What is an M1 High-Yield Cash Account?

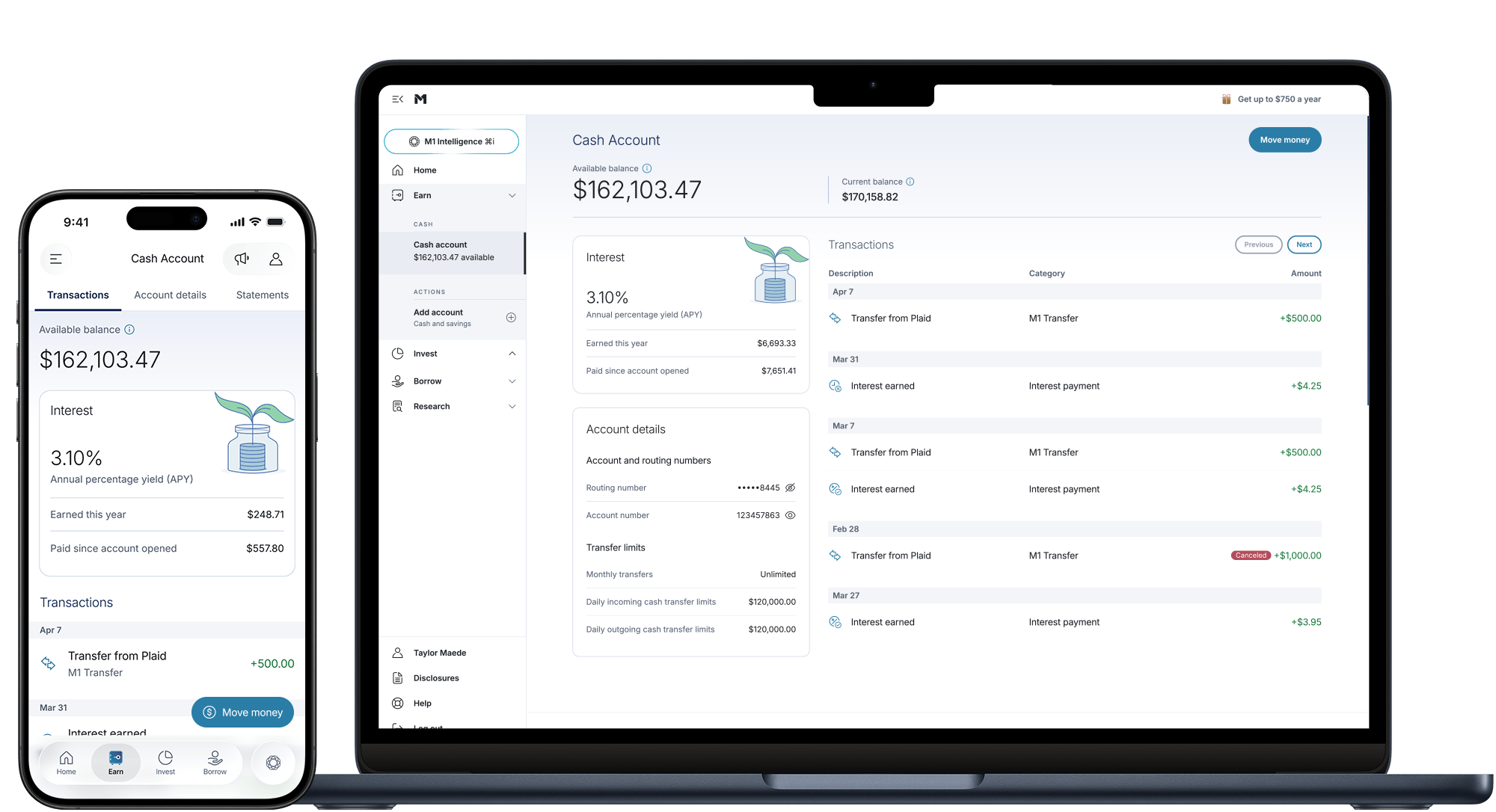

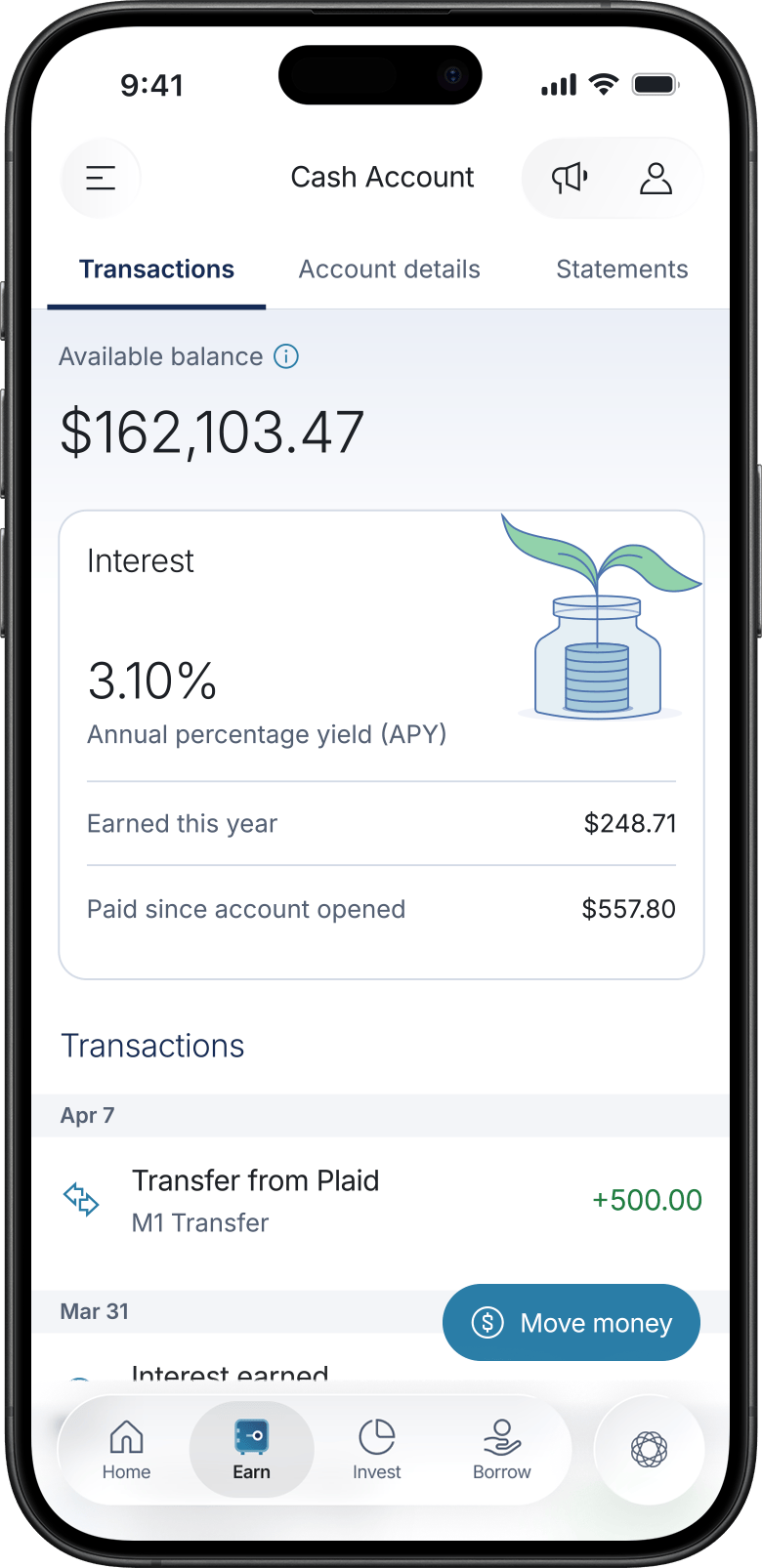

A High-Yield Cash Account is a cash reserve powered by your M1 brokerage account.

Instant transfers in M1

Move money with a tap when you’re ready to invest.

Unlimited withdrawals

Get your cash whenever you need it.

Transfer up to $120,000

Make big moves when the time is right.

See how much your cash could grow

Earn together. Grow together.

Working toward shared goals? Grow your combined contributions in a Joint High-Yield Cash Account.

Tell your money what to do with Smart Transfers

Set rules for how money moves across M1.

