Get an APY boost from

TruFinancials

As a new client, you can get an extra +0.65% APY for 12 months when you open a High-Yield Cash Account (standard rate: 3.10% APY*).

You’re invited to join M1, the app for investors with a long-term vision. When you join from this page, you’ll get an extra 0.65% APY1 boost for your M1 High-Yield Cash Account. Plus, you get access to M1’s pioneering investing technology.

A cutting-edge cash reserve

No minimum balance

Custom automation rules

Unlimited number of withdrawals

Joint account access

Get in on FinTech’s

best kept secret

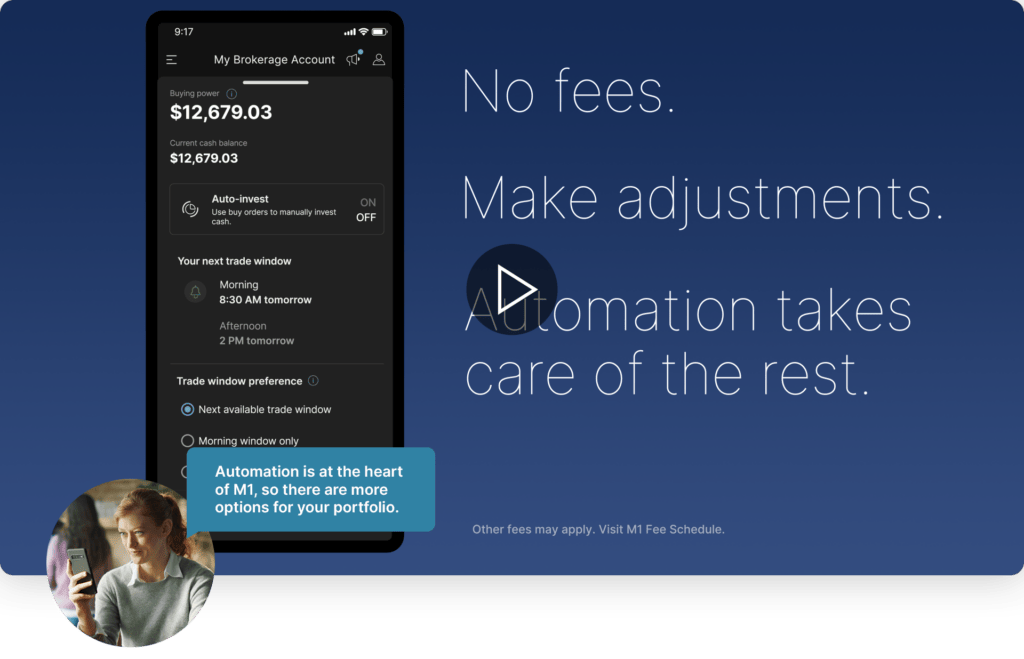

Tech fans and long-term investors alike can’t stop talking about M1. Why? The proprietary algorithm is unlike anything else out there. Often imitated by big players like Schwab and Fidelity, nothing comes close to the original. See how it works (in less than a minute).

Your money is protected

Member of SIPC. Securities in your account protected up to $500,000. For details, please see www.sipc.org.

All M1 High-Yield Cash Account deposits are FDIC-insured up to an aggregate total of $4.75 million.2

As a technology-first company, M1 utilizes the latest in information security to keep your private information secure.

Score your APY1 boost now

¹

Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

2 The cash balance in your Cash Account is eligible for FDIC Insurance once it is swept to our partner banks and out of your brokerage account. Until the cash balance is swept to partner banks, the funds are held in a brokerage account and protected by SIPC insurance. Once funds are swept to a partner bank, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.