Five years on M1: How I built a $1,000,000 dividend portfolio to become financially independent at 37

Five years ago, I took the leap of faith and started talking openly about my pursuit for a different life on my YouTube channel Dividend Growth Investing. I share what it’s really like to pursue a more meaningful life centered around financial independence… with a little humor. A life of my choosing and a life of purpose on my terms.

Growing up in the early 90s, I was never taught about financial literacy. However, the building blocks were laid from a very young age when it came to understanding the importance of living below my means and not spending more money than I had. I learned that if I wanted something, I had to work for it and exchange my time for money. The idea of creating passive income, or putting my money to work was a foreign, under-the-radar concept for me.

I do not come from money. My first job was at 16, working at a donut shop, making $5.15 an hour. After decades of living below my means, side hustling and investing, I retired from my corporate software sales job at 37. I discovered that the harder I worked, the luckier I seemed to be. Putting myself in the position to be lucky through hard work gave me a lot of opportunities that I otherwise would have never had.

My struggle with investing

I first started investing in the stock market at the end of 2007. Unfortunately, I didn’t have a crystal ball because shortly after, the global economy entered one of the worst recessions in modern history. At the time, I was working as a teller at Chase Bank seeing the panic in people’s eyes as they came to withdraw their life savings in fear of losing all their money.

Despite losing most of my money in the stock market during the 2008/2009 Great Financial Crisis, I learned a valuable lesson that has stuck with me all these years: Investing is emotional.

I thought the only way to invest was to time the market. I had to only buy stocks when they were low and only sell them when they were high. Sounds easy enough, right? Unfortunately, I wasn’t that lucky when it came to timing the market. I was too fixated on timing the market instead of time in the market. At this point in my life, I felt hopeless and ready to surrender to the idea that I was playing in a rigged system. It took me many years to build up the emotional fortitude to start investing after losing so much during that challenging time.

How the FIRE movement changed my life

In 2018, I found the Financial Independence, Retire Early (FIRE) movement. At the time, I worked in a high-stress environment where I knew I couldn’t last until the traditional retirement age. As a result of this, I started consuming every piece of content around FIRE that I could find. I was intrigued by the idea of buying my freedom. At first, like many others, I struggled with my own internal naysayers. I would catch myself thinking that reaching FIRE was only for more fortunate people and that I could never actually achieve something like that. It felt like I was standing at the bottom of Mount Everest.

While pursuing FIRE, I learned that there is no “one-size-fits-all” and that all roads lead to Rome. When most people think about FIRE, they think about living off the 4% rule, but this was not how I wanted to achieve FIRE. I was inspired by what JL Collins shares in his book, The Simple Path to Wealth. However, instead of focusing on investing with the total US stock market with VTSAX or the ETF version VTI and living off the 4% rule, I focused on building a dividend portfolio where I could live off the passive income. I invested primarily in low-fee dividend growth index funds with a focus on keeping things simple.

Focusing on FIRE with dividend investing changed my life because it helped me overcome my greatest challenge: controlling my emotions. This is because I prioritize the income my investments produce, rather than looking at the share price or total value of my portfolio.

Financial independence, feeling light as a feather

In 2023, I reached what is called Barista FIRE. Barista FIRE is where you are living off your investments but also working part time at something that you enjoy. Barista FIRE has allowed me to buy back my time and focus on other passions in life. I now spend the bulk of my time with my family and creating dividend investing and financial independence content on my YouTube channel Dividend Growth Investing.

While pursuing FIRE, I would often wonder what it would finally feel like once I reached my goal. Now having achieved financial independence for 1.5 years, the best way I can describe it is feeling light as a feather.

Let me explain. Imagine you are going through life wearing a backpack and someone constantly fills that backpack with rocks. While working in various jobs to earn a living, my backpack got heavier as it felt like more rocks got added with time. But once I reached financial independence, it was as if suddenly someone took that backpack off and I was free. I was light as a feather.

How M1 helped me reach financial independence

It’s hard to believe that it has already been five years since I first started investing with M1. I originally started investing with M1 because of the simplicity of building my portfolio based on my desired target allocation per holding and Pie. I’ve been impressed with all the new functionality that they’ve added to the platform since then. For example, instead of selling out of my portfolio in 2021, I borrowed against it using an M1 Margin Loan to put a down payment on my house. The same year, my wife and I welcomed our son into the world and instead of investing with a different brokerage, we simply opened an additional account with the purpose of investing a small amount each week for his future. By automating these investments, it really helped us to focus on building generational wealth for our family.

These are some of my favorite ways M1 helped me reach financial independence:

Simplicity & Automation

M1 is not ideal if you are looking to trade in and out of the stock market. M1 is ideal if you want to invest for the long-term. Once I understood this, I was able to fully embrace their platform instead of using multiple brokerages. Because I was looking to automate every aspect of my investing, using M1 was a no-brainer. Just because something is simple, it doesn’t mean it has to be bare-bones when it comes to how you invest. With the roll out of Smart Transfers, I was able to automate every step of how I wanted to invest or move my money around between my accounts.

Dynamic Rebalancing

I believe M1’s Dynamic Rebalancing is a very underrated feature. I automated my transfers and dollar-cost-averaged into my portfolio each week. The Dynamic Rebalancing allowed me to constantly rebalance my portfolio based on my target weighting without having to trigger a taxable event. This continues to be a game-changer for passive investors like me looking to automate their investing.

