Margin investing just got simpler: Introducing M1’s margin buying power

Sophisticated wealth building, simplified

Today, we’re excited to unveil our latest feature: Margin buying power. This advancement streamlines how you leverage margin in your investment strategy, offering improved control and efficiency for sophisticated investors.

Always consider the risks before using Margin. To learn more, see our margin account risk disclosure.

Addressing a key challenge

In recent years, M1 clients have initiated over 300,000 transfers to utilize margin to invest. This high volume highlighted a significant inefficiency in accessing and deploying margin for investments. We saw this as an opportunity to eliminate a time-consuming process and designed a streamlined experience that seamlessly integrates your margin buying power into your investing experience.

Understanding margin buying power

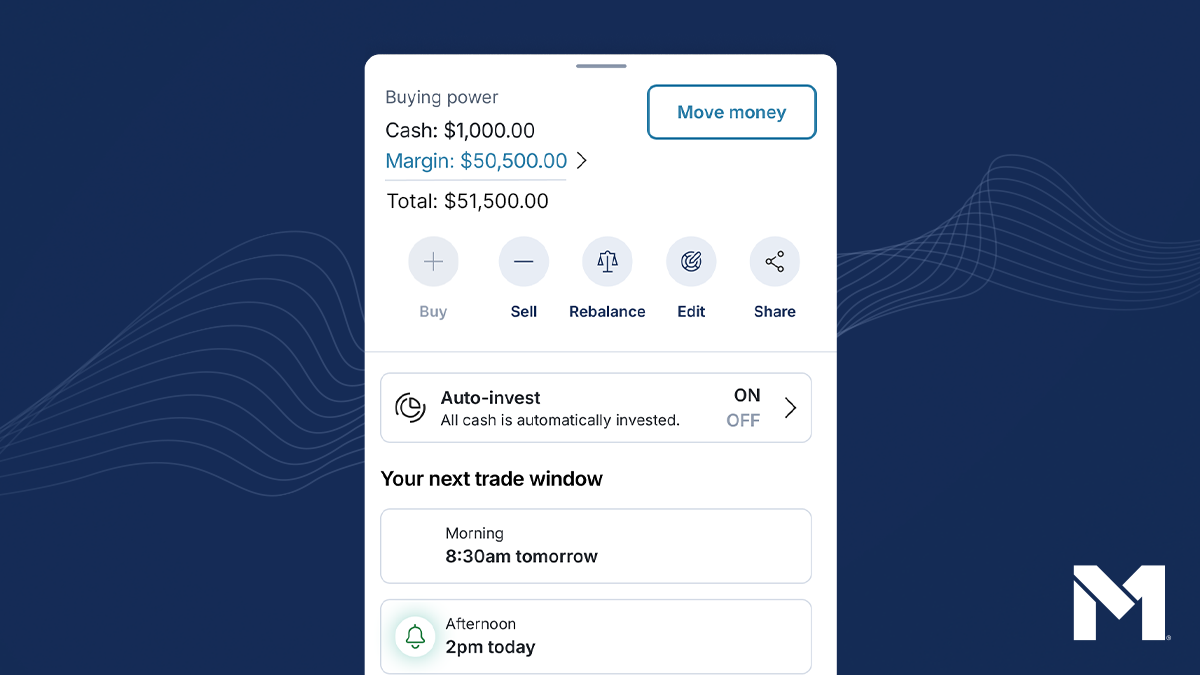

Margin buying power is a dynamic representation of your borrowing capacity that updates in real-time based on your current portfolio and the specific securities you’re considering for purchase. This feature fundamentally changes how you interact with margin in your M1 account.

Total buying power = cash buying power + margin buying power

- Cash buying power: The cash available in your account for investing.

- Margin buying power: The additional amount you can borrow against your existing portfolio for further investment.

