I played the Stock Market Game in fifth grade. Here’s what my investments look like 15 years later.

Last month, I found a notebook from 2008. I was packing up my childhood bedroom during my parents’ move and under a couple of Time magazines, Little League baseballs, and an original iPod Nano was this weathered, blue notebook.

Inside was a ledger of trades I had made while playing the Stock Market Game in the first half of 2008. An entire portfolio of stocks I had owned—sort of—as a fifth grader. It revealed both the mistakes I made in my first introduction to investing and also my surprisingly strong performance after those four months.

But all I could really think about was, what if I had really bought these companies? And what if I held for 15 years until right now? How would my investment strategy hold up? In other words:

Are you smarter than a fifth-grade investor?

There is a wealth of knowledge to gain in 15 years of time. Any level of investor can learn from the mistakes and successes of a beginner. It’s an opportunity to revisit the fundamentals and a reminder of the joys and possibilities of long-term investing, but also to take stock of the risks involved. While companies change, patience, risk-assessment, and our reasons for investing tend to stay the same. Ultimately, by examining the experiences and choices of a beginner over time, even veteran investors can find new perspectives to add to their own investment strategies.

The notebook

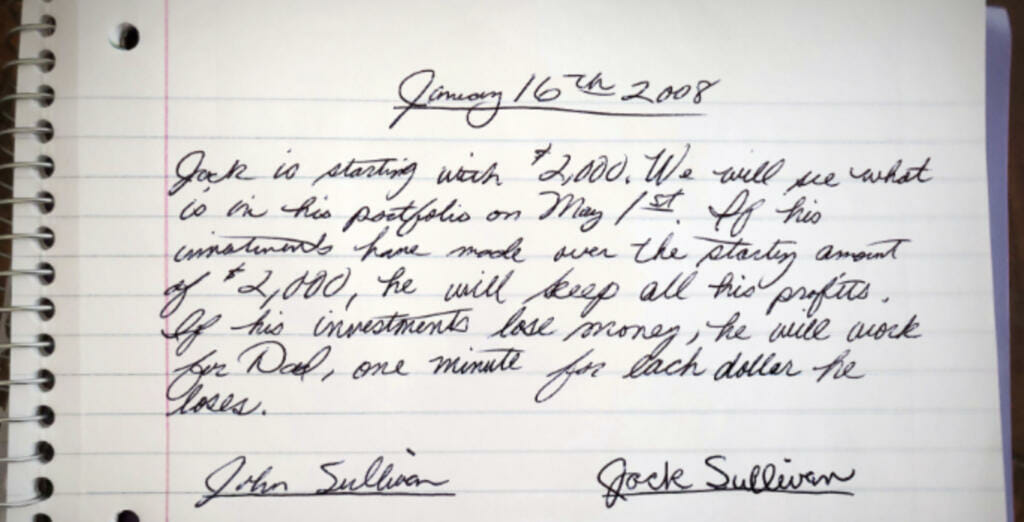

The first page of the notebook detailed the rules my dad had set for the game. Real money was not used and real stocks were not bought. Instead, he gave me $2,000 of play money to buy shares of companies. I used the family computer to research companies and record the prices of shares. I kept track of all my trades in the notebook.

The goal was to give me a beginner’s introduction to the stock market and how money can work for you. It introduced me to American industry and risks and the consequences of risks.

The game lasted from January 2008 to May 2008. Any gains I made over the $2,000 I was given I would get to keep (maybe in exchange for an ice cream or a new Chicago Cubs jersey). Any dollar under the $2,000 would be a minute worked for my dad (probably yard work or doing the dishes).

An excerpt:

Jack is starting with $2,000. We will see what his portfolio has on May 1st, 2008. If his investments have made over the starting amount of $2,000 he will keep all profits. If his investments lose money he will work for Dad one minute for each dollar he loses.

We had a deal.