Peace of Mind

Having experienced the fall of many financial institutions during the Great Financial Crisis, I’ve been very cautious of where I put my money. When I first heard about M1 in 2019, I was very careful and only invested a few hundred dollars. Since then, I’ve been continuously impressed with how well they’ve gone above and beyond to protect investors. When it comes to peace of mind, it starts with transparency and communication—and I believe M1 does an incredible job with both. At the time of writing this article, M1 offers $3.75M in FDIC insurance on cash held in their new High-Yield Cash Account and up to $500,000 of SIPC insurance on investments.

New Dividend Tracker & M1 DRIP

I’ve had the opportunity to test the new dividend features that are about to be rolled out in M1: a dividend tracker and dividend handling, which can also be understood as a Dividend Reinvestment Plan (DRIP).

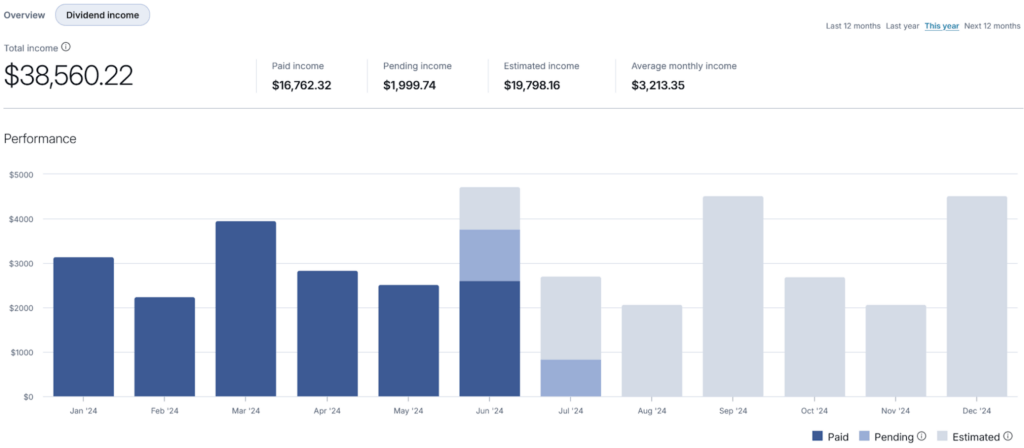

Let’s talk about the dividend tracker first. For those of you who have never used a dividend tracker before, it’s a tool to visualize your upcoming, declared, and estimated dividend income month over month.

Dividend Tracker from M1

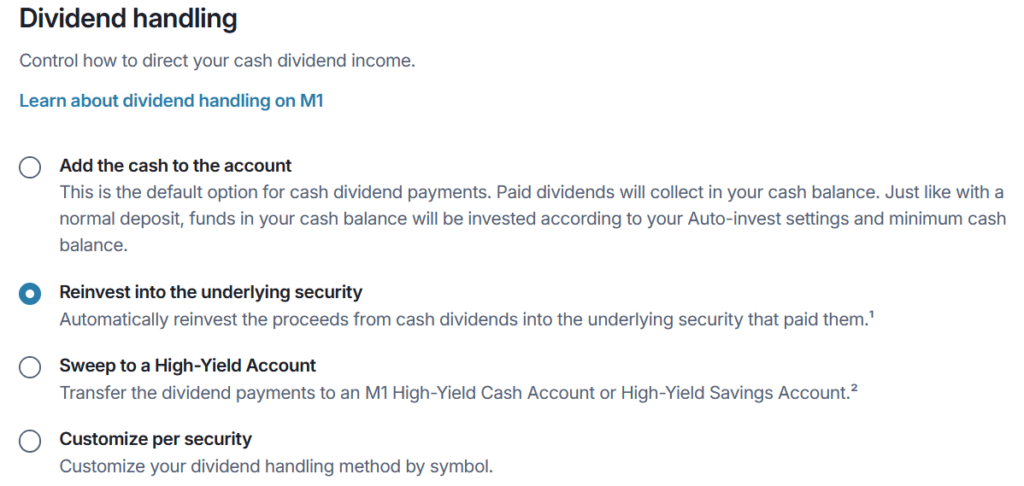

The next dividend feature is called dividend handling. This feature will now empower you to have more control over how you manage your dividend income. Specifically, this means that you can now decide where you want to move your dividend income. For example, if you get a $100 dividend from Coca-Cola, the dividend handling unlocks three options:

- You can choose to reinvest those $100 back into Coca-Cola

- You can also choose to send the $100 to your cash balance in your investment account to be invested like any other deposit using the auto-invest function

- Alternatively, you could have it sent directly to your High-Yield Cash Account

The best part in my opinion is that you can do this individually for each dividend stock or ETF that you own in your portfolio.

Dividend Handling from M1

Being a dividend investor just got a whole lot better investing with M1!

It’s ok to be different

Having read thousands of comments on my YouTube channel over the years, I have found that most people are distracted with the illusion that they are going to pick that one stock at the right time and hit it big. Most people focus all of their energy on picking the right stocks and building their wealth in their brokerage. I focused my energy in a different way by building my wealth outside of my brokerage account with the intent of bringing the money into my investment account. This allowed me to automate all my investments so that they could compound and grow passively. This really helped me control my emotions and have a long-term mindset. I believe M1 has been the best investment platform for me to accomplish this.

Planning for my financial future is complicated enough, but I don’t believe investing should be. Investing with M1 has been one of the best decisions I’ve made when it comes to creating generational wealth for my family and reaching financial independence at the age of 37. Here’s to another 5 years and beyond!

Disclosure note:

Jake did not receive monetary compensation for this post. However, Jake is part of the M1 Affiliate program and earns commissions from users signing up via M1 affiliate links on his YouTube channel.

20240627-3662693-11651074

- Categories

- Invest