What’s a Roth IRA?

The Roth IRA gives investors the opportunity to put money away to grow over the long term for retirement — without worrying about taxes on the back end. There are penalties if you need to access the funds you’ve invested before you turn 59.5. You must have taxable income in order to invest in a Roth IRA.

Investing for retirement is a must for everyone, but finding the right type of account to put those dollars can be puzzling. However, many investors appreciate the Roth IRA for its tax-friendly benefits.

A Roth IRA (individual retirement account) is an account that offers investors the opportunity to invest with post-tax dollars and not owe taxes when you take distributions in retirement. This is different from a traditional IRA, which is used to defer taxes until you take distributions in retirement.

The Roth IRA is favorable by some because the growth and gains in the account are completely tax-free since the account is funded with post-tax dollars. However, there are several rules regarding this account that you should know before contributing to a Roth IRA.

How a Roth IRA works

Named after the late U.S. Senator William Roth, the Roth IRA gives investors the opportunity to put money away to grow over the long term for retirement — without worrying about taxes on the back end. That means you can pay taxes on your contribution now and not have to pay any on your gains when you retire, when you may be in a higher tax bracket.

But since this account is designed to be saved until retirement, there are penalties if you need to access the funds you’ve invested before you turn 59.5 — with a few exceptions, which we’ll get into below.

If you’re eligible, Roth IRAs let you invest thousands of dollars every year. Those contributions can grow tax-free (if requirements are met).

Roth IRA rules

First, you must have taxable income in order to invest in a Roth IRA. (For example, you aren’t able to invest money that is gifted to you.)

Next, your filing status, age, and income determine how much you can invest in a Roth IRA. Here are the 2023 Roth IRA limits:

| Single Filers (MAGI) | Married Filing Jointly | Married Filing Separately | Yearly Maximum Contribution for those under 50 years old | Yearly Maximum Contribution for those over 50 years old |

| under $138,000 | under $218,000 | $0 | $6,500 | $7,500 |

| $139,500 | $219,000 | $1,000 | $5,850 | $6,750 |

| $141,000 | $220,000 | $2,000 | $5,200 | $6,000 |

| $142,500 | $221,000 | $3,000 | $4,550 | $5,250 |

| $144,000 | $222,000 | $4,000 | $3,900 | $4,500 |

| $145,500 | $223,000 | $5,000 | $3,250 | $3,750 |

| $147,000 | $224,000 | $6,000 | $2,600 | $3,000 |

| $148,500 | $225,000 | $7,000 | $1,950 | $2,250 |

| $150,000 | $226,000 | $8,000 | $1,300 | $1,500 |

| $151,500 | $227,000 | $9,000 | $650 | $750 |

| $153,000 & over | $228,000 & over | $10,000 & over | $0 | $0 |

Note: you do have leeway on how long you have to invest in each year. For example, you can contribute for the 2022 tax year until Tax Day 2023. And the same will apply for 2023, giving you until Tax Day 2024 to max out your contribution limit.

For many investors, they will fall into the top row — meaning they can invest either $6,500 or $7,500, depending on their age. And maxing out your contributions every year you’re eligible over the long term could potentially give you a chance to see significant growth.

But if you find yourself needing to access your funds before you reach age 59.5, you can withdraw your own contributions at any time with no penalty. However, earnings and gains must stay within the account or you will incur taxes and penalties.

If you need to withdraw more than your contributions before you’re 59.5 years old, there are a few cases where you can do so without incurring a 10% early withdrawal penalty. They are:

- A first-time home purchase (up to $10,000 lifetime maximum)

- College expenses

- Birth or adoption expenses

- Unreimbursed medical expenses or health insurance if you’re unemployed

Additionally, if the account is part of your estate when you pass away, a payment from your Roth IRA to an inheritance recipient wouldn’t incur any early withdrawal penalty.

If your account is more than five years old, taxes don’t apply to early withdrawals in the case of a first-time home purchase, if you become disabled, or pass away.

The power of a Roth IRA

The principle of investing comes down to one simple concept — delayed gratification. Every dollar you put away in this account has the potential to multiply many times over between now and retirement. And because of the post-tax benefits of the Roth IRA, the money inside the account is tax-free for you to enjoy in retirement.

