downturns.

Over the past six months, markets have dropped, interest rates have risen, and travel is back in full swing. The plans or budget you made…

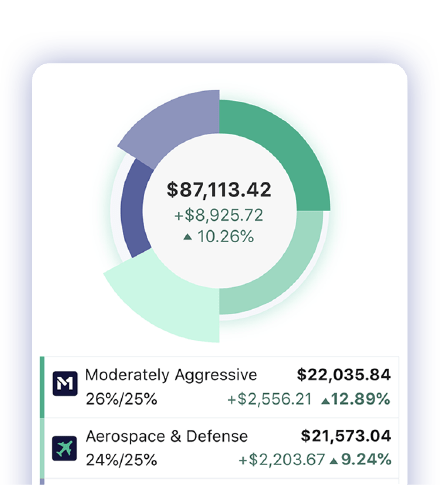

Invest, borrow, and spend on one intuitive platform. Customize your strategies, automate the big picture, and let The Finance Super App®️ take care of the day-to-day. M1 gives total control for your wealth today and tomorrow.