How I Use Margin to Enhance Portfolio Diversification and Increase My Expected Returns

I grew up envisioning a big red warning sign anytime I saw the terms margin, leverage, or debt. I was told, just like you probably have been, that all debt is inherently bad and that portfolio leverage is too risky, period. But the more I learned about diversification and portfolio construction over the years, the more I realized there’s a lot of fearmongering – and nuance – surrounding such ideas.

When I started my blog Optimized Portfolio and its accompanying YouTube channel, I set out to provide helpful, beginner-friendly information to novice investors who are curious to get started but who are also perhaps afraid and intimidated. I’ve certainly done that, but as a pretty seasoned investor myself, my content also naturally evolved into much more advanced ideas like the [arguably] sensible use of “modest” leverage via margin, and I’ll admit those topics tend to be much more fun. As a long time client of M1, I’d like to share my perspective on some of those ideas to illustrate how leverage can enhance both diversification and risk-adjusted return.

What is Margin?

The term margin just refers to borrowing against your portfolio, using your investments as the collateral for the loan. Margin loans often allow investors to access cash at interest rates lower than that of typical uncollateralized loans like personal loans and credit cards. This difference is amplified for those with less-than-stellar credit, for whom an uncollateralized loan may not even be an option.

Margin loans can be logistically easier and more flexible than other loan types. There’s no paperwork or application or credit check or late fees, because again, your existing investments are the collateral for the line of credit, so margin access essentially comes preloaded in your brokerage account. There’s no term; you pay interest monthly and you can pay back the loan whenever you want as long as your investment portfolio maintains its equity. Interest can even be rolled into the margin loan as long as the equity requirement is maintained.

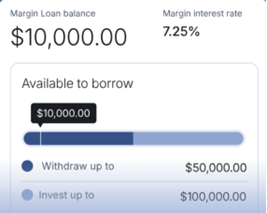

The amount of margin available to you is dependent on the value of your portfolio and the underlying securities. For a hypothetical example to illustrate, someone with a $100k portfolio of conservative investments may have access to a $50k margin loan, while someone with a $20k portfolio may have access to a margin loan of only $10k. If using margin to invest in your portfolio as leverage, you’ll have access to a higher margin amount than if you were to simply withdraw it as cash.

You can check your available margin on M1 at a glance:

M1 makes accessing margin particularly easy. With just a few clicks, you can take out a loan, see your available credit, pay down your loan, and see your activity.

Using Margin to Access Cash

The margin loan you take out can be withdrawn as cash to use for whatever you’d like or it can be reinvested back into your portfolio, thereby increasing exposure, which we call leverage. I’ve utilized both at one time or another, and I’ll cover both here.

Suppose you suddenly need to make a large purchase that exceeds your emergency fund, or you just want to keep your emergency fund intact. A margin loan allows you to access cash without selling your positions to realize gains, which would incur taxes. This also allows your investment capital to stay invested and keep growing.

I live in the South where it’s hot and humid most of the year and A/C is a necessity. One night, mine suddenly stopped working. Long story short, this ended up becoming a $7k expense for a whole new A/C unit. That would have been a significant chunk of my emergency fund, I didn’t want to sell my investments, and the HVAC company’s financing offer wasn’t exactly favorable, so I used a margin loan for the expense.

Or you may need to consolidate some high-interest credit card debt. The interest rate on a margin loan will usually be much lower than that of a typical credit card, making it advantageous to utilize margin to pay down the high-interest debt.

Using Margin as Portfolio Leverage

Now let’s talk about that second use case – using margin as buying power to buy more of your investments, which we call leverage.

Suppose the young index investor has multiple decades until retirement and wants to take on more systematic risk to increase the expected return of the portfolio. As an aside, there’s actually some research that suggests utilizing leverage while young may reduce retirement risk by smoothing exposure over time. To get that leverage, the investor can use options contracts, futures contracts, leveraged funds, or margin.

Those first two are called derivatives and are complex financial products that require pretty advanced knowledge and extra logistics and hands-on management. Leveraged funds are ETFs or mutual funds that utilize derivatives inside them to get leveraged exposure. While there are some exceptions, they often carry high fees, are tax-inefficient, have significant and nuanced risks that are not immediately obvious, and are typically more suitable for day trading than long-term buy-and-hold investing.

That leaves margin as potentially the most effective, most efficient type of leverage for the average investor wanting to enhance exposure to their portfolio of low-cost index funds.

M1 allows investors to leverage up to 50% of their portfolio. We would call this “2x levered” for effective notional exposure of “200%.” For a familiar, tangible example, if you get a mortgage loan to buy a home with a 20% downpayment, you are 5x levered.

