What is a SIMPLE IRA?

A Savings Incentive Match PLan for Employees (SIMPLE) IRA is an account that allows employees and employers to contribute tax-deferred to traditional IRAs set up for employees of a qualifying small business. To qualify, the business must employ no more than 100 people.

Employee contributions are not subject to federal income tax, providing tax-deferred growth. Employers can claim a tax deduction for contributions to employees’ SIMPLE IRAs as a business expense. Employers who offer SIMPLE IRAs have the option to either match employee contributions up to 3% or make a 2% non-elective contribution, encouraging retirement savings.

In this post, we’ll explain what a SIMPLE IRA is, the advantages and disadvantages of the account, and compare other retirement accounts.

Contributions to a SIMPLE IRA

In 2023, the annual employee contribution limit for a SIMPLE IRA is $15,500. Those age 50 and older can make an additional $3,500 catch-up contribution. Employee contributions are made by salary deferrals.

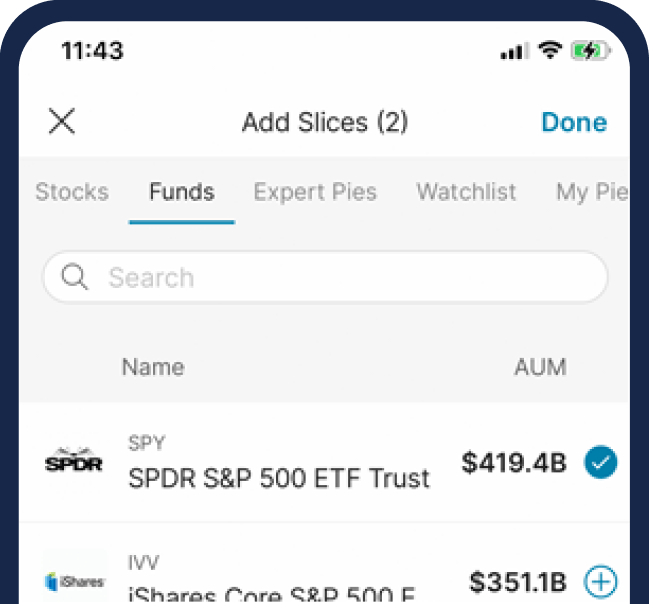

If you have a SIMPLE IRA, you can fast-track your retirement plan by opening a Roth or traditional IRA on the M1 platform.

If an employer offers a SIMPLE IRA, employees may choose whether to take part in the program. Employers are required to make contributions to each employee’s SIMPLE IRA, although they may choose one of two methods.

Employer contributions to SIMPLE IRAs

Employer contributions do not have an annual contribution limit. But their contributions must follow one of these two options:

2% nonelective contribution: A contribution equal to 2% of an employee’s compensation regardless of how much the employee deferred.

3% matching contribution: A contribution that matches the employee’s elective deferrals dollar-for-dollar up to 3% of the employee’s compensation. If the employee doesn’t contribute anything to their SIMPLE IRA, then the employer doesn’t need to make a matching contribution.

Employer requirements once choosing a SIMPLE IRA

If an employer offers a SIMPLE IRA retirement plan to its employees, it must offer a SIMPLE IRA to all employees who earn at least $5,000 in compensation during any two preceding years and are expected to earn at least $5,000 in the current year.

Employer contributions are fully vested instantly. Unlike some other retirement plans, employees have immediate ownership of all money deposited by their employer, without any waiting period or gradual vesting schedule.

Distributions from a SIMPLE IRA

Once an individual reaches age 59½, they can start taking distributions from their SIMPLE IRA without incurring an early withdrawal penalty. However, any distributions are subject to regular income tax.

If you reach the age of 73 (or age 72 after December 31, 2022), you must start taking RMDs (required minimum distributions) from your SIMPLE IRA, just like with a traditional IRA.

Early withdrawal penalty

For SIMPLE IRAs, a 25% penalty may be applied if you withdraw in the first two years of your first contribution. After the first two years but before you turn 59 1/2, the penalty is 10%.

Limited rollover options

While a rollover from a SIMPLE IRA to another SIMPLE IRA is tax-free at any time, a rollover from a SIMPLE IRA to another retirement account may be taxable during the first two years.

Taxes on a SIMPLE IRA

Employers can receive a tax deduction for their contributions to employees’ accounts. How they claim the deduction will depend on whether the employer is classified as a sole proprietorship, corporation, or another type of business entity.

Employee contributions to a SIMPLE IRA are not subject to federal income tax, so SIMPLE IRA contributions may reduce employees’ taxable income for the year. However, contributions are still subject to the taxes that pay for Social Security, Medicare, and federal unemployment insurance.

Employees’ investments grow tax-deferred, but when withdrawals are made during retirement, they are taxed as regular income.

Comparing a SIMPLE IRA to other types of retirement accounts

Employees can’t generally choose the retirement plan offered by their employers. However, many employees may want to complement their investing strategy by opening up personal brokerage accounts.

If your employer’s SIMPLE IRA plan isn’t enough for your financial needs, M1 offers traditional IRAs, Roth IRAs, and SEP IRAs, so you can take more control over your investments.

Traditional IRA vs SIMPLE IRA

A SIMPLE IRA is very similar to a traditional IRA. However, while the SIMPLE IRA is designed for small businesses, a traditional IRA can be opened by anyone. Both accounts allow contributions made by employees, but a SIMPLE IRA allows contributions from employers too and employers can get a tax deduction from it. Employers can’t contribute to a traditional IRA.

Roth IRA vs SIMPLE IRA

A Roth IRA and SIMPLE IRA differ in their contribution methods and tax treatment. Roth IRA contributions are taxed, but can be withdrawn tax-free, while SIMPLE IRA contributions are deducted from your taxes but you may need to pay taxes on withdrawal. Employers also can’t contribute to a Roth IRA like they can a SIMPLE IRA. Both offer tax-free growth and qualified withdrawals in retirement, but Roth IRAs have a lower contribution limit compared to a SIMPLE IRA.

SEP IRA vs SIMPLE IRA

A SEP IRA allows a business of any size to open one and allows employers to contribute up to 25% of the employee’s total compensation or a maximum of $66,000 for the 2023 tax year, whichever is less. A SEP IRA only allows the employer to make contributions, but these contributions are tax-deductible.

A SIMPLE IRA allows employees and employers to contribute tax-deferred to traditional IRAs set up for employees of the business. SIMPLE IRAs require businesses to be smaller than 100 employees and require the employer’s contribution to be up to either a matching contribution of up to 3% of the employee’s compensation or a 2% nonelective contribution. SIMPLE IRAs let both the employee and the employer contribute.

The M1 line

M1 does not offer SIMPLE IRAs as they are offered through your employer. On M1, clients can choose between a variety of other accounts to save for retirement or other long-term financial goals.

Employees: If you meet the eligibility criteria for your employer’s SIMPLE IRA plan, it is strongly recommended to take part, especially if your employer provides matching contributions. These matching contributions essentially mean free money for you, and with a SIMPLE IRA, they become immediately vested once they are deposited into your account.

When compared to other retirement accounts, the SIMPLE IRA’s focus on businesses and employer contributions sets it apart. However, it’s important to review your options and consider what makes sense for you.

While you can’t open a SIMPLE IRA on M1, you can open other types of investing accounts which may complement the SIMPLE IRA you get from your employer.

M1 offers traditional, Roth, and SEP IRAs. Learn more here.

20230816-3046496-9732000

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.