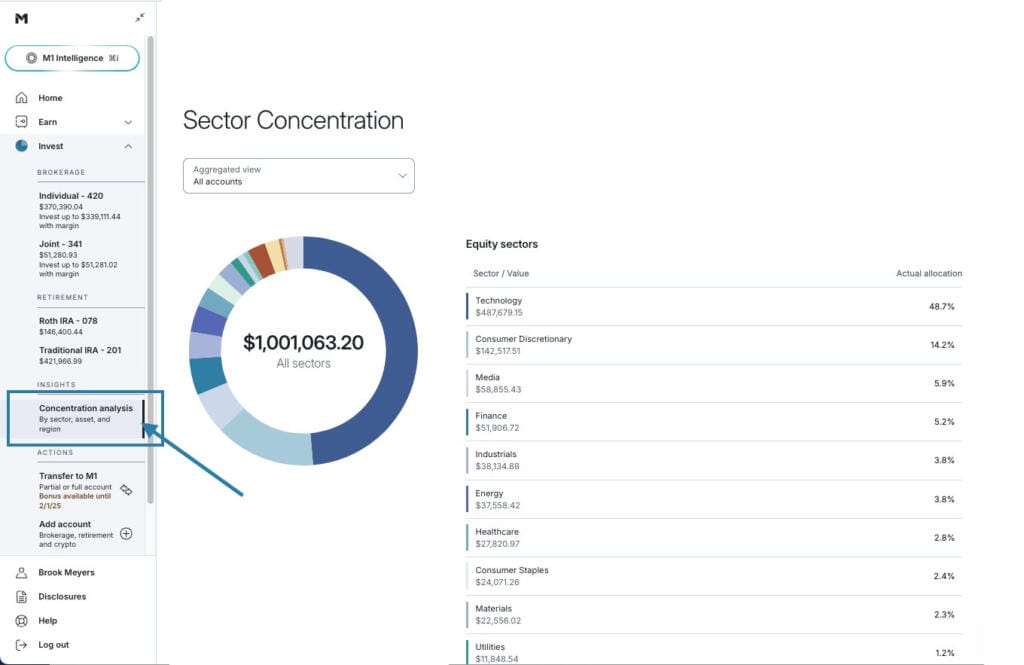

Introducing Concentration Analysis: Insights to identify your hidden risks

Want to know if your investments are concentrated in the areas you want? Or if your portfolio is sufficiently diversified? M1’s newest feature, Concentration Analysis, can help you find the answers. It’s the latest in our expanded Insights tab, designed to empower you to make data-driven investment decisions.

What is Concentration Analysis?

When you’re investing with a long-term vision, your investment allocation matters. Most investors know the classic principle: don’t put all your eggs in one basket. Many investors are aiming to build a broadly diversified portfolio and minimize being too concentrated in any given investment.

However, some investors with an active selection strategy may concentrate more on certain investments because they have a high level of conviction that these assets will outperform with a long-term buy & hold strategy.

Whether you’re looking for broad diversification or a clearer picture of your particular concentrations, this tool is for you. Concentration Analysis helps you can see a clear, visual breakdown of your portfolio across three areas:

