What is a bear market?

A bear market is a period of time during which benchmark stock market indices drop in price by at least 20% from their most recent highs.

Bear markets can last anywhere from a few months to a few years. Historically, bear markets are typically shorter in length than bull markets. And while they can be stressful for investors, they happen on a somewhat regular basis. They occur, on average, every 3.5 years.

Additionally, if someone has negative predictions about the future of the stock market, they may refer to themselves as “bearish.” Here’s what you need to know about bear markets, and how to potentially invest while the stock market is experiencing headwinds.

Understanding bear markets

A bear market is a time when investors are generally fearful and may begin to move their money from the stock market to safer investments. This mass sell-off results in lower stock prices across the market as investors race to get out of what they feel are riskier assets.

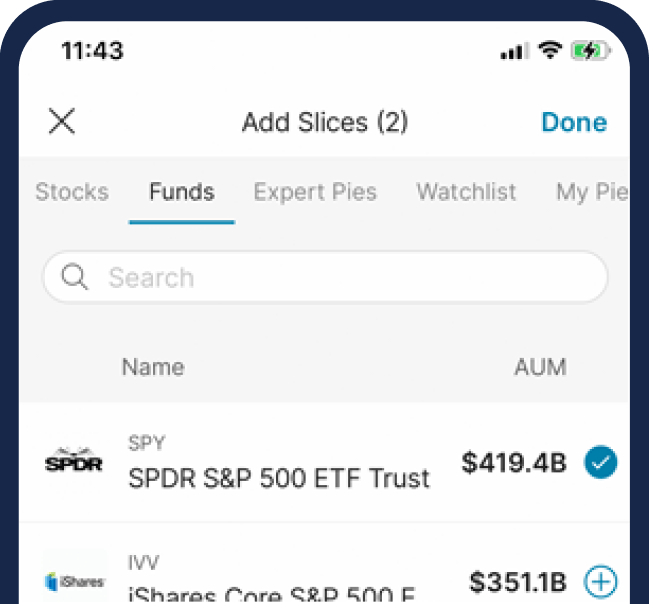

Beginning to invest can be an intimidating step. But M1 makes it easy to navigate your different options and put your money to work.

Typically, there are four phases of most bear markets that investors can be on the lookout for:

Recognition

The recognition stage is when investors begin to see equities sliding in price over several weeks. They may have been “buying the dip” along the way to lock in a lower price, but the bottom never seems to come.

Panic

Once the slide begins a longer stretch than two or three, investors may begin to panic and sell off their stocks, locking in losses. That negative sentiment could grow into “contagion” where hordes of investors sell off. This is potentially when leading economists may declare that a bear market is underway.

Stabilization

At this point, the slides begin to slow down, but the negativity, stress, and anxiety of investors remains palpable.

Anticipation

Once investors have quelled their worries, they may become bullish for the future. They may begin their purchases again, with the hopes that the market recovers and may start to realize gains again.

However, no two bear markets (or bull markets) are the same, and it’s never a linear path from a stock market fall and back into heading upward. So while bear markets can follow patterns, there’s much more to understand when the market heads downward.

Time and severity can vary

Bear markets come in all shapes and sizes and can be difficult to understand until after they are completed. This is because economists need to have the data to evaluate what happened, both during the bear market and after it has ended.

On average, bear markets last just under a year, with average losses around 35%. However, this isn’t a hard and fast rule. The most recent bear market was in 2022, lasting nine months and shaving off roughly 25% of the total stock market value. The longest bear market was from 1946-49, which included two periods of sizeable downward movements in the stock market following World War II.

Causes of a bear market

Bear markets are generally reflective of several key economic factors. These reasons range from economic slowdown to investor uncertainty and fear, and the negative data and sentiment can quickly drive the stock market in a downward spiral. Here are a few reasons that the stock market could slowly slide into a bear market.

Economic slowdown or recession

Economic indicators, such as GDP growth, unemployment rates, and consumer spending, play a crucial role in driving investor sentiment. A significant slowdown in economic activity or an outright recession can trigger fears of reduced corporate earnings, leading to decreased investor confidence and a sell-off in the stock market.

Monetary policy shifts

Central banks often influence market conditions through monetary policy decisions. When a country’s central bank tightens interest rates, borrowing money becomes more expensive — creating an overall slowdown in the market.

For example, the Federal Reserve has been raising interest rates since 2021 to quell rising inflation. This was done to intentionally slow down market growth. Along with other factors, this monetary policy may have contributed to the bear market in 2022.

Geopolitical uncertainty

Political instability, trade disputes, and international conflicts can create uncertainty, leading investors to flee or sell off. Geopolitical events can disrupt supply chains, increase costs, and impede international trade, causing investors to retreat from riskier assets like stocks and into safer investments like bonds.

Difference between bear market and corrections

A correction in the stock market is a rapid decline of one of the major indices by more than 10%, but less than 20%. A bear market is when the overall market when it’s in decline by 20% or more.

But just because a correction happens doesn’t mean that a bear market is guaranteed to happen. There have been 24 corrections since November 1974, and only five of them became bear markets.

And, ironically enough, corrections can take place even within a bull market run. During the Great Financial Crisis in 2008-2009, the stock market plummeted into a recession. However, after the market hit the bottom, stocks went on a bull market run until the 2020 crash caused by the pandemic. But during that run, there was a correction in 2018 where stocks lost value over the course of the year. However, it wasn’t deep enough losses to be considered a bear market.

Despite the correction, that 11-year period delivered fruitful returns to investors:

| Year | S&P 500 returns (includes dividends) |

| 2009 | 25.94% |

| 2010 | 14.82% |

| 2011 | 2.10% |

| 2012 | 15.89% |

| 2013 | 32.15% |

| 2014 | 13.52% |

| 2015 | 1.38% |

| 2016 | 11.77% |

| 2017 | 21.61% |

| 2018 | -4.23% |

| 2019 | 31.21% |

The M1 bottom line

Bear markets can be quite intimidating and fear-inducing. No one likes their stock portfolio losing value. But investing for the long-term can help quell some of their short-term urges to take matters into your own hands. In fact, nearly 80% of active fund managers, whose entire job it is to pick winning stocks for their clients, fail to beat major indices.

So if the market is bearish, just know that if you’re investing with a long time-horizon, you have a chance of coming out ahead when retirement comes.

All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. M1 does not provide any financial advice.

All investing involves risk, including the risk of losing the money you invest. Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc.

20231030-3093431-9909343