A brokerage account vs. an IRA: Everything you need to know

Achieving long-term wealth growth is a fundamental objective of investing, and choosing the right account to hold your investments is crucial in realizing that goal. Different investment accounts offer unique advantages and selecting the right ones for your portfolio depends on your goals, tax situation, and timeline.

A brokerage account is an account in which you can buy and sell securities like stocks or ETFs.

An IRA (individual retirement account) is also an account where you can buy and sell securities; however, they have different tax implications and are designed to help users save for retirement.

On M1, clients can choose between a variety of accounts to save for retirement or other long-term financial goals.

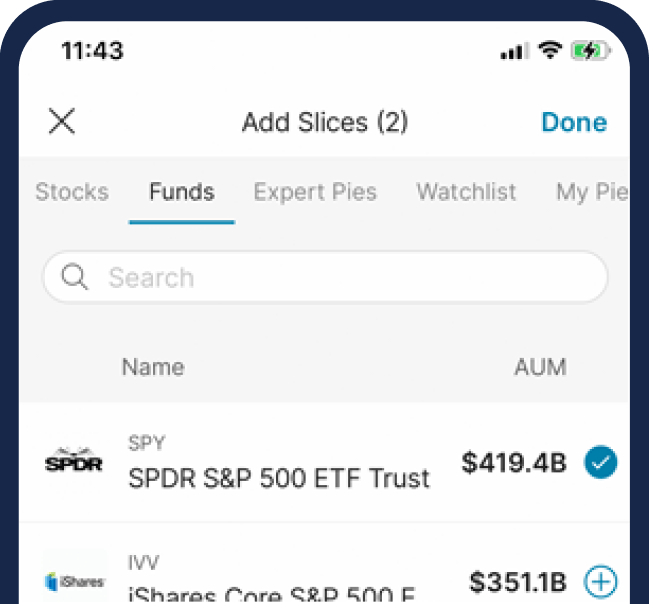

In these accounts, users use pies to build their portfolios. Pies are groups of investments. They are made up of slices which can contain an individual investment, another Pie, or even a group of Pies. Auto-invest takes care of the rest. Contributions will be automatically invested in accordance with the proportions of your Pie. Want to learn more? Check out our page on Pies.

In this post, we’ll break down the differences between brokerage accounts and IRAs. By the end, you’ll have a better understanding of which or both investment accounts are right for your long-term financial plan.

What is a brokerage account?

A brokerage account is a type of investment account that you can open with a broker, brokerage firm, or financial platform. With a brokerage account, you can buy securities like stocks and bonds and investment funds like mutual funds and ETFs.

On M1, this looks like our individual, joint, or custodial brokerage accounts. Clients can create their own pies or select from pre-built pies.

Advantages of a brokerage account

Investors typically use brokerage accounts to help them meet financial goals. Some may also use them for building long-term wealth or for day trading depending on one’s needs.

Brokerage accounts offer more flexibility, because the funds can be withdrawn at any time and they have no limits on annual contributions. However, unlike an IRA, there are fewer tax benefits for using a brokerage account to save. They are taxed at almost every level including capital gains, dividends, and interest income tax.

Open your brokerage account or IRA with M1 and start your wealth-building journey today. Our automated tools put the controls in your hands.

What is an IRA?

An IRA, or individual retirement account, is a retirement savings account that you can open with a brokerage firm or other financial platform. Two of the most important types of IRAs are traditional IRAs and Roth IRAs.

For frequently asked questions and the latest information, visit the IRS FAQ.

Traditional IRA

A traditional IRA allows individuals to contribute tax-deductible dollars, depending on your eligibility. The contribution limit is $6,500 for tax year 2023, or $7,500 if you’re age 50 or older. You can contribute to tax year 2022’s IRA up to April 2023. The account grows tax-deferred, meaning that an individual typically won’t owe taxes on it until they withdraw the money from the account, at which point they are taxed at the individual’s income tax rate at that time. There are limits on how much individuals can contribute to a traditional IRA each year, based on their age and income level, and there may be penalties for withdrawing money from the account before age 59 1/2.

