CAPITALIZE Retirement ROLLOVER

Prepare for

life after work

Capitalize and M1 have joined forces to help you set up an IRA that lets you automatically invest for retirement. Custom-build your portfolio or choose a pre-made option based on your long-term goals.

The right time to open your IRA

IRAs (Individual Retirement Accounts) help you save for your future with tax benefits. You can open an account at any time, with potentially added advantages when you invest earlier and compound your earnings.

Hypothetical example for illustrative purpose only. Calculations assuming the following constraints: (a) an initial investment of $1000, (b) an annual rate of return of 10%, (c) no taxes, fees, inflation, or withdrawals. The assumed rate of return is not guaranteed as investing involves risk of loss. Source: Investopedia.com

Choose the account type that’s right for you

Traditional IRAs

Traditional IRAs can be funded with pre-tax earnings for tax-deferred growth on your retirement savings. You need to pay taxes on funds you withdraw from this account. Open a Traditional IRA

Roth IRAs

Fund your IRA with post-tax funds for tax-free growth of your retirement savings. You won’t pay taxes on funds you withdraw from this account. Open a Roth IRA

SEP IRAs

SEP (Simplified Employee Pension) IRAs are for those who are self-employed, own a business, employ others, or earn freelance income. You need to pay taxes on funds you withdraw from this account. Open a SEP IRA

Rollover IRAs

Have an existing 401(k) or IRA that needs a new home? It’s easy to transfer these accounts and begin managing them on the M1 platform. Transfer an IRA or Transfer a 401(k)

Visit our Help Center to learn more about account types.

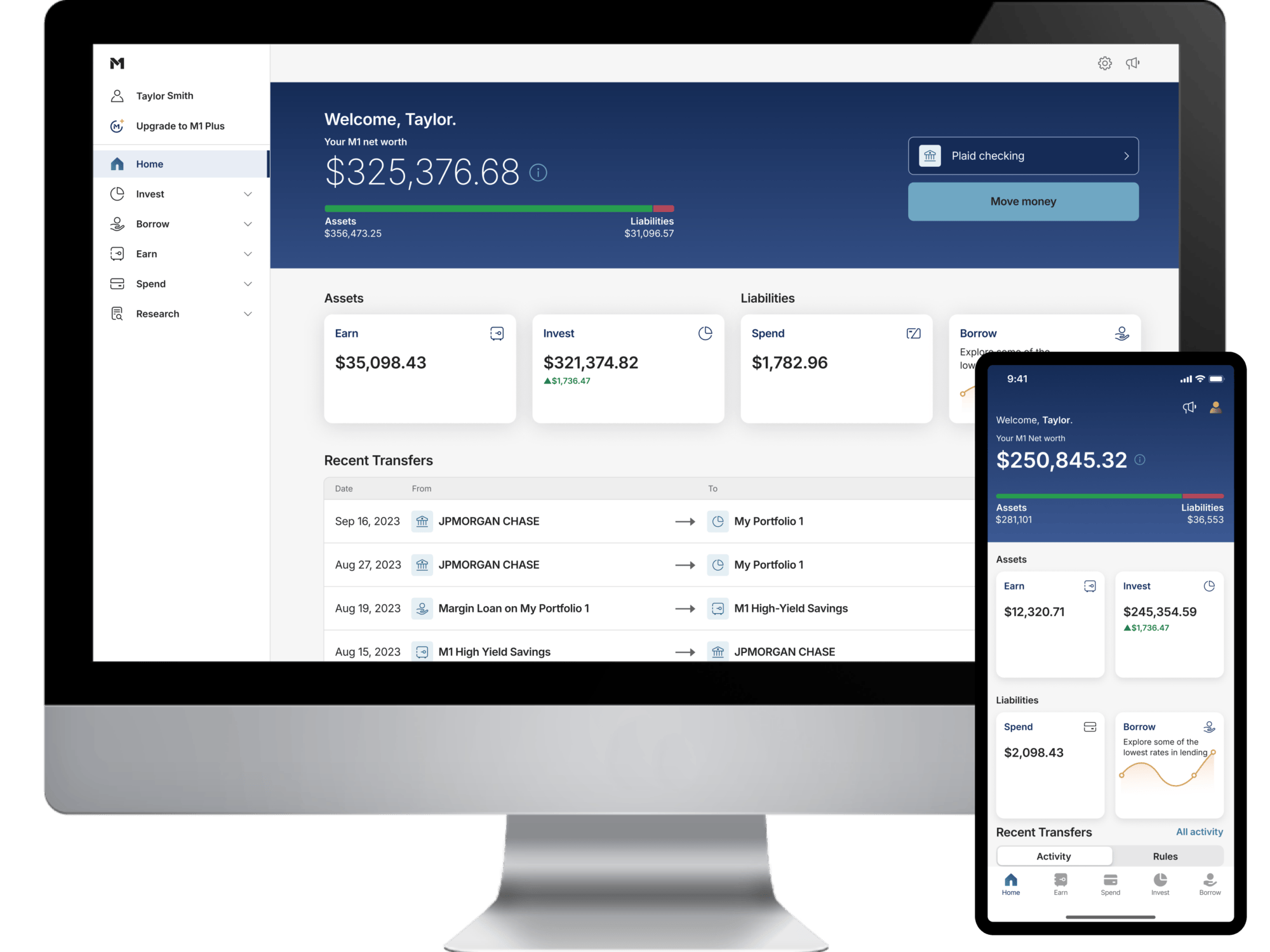

Put your long-term mindset into practice

Try a Model Portfolio

Choose from a wide selection of pre-built portfolios structured around your target retirement date, risk tolerance, or other long-term investing focuses.

Get into the details

Customize your Pie completely: include slices of different Model Portfolios, select individual stocks and ETFs, and set the amounts to your liking.

Stick to the plan

Turn on auto-invest and we’ll take care of the rest. Your contributions will be automatically invested in accordance with the proportions of your Pie.

No management fees

1 Brokerage accounts including M1 IRAs offer commission-free investing Commission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Other fees may apply such as regulatory, M1 Plus membership, account closures, and ADR fees. For complete list of fees, visit m1.com/legal/disclosures/misc-fees . For a complete list of fees, see the M1 Fee Schedule.

Total control, total automation for your wealth today and tomorrow.

1Participate in both trade windows when you have $25,000 or more equity to comply with pattern-day trading regulations.

2M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not available for Retirement or Custodial accounts. Margin rates may vary.