My stock picks

On January 16th, 2008, I chose the stocks I would buy with my $2,000 of play money. Here are the average prices of what I bought during the game:

| Stock | of shares | Total |

|---|---|---|

| Disney (DIS) | 5 shares @ $31.93 | $159.85 |

| Microsoft (MSFT) | 10 shares @ 28.22 | $282.20 |

| Viacom (VIA) | 10 shares @ $39.50 | $395.00 |

| Yahoo (YHOO) | 10 shares @ $29.87 | $298.70 |

| Exxom (XOM) | 5 shares @ $89.13 | $445.65 |

| Walmart (WMT) | 7 shares @ $51.10 | $357.70 |

| Nike (NKE) | 3 shares @ $14.42 | $43.26 |

| Apple (AAPL) | 3 shares @ $5.70 | $17.10 |

| Portfolio Total | 53 shares | $1999.46 |

Yes, Apple was $5.70 a share in 2008.

“If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so the fifth grader won’t get bored.”

Peter Lynch

Why I, as a fifth grader bought these stocks:

Disney: I bought Disney because I had recently gone on a trip to Disney World with my family and I was a big fan of the Pirates of the Caribbean franchise.

Microsoft: I bought Microsoft because I had read stories about the billionaire founder, Bill Gates. I knew about Microsoft’s flagship product, the Windows operating system, because it came preloaded on our home PC.

Viacom: I wanted to buy Nickelodeon next. They were my favorite TV channel growing up with classics like SpongeBob SquarePants. But Nickelodeon, I soon found out, was owned by Viacom. So, I bought Viacom.

Yahoo: In the 2000s, Yahoo was a very popular news site and one I would frequent almost every day for its search engine and news. It was also my very first email address.

Exxon: Every time I watched my parents watch the news; the news was talking about oil! I figured I should invest.

Walmart: I knew my dad owned a lot of Walmart stock so I should too.

Nike: I loved sports and everything I wore was Nike (unless it was Picture Day). And being from Chicago, I understood that any brand smart enough to sponsor Jordan was going to have a bright financial future.

Apple: I had an iPod Nano and loved it. All the computers at school were Apple. And I was vaguely aware that they’d just launched something called the iPhone, although it’d be years before I encountered one in the wild.

I had no idea what a P/E ratio was. I had no knowledge of the complexities of the stock market. I just invested in what I liked. All I needed to know was buy and sell. I’d log into my family’s Microsoft PC wearing Nike to read about Disney movies on Yahoo News. It was what I knew.

Here’s why an investor may have bought these same stocks.

Why an investor may have bought these stocks in 2008:

As an elementary school trader, I wasn’t half-bad. Although I mostly picked companies I was personally aware of, some of my thinking overlapped with how investors might have approached their own strategy.

Here’s how the professionals could have viewed it.

Disney: Disney had a strong product portfolio and business approach in 2008. They acquired Pixar in 2006 and had several major hits the following year. They continued building out intellectual property and franchises such as the Pirates of the Caribbean series, which by 2007 had taken in billions of dollars at the box office. Disney was an American institution that continually showed change and growth.

Microsoft: Microsoft was dominating in software with its Windows operating system. They also expanded into gaming with the Xbox line of consoles — the Xbox 360, released in 2005, wound up selling over 38 million units in the US during its lifetime. Microsoft’s stock growth may have been hindered by the mixed reviews its Windows Vista launch received in 2007, and by the fact that its Zune product never seemed to get out from under the iPod’s shadow.

Viacom: Viacom had a diverse media portfolio with networks like MTV, Nickelodeon, and Comedy Central that dominated cable TV in the 2000s. At the end of 2007, Viacom signed a five-year $500 million contract with Microsoft for content sharing and advertising. Under the agreement, Microsoft gained the licensing rights to a wide range of television shows from Viacom’s cable television and film studios to use on Xbox and MSN. Viacom became the publisher partner for game development and distribution. Microsoft’s Atlas ad-serving platform also became the exclusive prover of ad space on Viacom owned websites. Along with the deal, Microsoft purchased advertising space across Viacom networks.

Yahoo: Yahoo had a large internet presence in 2008. They were a popular and competing search engine to Google. Yahoo Mail was extremely popular and predated Gmail by seven years. Yahoo began offering unlimited email storage in 2007. In addition to Yahoo’s search and email features, the company had a diverse portfolio of properties like Yahoo News and Yahoo Finance. Yahoo News was the default news site for millions of people since it was the home screen of some browsers.

