Put your dividends to work, your way

M1 DRIP

Reinvest dividends in the security that generated it.

Invest

Fund your portfolio with dividend income.

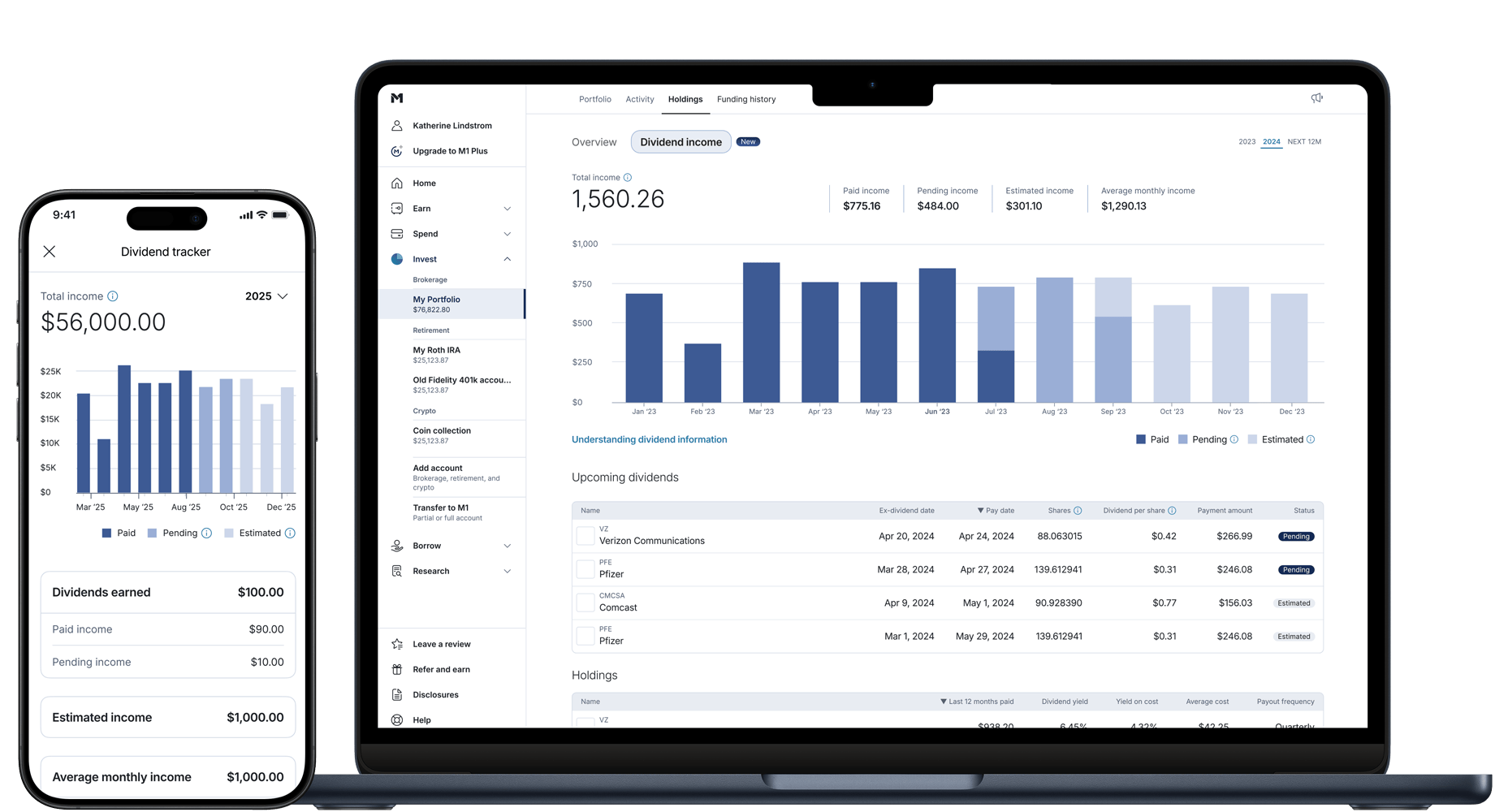

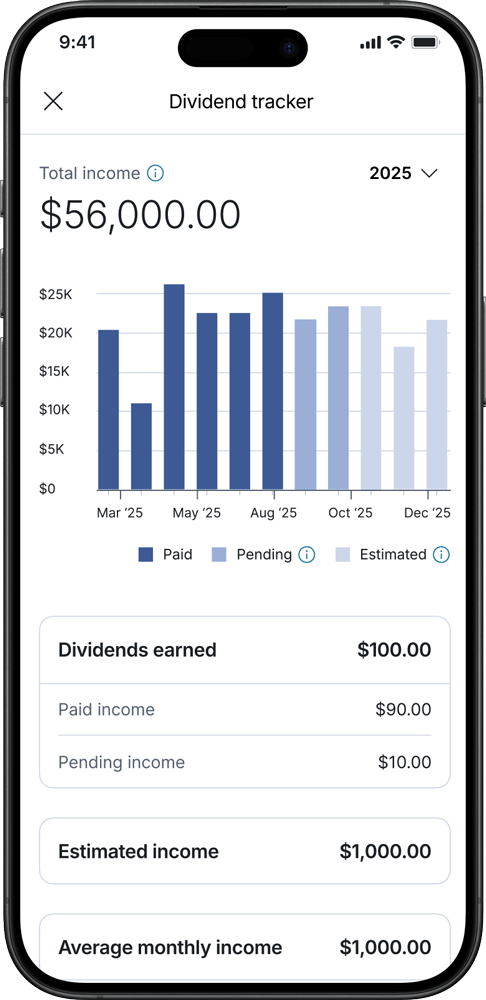

Track and act on your dividend income

See a breakdown of your dividend income in an informative chart. You can get insights into your wealth-building journey, so you’re always on top of your strategy.

View your Holdings/Dividend Income tab.

Customize your dividend strategy

Earn income

Some investors live off portfolio income, especially in retirement. If that’s you, it’s easy to automate transfers of dividend income to your Earn account, where it earns 3.10% APY.¹

Compound earnings

Growth investors may double-down on income-generating securities and reinvest the income in the same holding. Choose M1 DRIP if you want to do this.

Grow your portfolio

You can also use dividend income to help your portfolio grow holistically. This is the default setting on M1—dividends are added to your Invest account balance.

Tailor your strategy

Choose different rules for each of your dividend-generating securities. You can select different settings for each holding.

Put your dividends to work with powerful automation

1 Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

SAIF-03112025-ghvrmem9