Key features of margin buying power

1. Seamlessly leverage margin

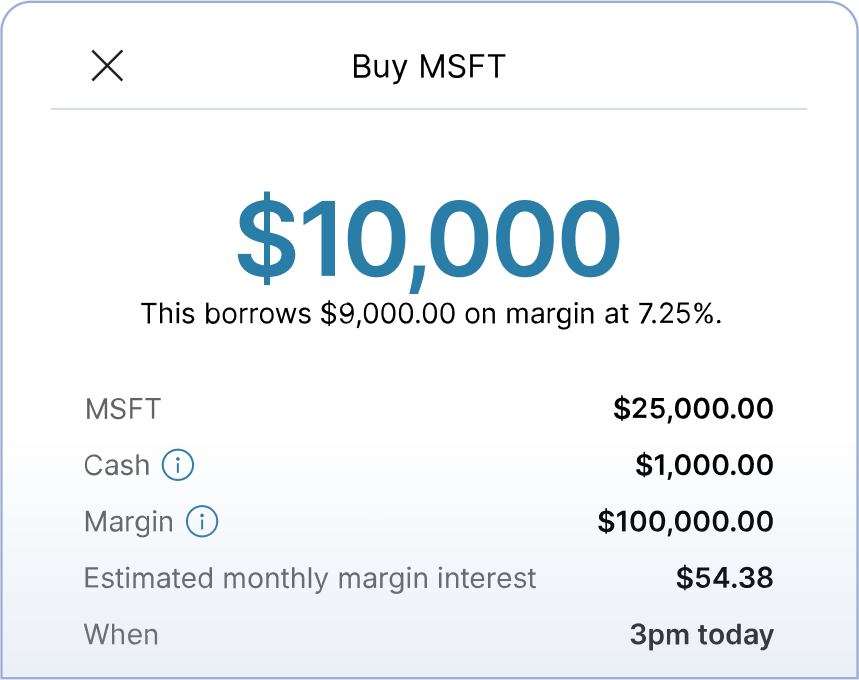

What’s New: Now you can invest using margin directly—no extra transfers needed. Margin buying power accounts for initial and maintenance margin requirements.

How it works: Seamlessly utilize your full buying power when you invest. You can buy securities with cash, margin or both. If you enter an amount greater than your cash buying power, you’ll see a clear breakdown of how much cash and margin will be used.

Why it matters: This feature simplifies the margin investment process, letting you take swift action on investment opportunities without the need to manually transfer funds from your margin loan balance. In this streamlined experience, your margin buying power enables you to efficiently use margin across various securities.

2. Dynamic calculations with seamless integration

What’s new: Margin buying power updates instantly as you consider different securities, factoring in potential equity additions. Your total buying power, including cash and margin components, is displayed while purchasing securities.

How it works: Our system continuously calculates margin availability based on your current portfolio, cash balance, and the specific investment you are considering. As you navigate your portfolio, your margin buying power adjusts to reflect specific margin requirements. We’ve redesigned our interface to prominently feature your total buying power throughout your decision-making process.

Why it matters: You can say goodbye to guesswork and manual calculations and get precise insight into your investment capacity. Access your full margin potential in one go.

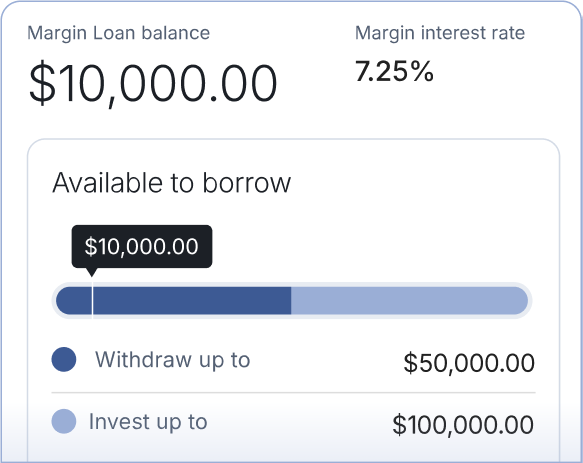

3. Understanding what is “Available to Invest” vs. “Available to Withdraw”

What’s new: We’ve clearly delineated your margin into two categories: the amount available for investing within M1 and the amount available for withdrawal.

How it works: Your margin is now presented as two distinct values: “Available to Invest” and “Available to Withdraw.”

“Available to Invest” represents the maximum amount of margin you can use for purchasing securities within your M1 account. This figure is based on your portfolio composition and M1’s margin rules, reflecting the additional buying power available through margin borrowing.

“Available to Withdraw” shows the amount you can transfer out, typically lower because withdrawals don’t increase your portfolio’s value or equity, unlike investments which can potentially grow your account’s value and borrowing capacity.

Why it matters: This clear distinction helps you make more informed decisions about using your margin, whether you’re increasing investments or addressing external financial needs.

Margin is built into your M1 experience

Margin at M1 isn’t just a standalone feature — it’s deeply integrated into our comprehensive financial platform. Here’s how margin fits into our broader ecosystem:

- Seamless Pie integration: M1’s unique Pie-based portfolio management works harmoniously with margin. When you’re investing in a Pie, the system calculates margin requirements based on the holdings and percentages within the Pie, considering what’s underweight and how much would be bought to rebalance.