In the beginning of 2008, Microsoft made an offer to buy Yahoo for over $44 billion which was later rejected, with Yahoo claiming the offer “substantially undervalues” the company.

Exxon: Exxon’s extensive operations in oil and gas exploration, production, refining, and marketing established a strong foundation for consistent revenue generation. In 2007, Exxon completed the drilling of the Z-11 well in Sakhalin, Russia, which the company claimed was “the longest measured depth extended-reach drilling (ERD) well in the world.” This record-setting well had an estimated 2.3 billion barrels of oil and 17.1 trillion cubic feet of gas. Additionally, Exxon’s regular dividend payments appealed to investors looking for reliable returns.

Walmart: Walmart dominated the retail space in 2008 as the world’s largest retailer. They continued to offer competitive prices due to their economy of scale. In the third quarter of 2007, they launched their Site to Store service, enabling customers to purchase products online and pick them up in stores. This was revolutionary at the time and it was reflected in their fourth quarter earnings. Walmart reported an increase of eight percent over the fourth quarter of fiscal year 2007 and marked record sales and earnings.

Nike: Nike was extremely profitable in 2007, undergoing a stock split and announcing a large dividend. From 2002-2007, Nike’s stock appreciated more than 70% and they returned close to $4 billion to shareholders through dividends and share repurchases. Nike had strong brand recognition and continued to dominate the sneaker industry. In 2007, they launched a new “statement” shoe, the Air Force 25, to pay homage to the basketball shoe revolution Nike started 25 years before. Nike also partnered with Kanye West for a sneaker launch which he previewed at the 2008 Grammys. They gained exposure in the soccer industry by buying uniform maker Umbro in 2007.

Apple: Apple continued to stand out with its innovative products. They switched to Intel processors in 2006, which became the industry standard for almost two decades. In 2007, the company launched a redesign of the Intel iMac. In June 2007, Apple released the iPhone, creating such aa loyal customer base that people would frequently make the news for waiting in hours long lines for the company’s product releases. By April 2008, iTunes was the largest music vendor in the US.

My performance after 6 months

Right at the start, I was trading nearly every day. It was fun, exciting, and new, and I thought this was what investing was all about. I was behaving more like a day trader than an investor. As the weeks went on, I slowed down and wised up. I was careful with my trades. While I was beginning to grasp some basic concepts of investing, this exercise still hadn’t taught me the most important concept of them all: time. I wouldn’t learn this until years later – at my first job at M1.

By May 1st, the end of my stock market game, I had $2,011.19 in my portfolio. $11.19 over the $2,000. It looked like I was getting that ice cream. And we did. My family went to Homer’s to celebrate.

If my dad had been a real stickler and tallied up the tax bill I would have run up from all those daily trades, I probably would have ended the game under that $2,000 and been stuck doing chores for the government all summer!

What would have happened if I had just held?

Out of the eight stocks I bought, seven were winners. Yahoo was the only stock that lost value from $29.87 a share to $26.81 a share.

If I had done nothing and just held on to those stocks for the six months, I would have had $2,052.96 in my portfolio. $52.96 over the $2,000 and I could have bought a ticket to the Cubs game.

And if any companies had paid out dividends during this exercise, it could have been even more. Maybe a Cubs ticket and a hat.

In fact, if had just bought and held those eight stocks, I would have beat myself day trading and the S&P 500 in those six months.

| My portfolio day trading | My portfolio buy and hold | The S&P 500 |

|---|---|---|

| 0.59% | 2.68% | 2.63% |

[M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance.]

As the old adage goes: “Time in the market, not timing the market.”

While the game was designed for the short term, the lesson is in the long term. Let’s see what happened to the stocks I, a fifth grader, picked over the next 15 years.

The decade of the bull

The longest-running bull market in history took place between 2009 and 2020 following the recession of 2008. On March 11th, the Dow Jones Industrial Average closed 20% below its all-time high, signaling a bear market. Throughout the decade, the bull market faced a US-China trade war, the European sovereign debt crisis, Brexit, and conflicts in the oil-rich Middle East but it was the COVID-19 pandemic that eventually brought it to an end.

What happened to my stock picks during this bull run?

