Market gyrations + E*TRADE ownership changes + Robinhood outage got you rattled? We understand

Tough times don’t last, tough people do.

Robert H. Schuller

OK, so it’s been a pretty crazy couple of weeks for investors in the markets and for some of our brokerage peers. Take a look:

- Last week (February 23 – 28), US markets suffered one of top five biggest weekly downdrafts in history.

- On Monday, March 2, markets recovered with a gain of about 5%, one of the biggest daily upticks in history.

- One of the largest fintech brokerages, Robinhood, was completely offline all-day last Monday, a big chunk of Tuesday, and again today.

- On March 3, the Federal Reserve took emergency action and cut rates by 0.50%.

Then markets promptly swooned again, dropping almost 3%.

- On Wednesday, markets opened up over 2% and closed up over 4%

- Thursday, markets were down over 3%

- And Friday, March 6, markets opened down again

- And less than two weeks ago, E*TRADE announced that it was being acquired by Morgan Stanley.

If all this has you a little rattled, we understand. Frankly, if all this didn’t rattle you, we’d want to check your pulse.

At M1, we won’t tell you what to do or how to react. Everyone is unique, with different risk tolerances and time horizons, so blanket statements won’t help.

But we will do two things:

- We will give you information and resources to help you make the smartest decisions that are right for you and your situation.

- We will keep building the best financial platform for managing and growing your money.

One part of building the best platform is providing one that’s reliable and stays up during all market conditions. The recent extended outage at Robinhood spurred many investors to look for alternatives, and some of them asked us what we do to ensure reliability and prevent downtime. So without getting too “inside baseball” on you, here’s a small peek into what we do:

- Failures can be driven by literally dozens of causes, so we plan for them. And we develop our systems with resiliency in mind, meaning that a failure in one system or place won’t take down the whole infrastructure. For all you non-techies out there, this is called “asynchronous decoupled microservice architecture,” just in case you’re wondering.

- We use proven technologies utilized by industry experts for scalability and stability. In fact, we use Akka, the same technology used by PayPal, LinkedIn and Fortnite, to handle billions of transactions at massive scale.

- We spread our infrastructure across many different data centers with Amazon Web Services, which means that a problem in one locality can be isolated there and compensated for in another.

- We have different systems for writes and reads of data, and we can scale each independently depending on the expected load on the system. (Fun fact: that’s called Command query responsibility segregation, or wait for it, CQRS for short).

- We run a bunch of different tests on each new code commit and deploy these commits many times throughout the day. This means that our code updates are small and manageable and lowers the risk of failure. It also means we can roll back quickly to the prior code within minutes if an error is detected.

We could go on and on about this, and we will… in a future blog post.

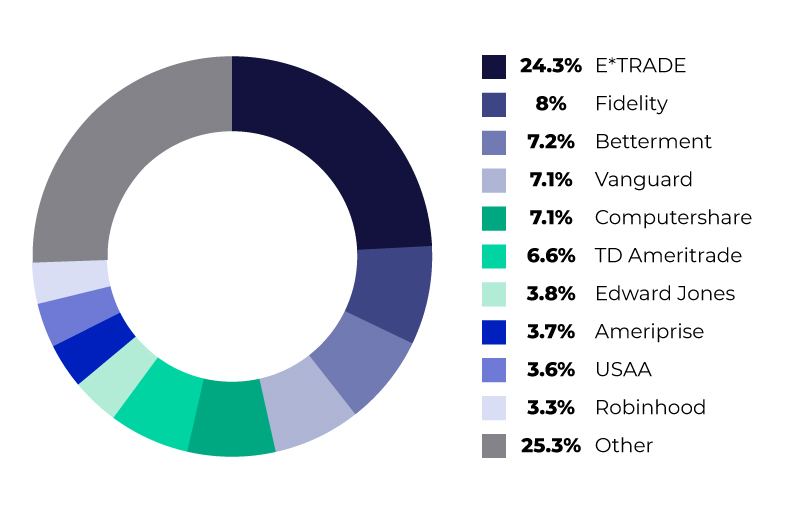

Another part of being the best is keeping you at the center of our innovation. We are focused on helping you keep as much of your money as possible and making it super easy to move and allocate your money in the ways you want. With Morgan Stanley acquiring E*TRADE, we’ve seen an uptick in account transfers from E*TRADE, which we believe was caused by concerns about its direction under new ownership. In the last two weeks alone, E*TRADE made up a quarter of all our account transfers.

So, if you’re uncomfortable with the upcoming ownership change at E*TRADE or you’re ready to find an alternative to Robinhood, we’d be grateful to serve your money management and wealth building needs. You can sign up here.

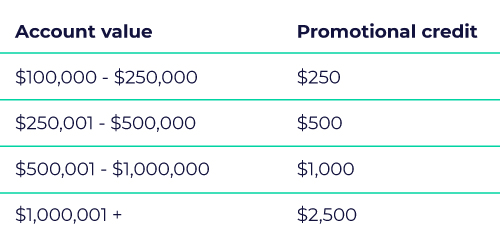

If you have accounts at either brokerage (or others) and you’d like to bring them over to us, we’re extending the following account transfer promotional payments for you. Check out the available transfer bonuses below.

Hang in there, tough people.

And as always, thanks for supporting M1.

- Categories

- Invest