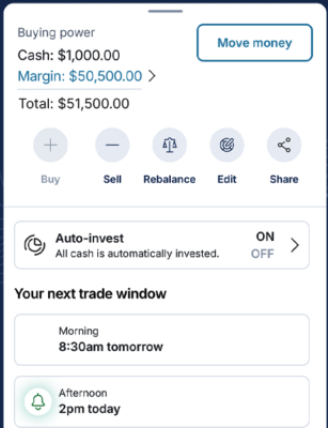

M1 clients can now immediately access margin to buy securities using the Buy button on the Invest page; no need take multiple steps to transfer from Borrow to Invest. Their new margin features show you your full buying power immediately, and it dynamically updates as you change the dollar amount on the screen. You can choose to invest using cash, margin, or both.

Examples and Use Cases of Margin as Portfolio Leverage

Here are some hypothetical examples to illustrate this concept and potential use cases.

Suppose the aforementioned young investor has an index portfolio for the total world stock market, i.e. 100% stocks. Levering up that position 50% via margin would provide 150% effective exposure to the same index, thereby increasing the risk/return profile of the position. This is an example of concentrating further within a single asset to increase expected returns.

Alternatively, the investor may be well-diversified across asset classes with a hypothetical portfolio of 60% stocks, 30% bonds, and 10% gold. Modern Portfolio Theory tells us we can usually increase return per unit of “risk” (called risk-adjusted return) by holding multiple uncorrelated assets that tend to move at different times, resulting in what we would call a more “efficient” portfolio.

In other words, in this instance, when stocks “zig,” bonds may “zag,” and gold may “zeg.” In that sense, the hope would be that at least one asset in the portfolio is always going up. This diversification could usually lower the volatility (variability of return) and risk of the portfolio.

But, all else equal, risk and return are inextricably linked, so in lowering risk, we would also expect to sacrifice some absolute return over the long term in doing so, for the simple reason that diversifiers like bonds and gold typically have lower returns than stocks. Depending on the investor’s risk tolerance, that sacrifice may be perfectly sensible. But for the investor who still needs to take on a requisite amount of risk to achieve the financial objective, leverage may help…

Borrowing on margin could allow us to buy more of all three assets in the diversified portfolio, thereby enhancing exposure to stocks, bonds, and gold simultaneously. This means we get to keep the benefits of diversification with uncorrelated assets while not necessarily sacrificing absolute return.

Specifically, we can lever up the diversified multi-asset portfolio to match the expected return of 100% stocks while reducing the risk of holding a single asset. In that sense, leverage can effectively “unlocks” the benefits of diversification.

Considering these two hypothetical examples, we’ve seen we can use leverage to increase the expected return profile of the portfolio by concentrating further within a single asset or by diversifying broadly and then enhancing exposure to the entire basket.

I personally think the second option is more efficient, more effective, and more sensible for several reasons, and the second example is how I personally use leverage in my own portfolio.

Risk, Return, Diversification, and Investor Behavior

Most investors overestimate their tolerance for risk, only realizing so when they panic sell in a crash. In the first example, if a 100% stocks portfolio drops by 20%, 150% stocks will drop by 30% (20% * 1.5). As such, the invariably greater risk of concentration via leverage is felt much more viscerally during market crashes. Many likely don’t have the stomach for a portfolio of 100% stocks during periods of market turmoil, much less 150%.

100% stocks is typically the default recommendation for a young investor with a long time horizon and a high tolerance for risk. Rationally, this may make sense, as stocks typically have the greatest expected returns of all investable assets. But investors aren’t rational. Such a recommendation completely ignores the very real behavioral aspects of investing that cause the average investor to severely underperform the stock market. Investing plans typically fail due to investor behavior, not financial markets.

While it may not be immediately intuitive, even the “100%” figure isn’t objectively optimal. Why not 110% stocks? Or 137%? See the problem? How much risk to take and how to best gain exposure to that risk are two different conversations. Leverage allows us to take what some would consider a “conservative” portfolio and make it riskier.

Now consider the second example of the well-diversified, multi-asset portfolio. During a stock market crash, we would expect diversifiers like bonds and gold to go up, or at least fall comparatively less than stocks, which again means less volatility and less risk for the portfolio as a whole. In other words, that diversification usually allows for a smoother ride through market downturns.

Consider the famous Lost Decade of 2000-2009, where U.S. stocks basically finished flat after 10 years. Would you have still felt confident in 100% stocks going into 2010 after finishing a decade with zero return? Over that same period, the aforementioned hypothetical multi-asset portfolio returned 41%.