While it is humbling to imagine that I would have held these stocks during the 2010s, emotions can get the best of even the most seasoned investors. I may have sold during any of the above crises or because of reasons that affected my specific portfolio. A lot happened to these companies during this time that may have made me buy more, sell, or hold.

Disney

From Disney’s acquisition of Pixar in 2006 came several massive, animated releases and franchises, such as Frozen. They also made three more key acquisitions in the decade: Marvel in 2009, which created billions in the era of superhero movies; Lucasfilm in 2012 which brought franchises like Star Wars and Indiana Jones; and 20th Century Fox in March 2019.

They opened another resort called the Shanghai Disney Resort in 2016 further serving customers in that region.

Towards the end of the decade, Disney launched Disney+, a direct-to-consumer streaming app with virtually all the entire Disney content library of the past century. The service competes with companies like Netflix and currently has around 160 million subscribers. While it is a loss-leader for the company, Disney+ continues to gain subscribers in the steaming space with the goal of becoming profitable by the end of 2024.

Microsoft

Microsoft struggled with the mobile market with failures in Windows Phone and its acquisition of Nokia. They only sold around 100 million Windows Phones and were unable to keep pace with other mobile innovators. The Nokia acquisition wasted at least $8 billion for Microsoft, leading many to argue that Microsoft never had any interest in running a phone business. Shortly after the acquisition, the strategy shifted away from devices and services and focused on cloud computing and Office 365 products.

The 2010s was a period of success for Microsoft since, with the increased growth and adoption of the Azure platform, they transitioned from the Windows company to the cloud computing company.

Viacom

Viacom failed to fully capitalize on the streaming industry and was left behind by upstarts like Netflix, while the controlling Redstone family fought each other over executive succession.

Viacom was re-merged with CBS in 2019. The two companies had previously split in 2005.

In 2022, ViacomCBS changed its name to Paramount Global and began trading under the symbol PARA. This rebranding move was to capture the historic Paramount Pictures brand identity and repurpose it for the modern streaming era. Its newcomer streaming service, Paramount Plus, surpassed 77 million subscribers in Q4 2022.

Yahoo

Yahoo is a famous business school example of a failed company for three main reasons.

First, they were unable to keep up with evolving technology and user trends. Companies like Google and Facebook crushed them through innovation and trendspotting. The Yahoo search engine quickly fell behind.

Poor management decisions, including unprofitable acquisitions of brands such as Broadcast.com, Geocities, Flickr, Right Media, Overture Services, Inc, and Tumblr also contributed to their demise. The company’s management focused on profit instead of user experience, flooding Yahoo sites with ads that confused and frustrated users who decided to go elsewhere — namely, to Google.

Finally, Yahoo suffered the largest data breach ever, further undermining trust in their brand.

At one point the company was worth $125 billion. In 2017, they sold to Verizon for $5 billion.

They are now owned by American private equity firm Apollo Global Management and still operate today, although the feature Yahoo became known for, its search engine, is now operated by Microsoft’s Bing.

Exxon

Exxon performed well in the 2010s. The company benefited from rising oil prices and expanded its production in the Permian Basin. They also earned hundreds of billions in revenue each year. The only year they lost net income since I ended my Stock Market Game was in 2020.

Russia nationalized and claimed Exxon’s Russian assets in 2022, to help fund its war in Ukraine, including the record-breaking Sakhalin project mentioned earlier.

Exxon’s overall performance in the 2010s was characterized by a combination of successes and risky investments in R&D, reflecting the volatility and evolution of the energy industry.

Walmart

Walmart performed well in the 2010s, experiencing growth and success. The company benefited from strong revenue growth from e-commerce and expanded its operations to compete with online retailers like Amazon. While Amazon obviously dominates in market share, Walmart has been able to find profits in its e-commerce business growing year-over-year while continuing to dominate brick-and-mortar.

Nike

Nike continued its brand dominance in the athletic wear industry. They expanded their global presence, particularly in China, and were perfectly positioned to capture the athleisure fashion trend of the 2010s. They also capitalized on the online shopping boom, adopting direct-to-consumer retailing through their website and app. They became the official supplier of NFL and NBA apparel and sponsored athletes like Kevin Durant and Russell Wilson.

Apple

Apple had achieved incredible success in the 2010s. During this time, the iPhone became the most successful consumer product in history, selling at least 2.2 billion units by 2018. The company also established a strong software and hardware ecosystem with services like the App Store and Apple Music.

