M1 RETIREMENT ACCOUNTS

Ready to roll over your retirement account?

M1 makes it easy. You can consolidate old accounts, automate your contributions, and manage your retirement savings under one roof.

What is a rollover?

It’s common to collect employer-sponsored retirement accounts over the course of a career, such as a 401(k) or 403(b). You can roll over these accounts into an M1 IRA anytime, without penalty.

A rollover is not your only option. Consider your personal financial situation and what’s right for you. You may want to consult a tax professional to discuss your options.

Direct vs. indirect rollovers

There are two options for transferring retirement funds. You can have your provider mail a check with your retirement funds directly to M1—called a direct rollover. Or you can have your provider send your retirement funds to you, then transfer that to M1 (known as an indirect rollover).

Roll over in 3 steps

Open an M1 IRA

You’ll need your new account number to initiate a rollover.

Initiate your rollover

Have your account provider write a check payable to Apex Clearing with your name and new M1 IRA account number printed in the memo line.

Start investing

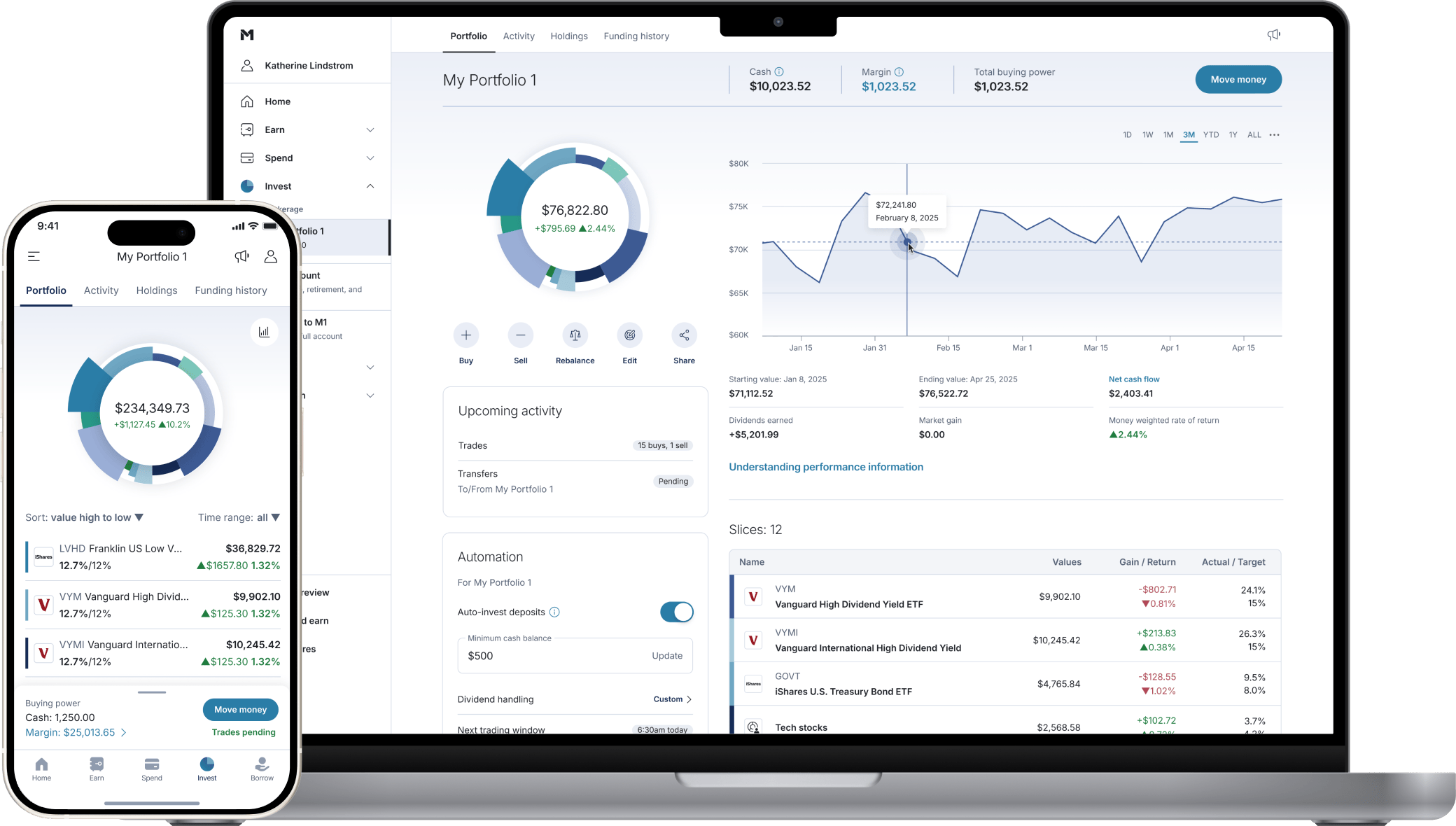

Once your transfer is complete, you can customize your portfolio and automate your retirement investing.

Your rollover questions, answered

Ready to start your rollover?

M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. M1 is not recommending or endorsing this investment by making it available to its customers. Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets. A rollover is only one of your options for your retirement account, please see IRS guidance about rollovers for additional details/considerations.

SAIF-01222025-8npwodtw