This is not a recommendation of that specific diversified strategy, but rather simply a real-world illustration of the potential benefits of diversification across asset classes. Always remember that past results do not indicate future results.

Similarly, we also have to consider the inherent unpredictability of markets. As you’ve just seen, stocks don’t always go up. There have been many extended periods throughout history, some as long as 20 years, when diversifiers like bonds and gold beat stocks. Again, I would ask: Could you remain confident in and stick with an underperforming asset for that long? I know I couldn’t. Even seasoned investors were scared off stocks entirely for years after the 2008 Global Financial Crisis when the stock market fell more than 50%.

So the well-diversified multi-asset portfolio may be a prudent idea for most. But on the other side of the same coin, such a portfolio may underperform 100% stocks and the investor may be tempted to change strategies. We call this tracking error regret.

That’s again where leverage can come into play and alleviate such regret. We can simultaneously get the benefits of diversification while maintaining the expected return of 100% stocks. Put another way, using leverage can free up space in the portfolio (i.e. greater than 100%) to diversify further when the investor otherwise might not. And doing so specifically with margin from M1 allows the investor to utilize the same low-cost index funds they already owned and avoid complex, tax-inefficient products. While there’s no guaranteed free lunch in investing, this idea is probably as close as we can get to one.

It’s important to remember in all this that we’re talking about a relatively “modest” amount of leverage of a maximum of 50% at the end of the day. More leverage invariably equals more risk. With leverage, after a certain point, not only do we get diminishing returns, we may actually work against the goal of efficiency.

For example, a hypothetical portfolio levered up to 300% stocks exposure would drop 99% if the stock market drops 33%. That portfolio may never recover. The maximum we’re going up to here is 150% notional exposure. Our hypothetical multi-asset portfolio of 60% stocks, 30% bonds, and 10% gold levered up 50% would effectively become 90% stocks, 45% bonds, and 15% gold.

It’s also worth noting that this idea of enhancing exposure to multiple uncorrelated assets by levering up is not new. Institutions and hedge funds have been doing it for decades in one form or another. But it was previously cumbersome and costly for retail investors like you and me to implement. M1’s margin loan offering solves that.

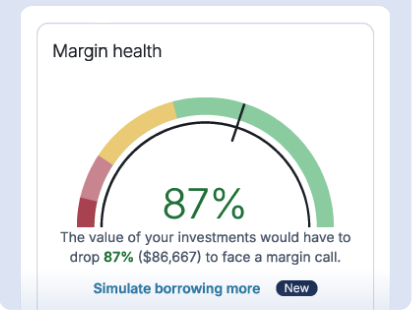

Margin Risks

Let’s briefly discuss the risks of margin itself. You need to be invested to access margin, and all investing involves risk, including the risk of losing your invested capital. Since margin loans are secured by your investments, if your portfolio drops too far in value, those investments may be sold to cover the margin loan, which is called a margin call, i.e. “calling in” the loan. You can view a meter of your margin “health” at a glance in the M1 Borrow dashboard at any time:

Make no mistake that even with the multi-asset framework example discussed above, we are still invariably increasing the risk of the portfolio by using leverage. That leverage amplifies both gains and losses, and it is not for every investor.

It’s all about how you use it…

Hopefully now you realize that the danger or sensibility of margin depends entirely on the context in which it’s used. Margin invariably adds risk to the portfolio, but it all comes down to how much risk is taken, where specifically that risk is applied, and how much we spread it out. On the bright side of that scale, margin has the ability to “unlock” the benefits of diversification and potentially solve behavioral issues like tracking error regret.

So next time someone says margin is too risky to ever be a good idea, you can now educate them on why Modern Portfolio Theory says otherwise.

Disclosures:

M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance.

The opinions expressed are solely those of the authors and do not reflect the views of M1. They are for informational purposes only and are not a recommendation of an investment strategy or to buy or sell any security in any account. They are also not research reports and are not intended to serve as the basis for any investment decision. Prior to making any investment decision, you are encouraged to consult your personal investment, legal, and tax advisors.

Brokerage accounts on the M1 platform are either fully disclosed to APEX Clearing or cleared through M1 Finance LLC. Please look at your account statement to determine how your account is cleared.

All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using margin can add to these risks. Users utilizing APEX cleared margin accounts should review the APEX margin account risk disclosure before borrowing. Users utilizing M1 cleared margin accounts should review the M1 margin account risk disclosure before borrowing. M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not available for Retirement or Custodial accounts. Margin rates may vary.

Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc.

SAIF-08012024-xkcr1g5h

- Categories

- Borrow