Their other product lines, such as MacBooks and iMacs, seamlessly connected with other Apple products through the cloud, allowing users to have the entire suite of products in their home. As a result of Apple’s success, it became the first trillion-dollar company.

My performance after 15 years

On May 1st, 2023, I checked on how my portfolio would have done if I had held all these years. My portfolio would now be worth $6,572.26 compared to the $1999.46 I started with.

This isn’t inclusive of reinvested dividends, which could potentially have made this impressive return even more impressive. (Many of these companies regularly paid out dividends in the intervening 15 years, but for the scope of this piece I did not track them.)

Out of the eight stocks, seven again were winners.

Viacom and Yahoo both struggled during the 2010s but were eventually bought by larger companies. Yahoo was bought by American private equity firm Apollo Global Management and the stock has performed. Viacom was merged with CBS and then renamed Paramount Global, but the company’s stock price is down about 70% since the merger.

These are just rough estimates. For example, for the purpose of estimation, I assumed that my Viacom and Yahoo shares would’ve been exchanged on a one-to-one basis for the shares in the companies they ended up merging with.

Some companies also issued stock splits, so I wound up with more shares although their value was temporarily diluted by the issuance of the new shares.

| Stock | No. of shares purchased during the Stock Market Game | Total | No. of shares on May 1, 2023 | Total |

|---|---|---|---|---|

| Disney (DIS) | 5 shares @ $31.93 | $159.85 | 5 shares @ $102.21 | $511.05 |

| Microsoft (MSFT) | 10 shares @ $28.22 | $282.20 | 10 shares @ $305.56 | $3,055.60 |

| Viacom (VIA) Now Paramount Global (PARA) | 10 shares @ $39.50 | $395.00 | 10 shares @ $15.86 | -$158.60 |

| Yahoo (YHOO) Now Apollo Global Management (APO) | 10 shares @ $29.87 | $298.70 | 10 shares @ $63.72 | $637.20 |

| Exxon (XOM) | 5 shares @ $89.13 | $445.65 | 5 shares @ $114.67 | $573.35 |

| Walmart (WMT) | 7 shares @ $51.10 | $357.70 | 7 shares @ $151.59 | $1,061.13 |

| Nike (NKE) | 3 shares @ $14.42 | $43.26 | 12 shares, following two 2:1 stock splits, @ $127.92 | $383.76 With stock split: $1,535.04 |

| Apple (AAPL) | 3 shares @ $5.70 | $17.10 | 84 shares, following a 2014 7:1 stock split and a 2020 4:1 stock split, @ $169.59 | $508.77 With stock split: $14,245.56 |

| Portfolio Total | 53 shares | $1999.46 | 143 shares | $6,572.26 With stock split: $21,460.33 |

Over the past 15 years, my portfolio would have returned 232.06% if I’d held until May 1, 2023, about 25 points better than the S&P 500 without accounting for the stock splits. Does this mean fifth graders should open hedge funds?

| My portfolio May 2008-May 2023 | My portfolio May 2008-May 2023 with stock splits | The S&P 500 May 2008-May 2023 |

|---|---|---|

| 228.70% | 973.31% | 203.52% |

[M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance.]

A lesson in long-term investing

What started as a beginner’s lesson in investing turned out to be a life-long lesson in time.

There are many ways to invest and investing in what you like is one of them.

Managing your emotions over time is a challenge but one that can potentially yield results if you stick to your individual decision-making and financial plan.

Short-term stock fluctuations or greater market moves can be intimidating. They may encourage you to sell. But examining your own portfolio over time may help you make decisions for the future. Staying invested for the long-term can be a decision you make.

The M1 line

As a young investor, I didn’t learn this lesson until I invested with M1. M1 offers an all-in-one financial platform for you to grow your wealth over time.

20230628-2966796-9562746

Disclosure:

This article is for informational purposes only and is not a recommendation of an investment strategy or to buy or sell any security in any account. It is also not research reports and are not intended to serve as the basis for any investment decision. Prior to making any investment decision, you are encouraged to consult your personal investment, legal, and tax advisors.

- Categories

- Invest