- Versatile margin usage: While primarily designed for investing, margin at M1 can be used flexibly within our platform. You can use it to:

- Invest in securities

- Pay your M1 Owner’s Rewards Card bill

- Transfer to your M1 High-Yield Cash Account

- Access liquidity while you stay invested

- Smart Transfers compatibility: Set up automated, rule-based movement of funds that can include margin when appropriate.

Leveraging margin in long-term investing strategies

While margin buying power makes accessing margin more efficient, it’s important to understand how margin can be used effectively in long-term investing strategies. Here are some ways sophisticated investors might incorporate margin:

- Dollar-Cost Averaging: Use margin to maintain consistent investment contributions, even during periods when cash flow might be temporarily reduced. This allows you to stick to your long-term investment plan without interruption.

- Portfolio Rebalancing: Leverage margin to adjust your asset allocation without having to sell existing positions. This can be particularly useful in tax-advantaged accounts where selling might not have tax implications.

- Seizing opportunities: Use margin to take advantage of market dips or newly identified opportunities without disrupting your existing portfolio allocation.

- Bridging temporary cash needs: Instead of selling investments and potentially realizing taxable gains, use margin as a short-term loan to cover unexpected expenses.

Remember, while margin can potentially enhance your investing strategy, it also carries significant risks. It can amplify both gains and losses, and you could lose more than your initial investment. It’s crucial to use margin responsibly and in alignment with your risk tolerance and financial goals.

Streamlining margin investing: A real-world example

Meet John, a sophisticated investor with a $500,000 portfolio. He believes in maximizing his investment potential through strategic use of margin. John’s goal? To fully leverage his available margin to capitalize on current market opportunities.

The old way: A time-consuming loop

Before margin buying power, John’s process was tedious and repetitive. He had to:

- Transfer $250,000 from his Borrow account to his Invest account (50% of his $500,000 portfolio).

- Invest the transferred amount, growing his portfolio to $750,000.

- Realize more margin is available.

- Transfer another $125,000 and invest it, growing his portfolio to $875,000.

- Repeat the process with decreasing amounts: $62,500, $31,250, and so on.

This approach wasn’t just time-consuming; it also meant John risked missing out on timely investment opportunities due to delays in transfers and calculations. John found himself spending more time on logistics than on actual investment strategy.

The margin buying power advantage: One-step efficiency

Now, let’s see how margin buying power transforms John’s experience:

- John logs into his M1 account.

- He immediately sees his total buying power, including maximum available margin.

- In one seamless action, he selects his desired investments, utilizing his full buying power.

- With a single click, John completes his entire investment strategy.

By eliminating the transfer loop, margin buying power allows John to execute his investment strategy swiftly and efficiently. He can now focus on what really matters — making informed investment decisions — rather than getting bogged down in repetitive transfers and calculations.

Elevating your investing experience

This enhancement aligns perfectly with M1’s philosophy of sophisticated wealth-building, simplified. It’s particularly beneficial for investors like John who employ margin as part of their long-term investment strategy, allowing them to:

- Act on opportunities promptly

- Manage their portfolios more effectively

- Spend less time on manual calculations and transfers

- Focus on developing and executing their investment strategy

With margin buying power, you can:

- Make faster, more informed investment decisions with real-time margin information

- Increase investment potential by fully utilizing available margin efficiently

- Execute trades more effectively without multiple transfers

- Respond swiftly to market opportunities, unhindered by transfer delays

As we continue to innovate and improve our platform, our goal remains the same: to empower self-directed investors like you with sophisticated yet easy-to-use tools for building long-term wealth. Margin buying power is another step towards realizing our vision of making the financial tools of the ultra-wealthy accessible to all investors.

We’re excited for you to experience margin buying power and welcome your feedback as you explore this new feature. Thank you for choosing M1 as your wealth-building platform. Here’s to more sophisticated, efficient investing!

Important Disclosures

Always consider the risks before using Margin. To learn more, see our margin account risk disclosure.

Clients must determine whether margin strategies align with their investment objectives, experience, risk tolerance, and financial situation.

Margin buying power is designed to provide more transparent, efficient margin access. M1 does not make recommendations about margin suitability for individual investors.

Carefully review our full disclosures and consider whether margin investing aligns with your financial goals and risk tolerance before utilizing this feature.

Ready to enhance your margin investing experience? Log in to your M1 account now and explore margin buying power.

Learn more about Margin at M1

For more detailed information about margin investing at M1, please explore our Help Center articles:

These collections of articles provide comprehensive information to help you understand and effectively use margin in your M1 account.

SAIF-07122024-s4tebizl