Americans take on more debt as interest rates rise

This week, the Fed confirmed a tighter balance sheet and Americans continued to take on massive amounts of debt.

Catch up on the stories and these other must-reads:

- Q1 earnings for travel and health companies

- Disney’s $1 billion municipal bond debt

- Ways to invest in crypto on M1

Quantitative tightening

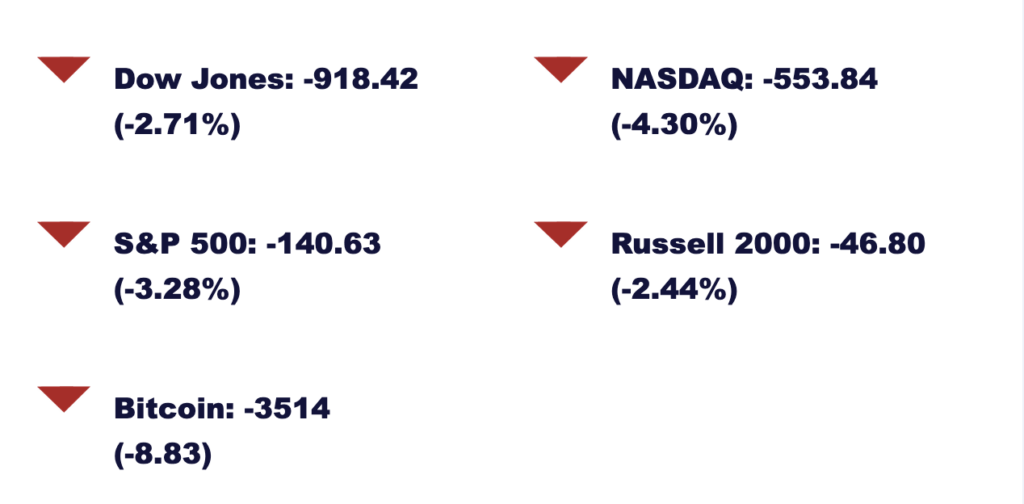

The Federal Open Market Committee (FOMC) wrapped its May monetary policy meeting this week. The hot topic—rising interest rates. Expert predictions came true as the FOMC approved a rate hike of 50 basis points (0.50%). The last hike of this magnitude happened in 2000 when the dot-com bubble burst. This time around, investors may be better positioned to handle higher rates due to the Fed’s warnings about tightening monetary policies.

Earnings reports

Almost one-third of companies in the S&P 500 shared first-quarter earnings this week. Here’s a quick overview of reported earnings per share (EPS) versus expected EPS:

- Pfizer (PFE): +$1.62 vs +$1.47 expected

- Starbucks (SBUX): +$0.59 vs +$0.60 expected

- CVS (CVS): +$2.22 vs +$2.08 expected

- Airbnb (ABNB): -$0.03 vs -$0.28 expected

- Uber (UBER): -$0.18 vs -$0.24 expected

- Lyft (LYFT): +$0.07 vs +$0.07 expected

- MGM (MGM): -$0.01 vs -$0.09 expected

- Marriott (MAR): +$1.25 vs +$0.95 expected

American debt

In February 2022, U.S. consumers took on five times the credit than the previous month—more than double what economists predicted. Credit card spending also rose by 20% in Q1. With interest rates and prices on the rise, this could be a warning sign the economy is heading toward a recession.

Quick hits

- How to make cash work harder as interest rates rise

- The most magical place on earth’s $1 billion legal mess

- Why Wall Street is embracing cryptocurrency

Investing in crypto

Since last year, anyone with an M1 Invest brokerage account can have exposure to cryptocurrency holdings through exchange traded funds (ETFs), trusts, mining firms, and public companies. Our latest post shares the fundamentals of crypto and how to factor it into your financial planning.

Explore options for investing in crypto on M1 →

May 6, 1964

Seabury Stanton, then President of Berkshire Hathaway (BRK.A), sent a letter to shareholders offering to buy 225,000 shares for $11.375 per share. But one shareholder, Warren Buffett, had a verbal agreement to sell for $11.50. Upset at the news, Buffett purchased hundreds of thousands of company shares. By May 1965, he owned over 40% of Berkshire and assumed control of the company.

Sign up for M1 to receive weekly market insights and financial wellness tips in your inbox.

- Categories

- Borrow