How I Taught Over 500 Everyday Americans the “Buy, Borrow, Die” Strategy on M1

When I wrote my first blog for M1, I shared how discovering the Borrow button completely transformed the way my wife Stella and I think…

Revolutionize your finances with M1’s innovative personal finance platform. Explore earning, investing, spending, and borrowing solutions.

When I wrote my first blog for M1, I shared how discovering the Borrow button completely transformed the way my wife Stella and I think…

Reflections on the past, present and future of M1 from CEO Brian Barnes This year, 2026, will mark M1’s tenth year in business. Trust me when…

It’s a problem every businessperson knows: lumpy cash flow. Let’s say you’ve got $18K in receivables landing in 38 days, a contractor who needs a…

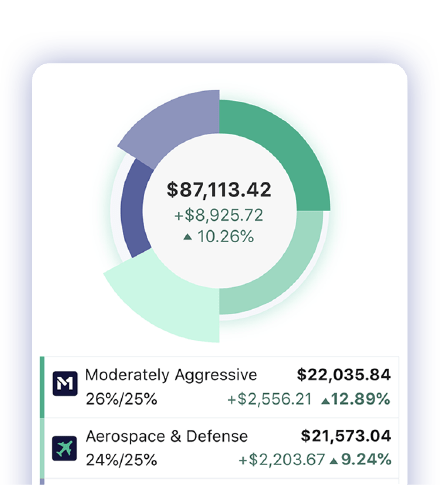

Want to know if your investments are concentrated in the areas you want? Or if your portfolio is sufficiently diversified? M1’s newest feature, Concentration Analysis, can help you find the answers. It’s the latest in our expanded Insights tab, designed to empower…

Right now, M1 clients have the opportunity to reduce their margin borrowing costs for the full year ahead. For a limited time, you can secure a 1.66% discount below our standard margin rate for 12 months—and you don’t need to carry a balance to qualify. If you’re eligible for the promotion, simply opt in within the app by January 31, 2026, and the discounted rate is yours if and when you borrow during the promotional period.

At M1, AI is a major part of how we plan, build, and safeguard the platform every day. From design and engineering to operations and compliance, teams across M1 have been using AI to move faster and operate at scale. Here’s how four teammates put AI to work.

Looking for news that actually matters to your long-term vision? News Snapshot has you covered. It’s M1’s latest update to the research tab, designed to…

New clients often wonder why M1 uses trade windows. M1’s trade windows are an intentional and core design choice to support long-term, automated, and diversified…

At M1, we’re committed to building helpful tools for long-term wealth building. A key part of that process is beta testing—and it helps us to…

Invest, borrow, and spend on one intuitive platform. Customize your strategies, automate the big picture, and let The Finance Super App®️ take care of the day-to-day. M1 gives total control for your wealth today and tomorrow.

Check the background M1 Finance LLC with FINRA’s BrokerCheck

Disclosures

By using this website, you accept our Terms of Use and Privacy Policy and acknowledge receipt of all disclosures in our Disclosure Library. All agreements are available in our Agreement Library. M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information.

M1 is a technology company offering a range of financial products and services. “M1” refers to M1 Holdings Inc., and its wholly-owned, separate affiliates M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC.

All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using M1 Borrow’s margin account can add to these risks, and you should review our margin account risk disclosure before borrowing. Nothing in this informational site is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.

Brokerage products and services are not FDIC insured, no bank guarantee, and may lose value. Brokerage products and services are offered by M1 Finance LLC, an SEC registered broker-dealer, Member FINRA / SIPC.

M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. For a complete list of fees M1 may charge visit M1’s Fee Schedule.

M1 is not a bank. M1 High-Yield Savings Accounts and Personal Loans are furnished by B2 Bank NA, Member FDIC and Equal Opportunity Lender, and serviced by M1 Spend LLC, a wholly-owned operating subsidiary of M1 Holdings, Inc.

M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

The Owner’s Rewards Card by M1 is no longer accepting new applications. Review Cardholder Agreement for important information about the Owner’s Rewards Card by M1. The Owner’s Rewards Card by M1 is serviced by M1 Spend LLC, on behalf of M1 Credit Receivables LLC.

© Copyright 2026 M1 Spend LLC. All rights reserved.

M1 Digital LLC is a wholly separate affiliate of M1 Finance LLC, and neither are involved with the execution or custody of cryptocurrencies. Cryptocurrencies are not FDIC or SIPC insured. For relevant crypto disclosures and risks, visit Crypto Disclosures.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

M1 Finance LLC

200 N LaSalle St., Ste. 810, Chicago, IL 60601

© Copyright 2026 M1 Holdings Inc.