- Save up to a goal and invest the rest

- Route dividend income from your portfolio to a High-Yield Cash Account

- Pay off your margin balance

Your cash account questions, answered

M1. Yours to build.®

M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 High-Yield Savings Accounts are furnished by B2 Bank, NA, Member FDIC.

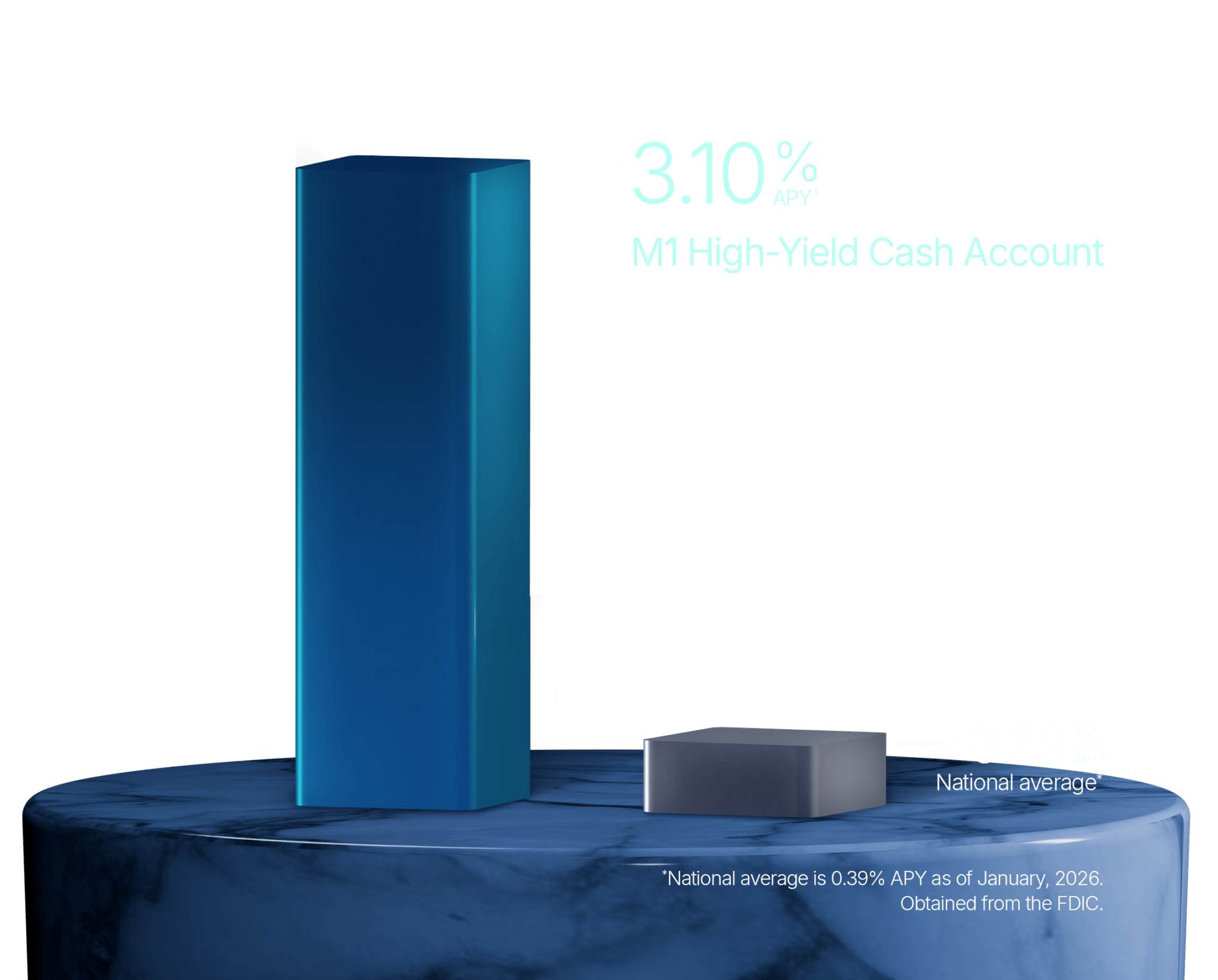

¹ Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

2 The cash balance in your Cash Account is eligible for FDIC insurance when it is swept to our partner banks and our of your brokerage account. Unless the cash balance is swept to partner banks, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.

SAIF-01292026-gdkz2phi