How many IRAs can you have?

There is no limit on how many IRAs you can have. But there are limits on how much you can contribute in a single year.

The annual contribution limit for 2024 is $7,000, or $8,000 if you’re age 50 or older. That’s the total amount you can contribute to all your Roth IRAs and traditional IRAs each year, not per account.

So, you can have multiple IRAs, such as Roth IRAs, traditional IRAs, and SEP IRAs, or multiple of the same type of IRA. But this does not raise your annual contribution limit.

Your annual contribution can be split across however many IRAs you have. (In 2023, the IRA contribution limit was $6,500, or $7,500 if you were age 50 or older.) The IRS periodically decides whether to raise the contribution limit to adjust for increases in the cost of living.

Is having multiple IRA accounts smart for your investment strategy? In this post, we’ll discuss four of the most common types of retirement accounts and the benefits and drawbacks of having multiple retirement accounts.

What are my retirement options?

There are four types of retirement accounts: Roth IRAs, traditional IRAs, SEP IRAs, and SIMPLE IRAs.

Roth IRA

A Roth IRA allows individuals to make after-tax contributions. However, when you withdraw after 59 ½, you won’t owe any taxes on your investment earnings or contributions.

Traditional IRA

In a traditional IRA, you make contributions with your after-tax income, but you can claim a tax deduction for these contributions for that tax year.

You pay taxes on withdrawals from the traditional IRA. Any withdrawals before the age of 59 ½ are subject to penalty with some exceptions. In that way, because of the tax deduction, you may be able to potentially defer taxes on your traditional IRA. You’re required to begin taking distributions after 73 and you’ll be taxed at your ordinary income rate on withdrawals.

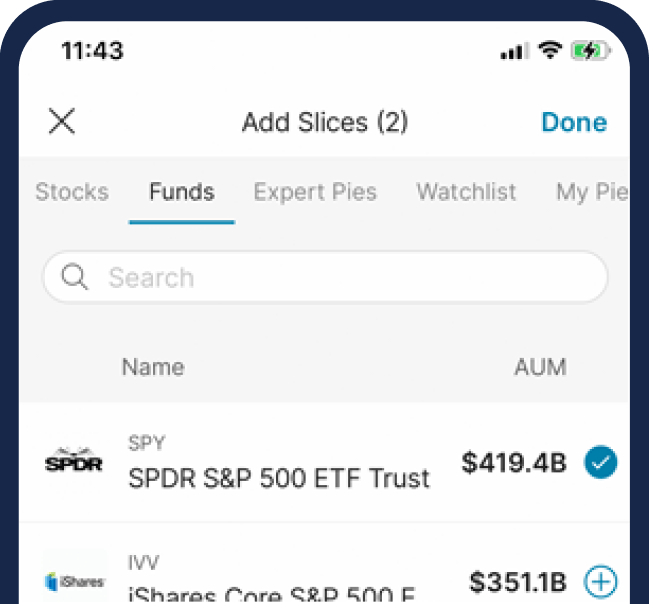

Starting an IRA is a major step in the marathon to a comfortable retirement. M1 offers traditional, Roth, and SEP IRAs all in one place.

SEP IRA

A Simplified Employee Pension (SEP) IRA is a plan that lets employers contribute to traditional IRAs set up for their employees. A business of any size or the self-employed can open a SEP IRA.

Contributions are tax-deductible for the employer and investments grow tax-deferred until 59 ½, where distributions are taxed as income. Employers can contribute up to 25% of the employee’s total compensation or a maximum of $61,000 for the 2022 tax year or $66,000 for the 2023 tax year, whichever is less.

SIMPLE IRA

A Savings Incentive Match PLan for Employees (SIMPLE) IRA is an account that allows employees and employers to contribute tax-deferred to traditional IRAs set up for employees of the business. It can be an option for small businesses that are not currently supporting another retirement plan. The contribution limits for a SIMPLE IRA are $14,000 in the 2022 tax year with a $3,000 catch-up contribution allowed for those 50 and over. In the 2023 tax year, the contribution limit is $15,500 with a $3,500 catch-up contribution allowed for those 50 and over.

For employers, they can choose one of the following contributions:

2% nonelective contribution: 2% of an employee’s compensation regardless of how much the employee deferred.

3% matching contribution: match the employee’s elective deferrals dollar-for-dollar up to 3% of the employee’s compensation. The employer has the option to reduce the 3% limit in some circumstances.

The benefits of having multiple IRAs

There may be benefits to having multiple IRA accounts.

You could possibly end up with both a Roth IRA and a traditional IRA anyway. If you already have a Roth IRA and decide to roll over an existing 401(K), usually it’s easiest to roll it over into a traditional IRA because of tax implications. This scenario would leave you with two IRA accounts.