Here are a few simple scenarios that demonstrate how you can grow your retirement nest egg and net worth using a Roth IRA.

- Let’s say you open a Roth IRA the day you turn 18, and begin contributing $1,500 per year until you’re 60 years old. In the account, you choose to invest in a broad market index fund that tracks the S&P 500 — which returns roughly 9% with dividends reinvested.

When you turn 60 years old, your total investment is $63,000 — but you may have nearly $660,000 waiting for you on your 60th birthday.*

- Let’s say you’re 25 years old, and you just discover the power of the Roth IRA and decide to completely max it out until retirement. The account limits can change year to year, so for this example, we will just use the 2023 maximum of $6,500. By age 50, you will have contributed $162,500. And if your funds have an annualized return of 8%, your account would be worth an estimated $510,000.*

Moreover, if you don’t contribute another dime after 50 years old and wait until you’re 60 years old to pull from it — it could potentially grow to $1.1 million. That is the power of compounding interest.*

To run the numbers on what you can accomplish by investing and using compound interest to

your advantage, use the U.S. Securities and Exchange Commission compound interest

calculator.

Additionally, you can learn about some of the types of investing strategies.

How to open a Roth IRA, and use it

You can open a Roth IRA in just a few minutes with M1. After that, there are a few more key steps to begin putting your money to work.

- After opening the account, you have to fund it from an active bank account. This typically takes one to two business days to see the money appear in your Roth IRA.

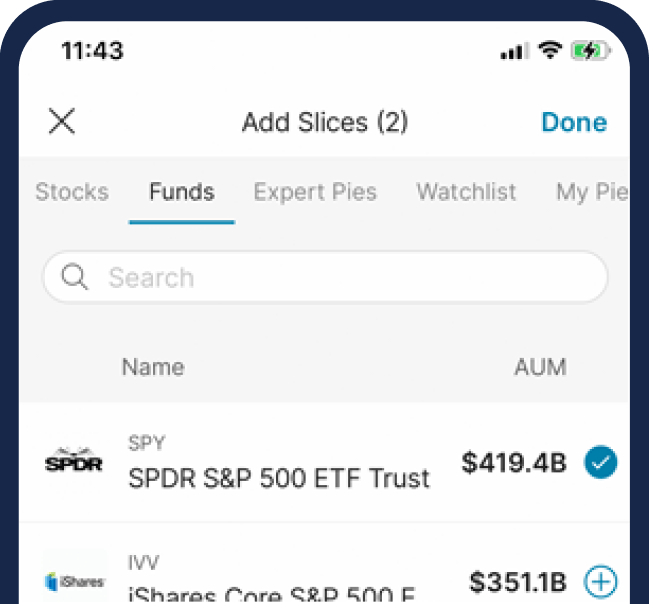

- Once the funds appear, you need to select a security to invest in. This can be an individual company stock, ETF, index fund, or another investment you’d like.

And now, you will be officially invested in your Roth IRA.

Did you know?: After you’ve invested your funds, your dividends could be reinvested so you can continue earning compound returns. In the M1 app, you can set your auto invest to $25 (or more) — and your dividends and other incoming cash will be automatically invested.

The M1 bottom line

A Roth IRA account is a great option to begin your long-term investing journey. You can invest in the stocks, ETFs, index funds and other securities you believe are going to grow over time — with no applicable taxes in retirement.

However, if you don’t qualify for a Roth IRA, a traditional IRA or taxable brokerage account are alternatives to consider for your investing strategy. (Read more about the difference between these accounts.)

*All examples above are hypothetical, do not reflect any specific investments, is for informational purposes only, and should not be considered an offer to buy or sell any products. M1 does not provide any financial advice.

Formula used for compound interest is FV=PV×(1+ni)nt • FV=Future value • PV=Present value • i=Annual interest rate • n=Number of compounding periods per time period • t=The time period The first example is FV=1500(1+365.09)^36542 The second example is FV=6500(1+365.08)^365*25

20230316-2766458-8862205