On M1, clients can open up traditional IRAs and create their own pies or select from Model Portfolios.

Roth IRA

A Roth IRA allows individuals to make after-tax contributions. However, when you withdraw the money during retirement, you won’t owe any taxes on your investment earnings or contributions. There are limits on how much individuals can contribute to a Roth IRA each year, based on their age and income level, and there may be penalties for withdrawing money from the account before age 59 1/2.

M1 offers Roth IRAs where clients can create their own pies or select from Model Portfolios.

IRA tax incentives

One of the main differences between brokerage accounts and IRAs is how and when you pay taxes on your funds. Both accounts have different tax rules and restrictions. It’s important to understand tax efficiency to insure you’re growing your wealth in the most effective way possible.

Brokerage account taxes

Brokerage accounts are taxed in three ways: capital gains tax, dividend tax, and interest income Tax.

- Capital gains tax: When you sell stocks, mutual funds, or other securities in a brokerage account for a profit, you could be subject to capital gains tax. The tax rate for long-term capital gains (assets held for more than one year) is lower than the rate for short-term gains (assets held for one year or less).

- Dividend tax: If you receive dividends from stocks held in your brokerage account, you could be subject to dividend tax. Dividend income can be taxed at your ordinary income tax rate or a qualified tax rate. Ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

- Interest income tax: If you earn interest on cash or securities held in your brokerage account, you could be subject to interest income tax. This tax is also typically taxed at your ordinary income tax rate.

In addition, you’ll make contributions to your brokerage account using after-tax dollars, meaning dollars on which you already owed income tax.

IRA taxes

Traditional IRAs and Roth IRAs offer their own unique tax benefits and drawbacks.

Traditional IRA: This account allows you to receive a tax deduction for your contributions. However, when you withdraw money from a traditional IRA in retirement, those withdrawals are taxed as ordinary income at your regular tax rate. If you withdraw money from a traditional IRA before age 59 1/2, you may also be subject to a 10% early withdrawal penalty, unless you qualify for an exception.

Additionally, traditional IRAs require you to start taking required minimum distributions (RMDs) starting at age 73. The amount of the RMD is based on your age and the balance in your traditional IRA, and you’ll be required to take these withdrawals every year for the rest of your life.

Roth IRA: While Roth IRAs don’t offer tax deductions for contributions, they do offer tax-free withdrawals in retirement. This means that you’ll pay taxes on the money you contribute to a Roth IRA in the year you earn it, but you won’t pay taxes on any investment earnings or withdrawals as long you withdraw after age 59 ½. Roth IRAs also don’t require you to take RMDs at any age (unless you inherited the Roth IRA account from a non-spouse), which can give you more flexibility in retirement.

There are income limits on Roth IRA contributions, so not everyone is eligible to contribute. For 2023, the income limit for contributing to a Roth IRA is $153,000 for single filers and $228,000 for married couples filing jointly. If your income is above these limits, you may be able to make a Roth conversion also called a “backdoor” Roth IRA by first contributing to a traditional IRA and then converting that contribution to a Roth IRA.

The M1 line

Choosing the right investment account is crucial in achieving long-term wealth growth, and both brokerage accounts and IRAs have unique advantages and drawbacks that can suit different investment goals, tax situations, and timelines. A brokerage account allows for flexibility and could potentially be suitable for day trading, financial goal saving, and long-term investing, while IRAs, including traditional and Roth IRAs, are mainly used as retirement savings accounts and offer tax benefits. It’s essential to understand the tax rules and restrictions of each investment account to grow wealth effectively. With this knowledge, investors are better prepared to make informed decisions on which or both investment accounts are suitable for their long-term financial plan.

DISCLOSURES:

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

All investing involves risk, including the risk of losing the money you invest. Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc.

20230321-2800413-8950504