What are capital gains?

Capital gains are the profits made when you sell an investment such as a stock or real estate. While you bask in the profits you’ve made, it’s important to know that the government may tax you on that profit.

However, how much you may owe in capital gains tax depends on several factors, including how long you held the asset and your current tax bracket. The capital gains tax rate is generally more favorable than the standard federal income tax rate. In fact, most people pay a capital gains tax rate of either 0% or 15%.

To qualify for the long-term capital gains tax rate, you have to maintain ownership of the asset for more than one calendar year. If you sell an asset in less than one year of ownership (also know as short-term capital gains), you could have to pay the ordinary income tax rate on the profits. Additionally, your current tax bracket will also be factored into how much you may owe in taxes on the profits you made.

So as you make decisions on buying and selling investments, it’s important to consider what the potential tax implications are, including any applicable capital gains tax. Here’s a summary of how capital gains works, and how to consider it in your investing journey.

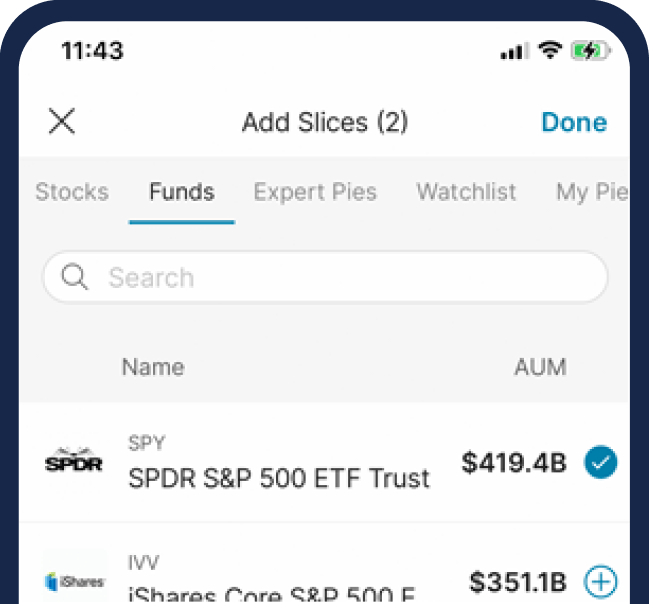

You can invest in a variety of equities using the M1 platform. Get started today by opening a brokerage account to put your money to work.

How capital gains work

A capital gain is generated when you have an asset and sell it for a profit. This is applicable to assets like real estate, equities like stocks and funds, bonds, jewelry and other high-price collectibles.

And if you sell any of these assets for a profit, it will be classified as one of two types: short-term or long-term capital gains.

For example, if you buy a stock at $100 and sell it at $250, you have a capital gain of $150. If you own the stock for less than a year, it may be classified as a short-term capital gain, which is taxed as ordinary income and so follows the IRS’ federal income tax brackets.

If you owned the stock longer than a year before selling it and making a profit, it becomes a long-term capital gain. The profit from selling an asset held more than one year can be taxed at a rate of anywhere from 0% to 20%, although some sales could be taxed at 25% or 28%.

Below are the different tax brackets for long- and short-term capital gains taxes based on income and tax filing status.

2023 long-term capital gains tax brackets

| Filing Status | Single | Married filing jointly | Married filing separately | Head of household |

| 0% | Up to $44,625 | Up to $89,250 | Up to $44,625 | Up to $59,750 |

| 15% | $44,626 – $492,300 | $89,251 – $553,850 | $44,626 – $276,900 | $59,751 – $523,050 |

| 20% | Over $492,300 | Over $553,850 | Over $276,900 | Over $523,050 |

This table reflects assets sold for a capital gain in tax year 2023 that have been held for longer than a year.

2023 short-term capital gains tax backets

| Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 10% | $0 – $11,000 | $0 – $22,000 | $0 – $11,000 | $0 – $15,700 |

| 12% | $11,001– $44,725 | $22,001– $89,450 | $11,001– $44,725 | $15,701– $59,850 |

| 22% | $44,726– $95,375 | $89,451– $190,750 | $44,726– $95,375 | $59,851– $95,350 |

| 24% | $95,376– $182,100 | $190,751– $364,200 | $95,376– $182,100 | $95,351– $182,100 |

| 32% | $182,101– $231,250 | $364,201– $462,500 | $182,101– $231,250 | $182,101– $231,250 |

| 35% | $231,251– $578,125 | $462,501– $693,750 | $231,251– $346,875 | $231,251– $578,100 |

| 37% | $578,125+ | $693,750+ | $346,875+ | $578,100+ |

This table reflects assets sold for a capital gain in tax year 2023 that were held for less than a year. They are identical to the IRS’ federal income tax brackets because short-term capital gains are taxed as ordinary income.

But while you can be taxed on gains, you can also potentially offset those gains with capital losses. This is when you sell assets at a loss. So if you happen to receive a capital loss, the good news is you might be able to write part of it off. A subset of investors are able to use this benefit intentionally to make use of tax loss harvesting.

Here’s an example:

If you buy a stock at $50 and sell it at $75, you could owe taxes on the $25 in profit. But if you also sell a stock at a total loss of $25 or more, you may potentially owe no additional taxes in that tax year. You may only pay tax on the net capital gain.

However, note that you can only deduct up to $3,000 in capital losses ($1,500 if married filing separately) each year, although you may be able to carry over a capital loss exceeding that amount to future tax years. Losses from the sale of personal-use property don’t qualify for a tax deduction.

The bottom line

Building wealth can be a dizzying journey with nearly endless factors to keep in mind, and taxes are just one part of it. So as you’re considering your next step with your investments, be sure to investigate what the potential tax implications, like capital gains tax, may be.

However, be sure to consult with a licensed tax advisor for the best strategy for your financial circumstances.

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

20230803-3042338-9659162