Diversification

There may be different levels of diversification available between IRAs you personally own such as a Roth or traditional IRA and IRAs your employer sponsors such as a SEP or SIMPLE IRA.

Traditional and Roth IRAs may have more options when it comes to investing while SEP or SIMPLE IRAs may only allow you to invest in a limited option of funds of the employers choosing.

If you have a SEP or SIMPLE IRA through your employer, you could potentially diversify your savings and investments more by opening up separate traditional and/or Roth IRAs for yourself.

Insurance and beneficiaries

Having multiple IRA accounts can increase your insurance coverage for cash and investments in case of a brokerage. SIPC insurance limits for a single account holder on a platform can be increased by having different IRA accounts on the same platform.

If you hold two Roth IRAs at a SIPC-insured institution, your SIPC coverage for securities in those accounts is limited to $500,000. However, if you have both Roth and traditional IRA accounts at the same institution, they are treated as separate accounts and securities in those accounts may be eligible for up to $500,000 SIPC coverage, providing increased protection for your cash and investments. The same is true if you have two of the same account at different SPIC-insured institutions.

Having multiple IRAs also allows you to name different beneficiaries for each account. While you can name more than one beneficiary per IRA account, having different beneficiaries on different accounts can help you distribute your assets more efficiently.

Withdrawal rules

In addition to this, IRAs have different rules regarding withdrawals.

Since contributions to a Roth IRA are made with after-tax dollars, you can withdraw contributions tax and penalty free. To withdraw earnings, you’ll need to have had the account for five years and meet certain qualifications such as:

- A first-time home purchase (up to $10,000 lifetime maximum)

- Education expenses

- Expenses related to a birth or adoption

- You become disabled

- Expenses related to medical needs or health insurance if unemployed

RMDs

For traditional, SEP, and SIMPLE IRAs, you’re required to start withdrawing money at a certain age. These are called required minimum distributions (RMDs).

You must start taking withdrawals from your traditional IRA, SEP IRA, and/or SIMPLE IRA, when you turn 72. The IRS recently moved to age 73 if you turn 72 after Dec. 31, 2022.

You do not need to start taking RMDs until April 1st of the calendar year following the year you turn 73. For example, if you turn 72 in 2023 and you turn 73 in 2024, you do not need to take the RMD until April 1st of 2025.

If you do not withdraw the required amount, you will be subject to a 50% penalty of the amount you should have withdrawn.

RMDs do not apply to Roth IRAs.

Tax planning

Traditional IRAs allow you to receive a tax deduction for your contributions. However, when you withdraw money from a traditional IRA in retirement, those withdrawals are likely to be taxed as ordinary income at your regular tax rate. If you withdraw money from a traditional IRA before age 59 1/2, you may also be subject to a 10% early withdrawal penalty, unless you qualify for an exception.

Roth IRAs offer tax-free withdrawals after age 59 1/2. This means that you’ll pay taxes on the money you contribute to a Roth IRA in the year you earn it, but you won’t pay taxes on any investment earnings or withdrawals as long you withdraw after age 59 ½. For early withdrawals from a Roth IRA, there is no early withdrawal penalty on contributions. For earnings, you’ll need to have had the account for five years and meet certain qualifications.

The drawbacks of having multiple IRAs

There may be drawbacks to having multiple IRA accounts.

Making mistakes

There is a higher risk of making mistakes such as exceeding annual contribution limits or failing to take required distributions (RMDs), which can result in penalties and taxes.

Maximizing your gains

More accounts mean more paperwork. Multiple accounts can be difficult to keep track of and complicate tax season.

Rebalancing your portfolio and maintaining your strategy can also get harder with more accounts.

One account can make tracking and updating your portfolio easier.

May not be right for everyone

For some people, having either a Roth IRA or a traditional IRA may be sufficient if they also have other savings and retirement accounts, like a 401(K). There may be other accounts you’ll want to consider maxing out than to have multiple retirement accounts that aren’t being fully utilized.

Read more: brokerage accounts vs IRAs.

The M1 line

Ultimately, the number of accounts you’d like to have is up to you and your investment strategy.

Since Roth IRAs and traditional IRAs share a contribution limit, the benefits of having both may be limited to some people. But having your own Roth or traditional IRA can offer you more freedom if you’re not satisfied with the options in your employers’ retirement fund.

The number of IRAs you can have is not limited, but there are restrictions on how much you can contribute each year. When choosing how many IRAs you’d like to have, consider the benefits and drawbacks as well as your own financial plan.

DISCLOSURES:

20230331-2816687-8970292