Early Withdrawals from Your IRA: Understanding Penalties, Exceptions, and Consequences

Individual retirement accounts (IRAs) are a great way to save for retirement. However, sometimes life happens, and you may need to withdraw money from your IRA before reaching your retirement age.

Taking an early distribution from your IRA means you’re taking it before you turn 59 ½.

While early withdrawals from your IRA can be a solution to your financial needs, the IRS may charge you a 10% tax penalty in addition to any federal and state taxes you owe from the withdrawal.

However, there are exceptions to this rule that could potentially help you avoid the 10% early withdrawal penalty. Read on to learn more.

Types of IRAs

A traditional IRA allows for tax-deferred growth on retirement savings funded with pre-tax earnings, but taxes must be paid on any withdrawals.

A Simplified Employee Pension (SEP) IRA is a plan that lets employers contribute to traditional IRAs set up for their employees.

A Savings Incentive Match PLan for Employees (SIMPLE) IRA is an account that allows employees and employers to contribute tax-deferred to traditional IRAs set up for employees of a qualifying small business.

A Roth IRA lets individuals contribute after-tax dollars to the account and does not tax distributions after 59 ½.

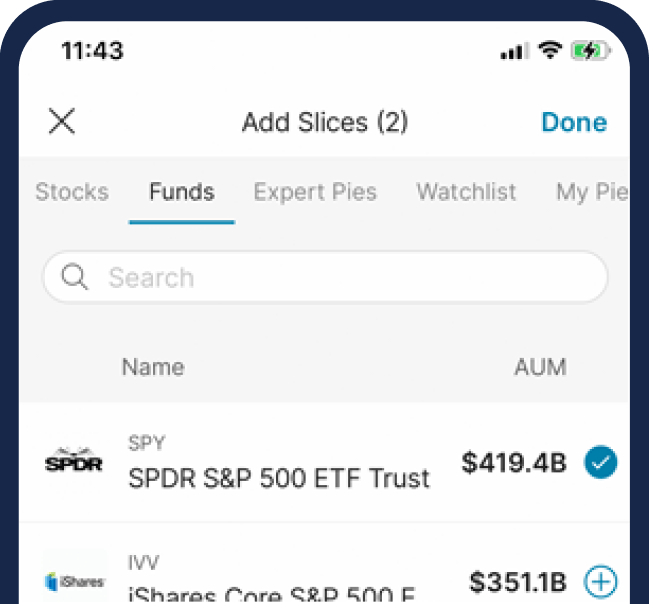

Withdrawals, transfers, and funding your account are easy on M1. Our platform takes the stress out of investing so you can focus on building wealth.

Learn more about the difference between traditional IRAs and Roth IRAs.

Each IRA has different rules that make up the account. In this post, we’ll explain the taxes and penalties that come with early withdrawals as well as the exceptions. Then we’ll discuss some consequences of choosing to withdraw funds early.

Taxes and penalties

You may be required to pay federal and state taxes on withdrawals from an IRA.

For early withdrawals, you may also pay a 10% penalty. However, the IRS will waive the 10% penalty if the withdrawal meets specific exceptions, which we’ll describe below.

For SIMPLE IRAs, a 25% penalty may be applied if you withdraw in the first two years of your first contribution. After the first two years, the penalty is also 10%.

For Roth IRAs, you can withdraw contributions without paying taxes or penalties at any time. But making an early withdrawal of earnings could be subject to the 10% tax penalty if the account is less than five years old or if the withdrawal doesn’t meet the requirements for a qualified distribution:

Qualified distributions

Roth IRA withdrawals can be tax- and penalty-free as long as they follow certain rules. You must own your Roth for five years and be withdrawing for one of the following reasons:

- You are 59 ½

- Permanent disability (or death, when the withdrawal is made by your estate)

- A first-time home purchase (up to $10,000 lifetime maximum)

Exceptions

You may be able to avoid the 10% early withdrawal penalty on traditional IRAs, Roth, SEP, and SIMPLE IRAs with the following exceptions:

A first-time home purchase

Qualified first-time buyers can withdraw up to $10,000 from their IRA penalty-free to buy, build, or rebuild a first home. Funds must be used within 120 days.

Education expenses

Funds can be withdrawn without penalty to pay tuition and other educational expenses for family members including yourself, your spouse, children, and grandchildren.

Birth or adoption expenses

Parents can withdraw $5,000 to pay for any birth adoption expenses per child without penalty.

Death or disability

If you pass, your estate can withdraw from your IRA penalty-free. If you are permanently disabled, you can withdraw from your IRA penalty-free.

Medical or health insurance

Funds may be withdrawn to cover unreimbursed medical costs as long as the cost is more than 7.5% of your adjusted gross income.

For health insurance, if you are unemployed for at least 12 consecutive weeks, you may withdraw funds to pay health insurance premiums for yourself, your spouse, or your dependents.

Consequences of early withdrawals

Early withdrawals come with consequences. They can significantly lower your retirement savings and affect your rate of return.

We discussed the exceptions to the rules but if you do not qualify for an exception, the taxes and penalties associated with early withdrawals can be considerable. In addition to any money lost on the initial withdrawal, the taxes and penalties could worsen the impact of an early withdrawal.

Therefore, you may want to consider exhausting other options such as an emergency fund or high-yield savings account.

Learn more about this option with M1’s High-Yield Savings Account.

The M1 line

IRAs can be an essential part of your financial plan. Always examine all options before withdrawing early from an IRA such as an emergency fund or high-yield savings account. Each type of IRA has different rules that should be carefully considered when deciding whether or not to withdraw early.

Learn more about how many IRAs you can have.

If circumstances require you to make an early withdrawal, it’s important to understand the penalties, exceptions, and consequences. Informed decision making is imperative to reaching your retirement goals.

DISCLOSURES:

M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 High-Yield Savings Accounts are furnished by B2 Bank, NA, Member FDIC

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

20230428-2856279-9135105