Borrow

Apply for a Personal Loan starting at

7.99

%3

on your cash balance

See your Personal Loan offers ›Borrow against your investment portfolio at 7.25%4

Get built-in Margin access ›On M1, you see groups of investments as Pies. Set a target for each Slice of your Pie. Every time you make a deposit, we’ll invest toward your target, commission-free.^

Member of SIPC. Securities in your account protected up to $500,000. For details, please see www.sipc.org.

All M1 High-Yield Cash Accounts deposits are FDIC-insured up to an aggregate total of $3.75 million.5

As a technology-first company, M1 utilizes the latest in information security to keep your private information secure.

Best for Sophisticated Investors

(Investopedia, 2024)

One of Time’s Best Investing Apps (Time, 2024)

Best for Money Management (Moneywise, 2024)

*Sources: https://apps.apple.com/us/app/m1-investing-banking/id1071915644 & https://play.google.com/store/apps/details?id=com.m1finance.android&hl=en_US&gl=US&pli=1

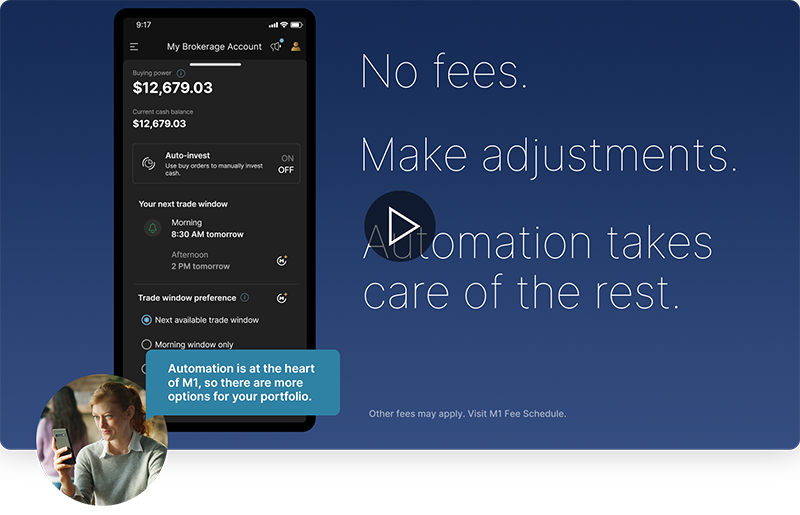

^Commission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Other fees may apply such as regulatory, M1 Plus membership, account closures and ADR fees. For complete list of fees, visit M1 Fee Schedule.

1Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is available from date of account opening and is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

21.5% - 10% Owner’s Rewards cash back earned on eligible purchases subject to a maximum of $200 cash back per calendar month. Cash back rates of 2.5% - 10% require an active M1 Plus subscription (billed at $36 annually or at $3 monthly).

3Rates are not guaranteed and are subject to change. Not all applicants qualify for the lowest available rate and rates are subject to credit history, income, term of loan, and other factors.

4M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not all securities are available for M1 Margin Loans and the amount that may be borrowed against a security is subject to change without notice. Available margin amount(s) of M1 Margin Loans may require greater than $2,000 per Brokerage Account. Not available for Retirement and Custodial accounts. Margin rates may vary.

5The cash balance in your Cash Account is eligible for FDIC Insurance once it is swept to our partner banks and out of your brokerage account. Until the cash balance is swept to partner banks, the funds are held in a brokerage account and protected by SIPC insurance. Once funds are swept to a partner bank, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.