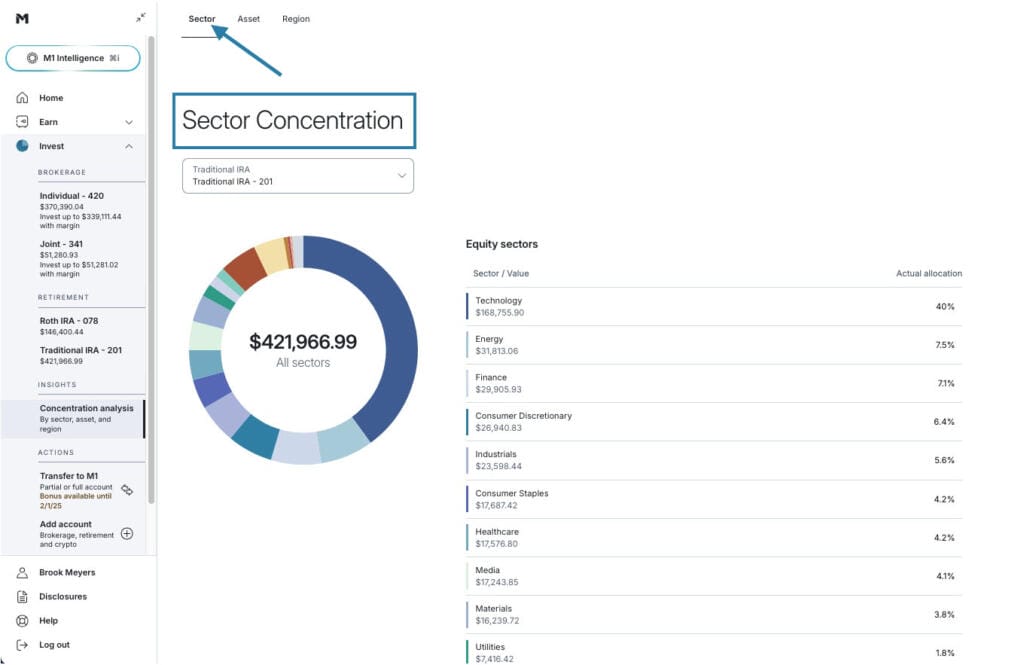

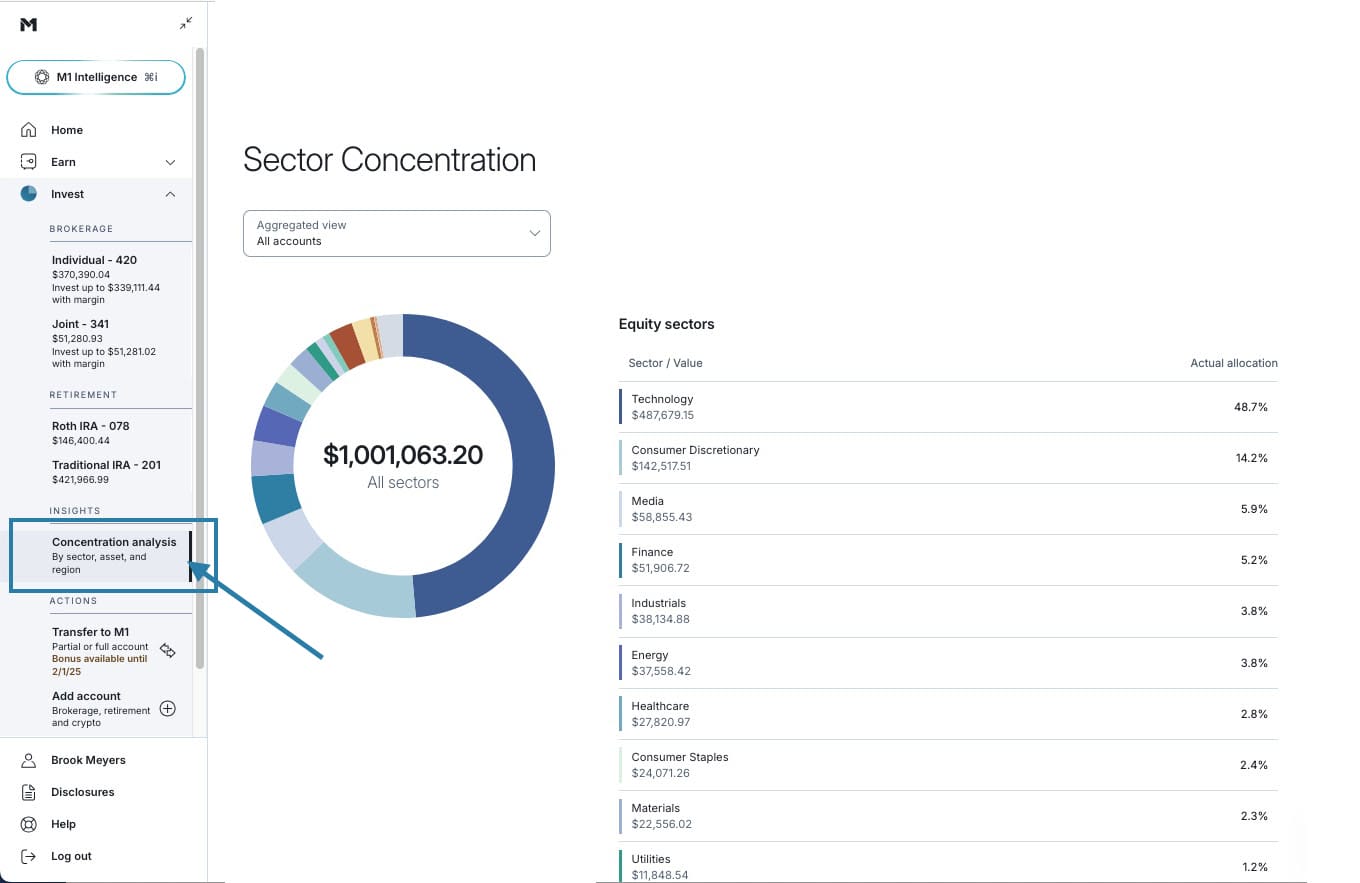

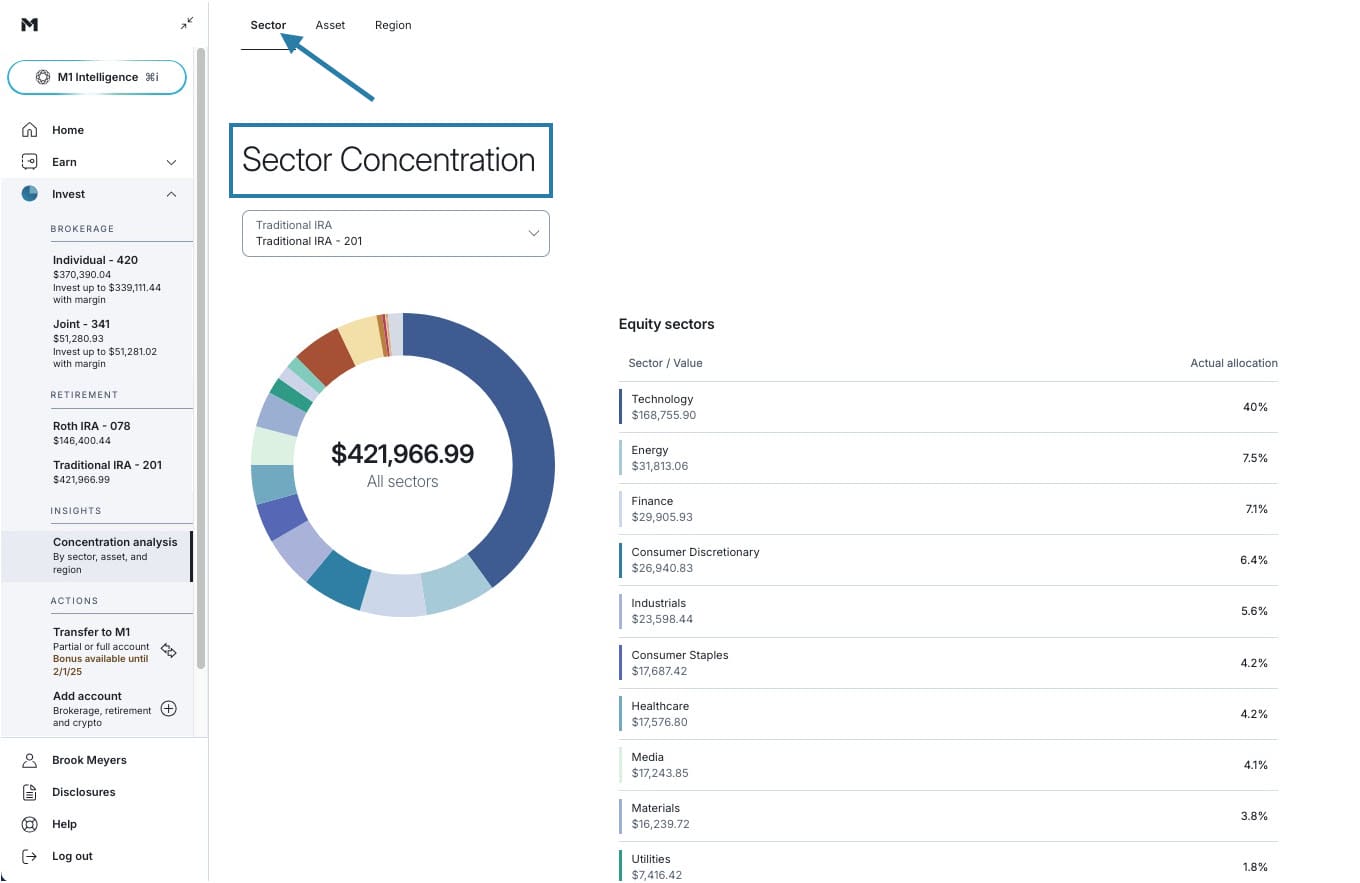

- Sectors: See your exposure to economic sectors like Tech, Healthcare, Finance, and more.

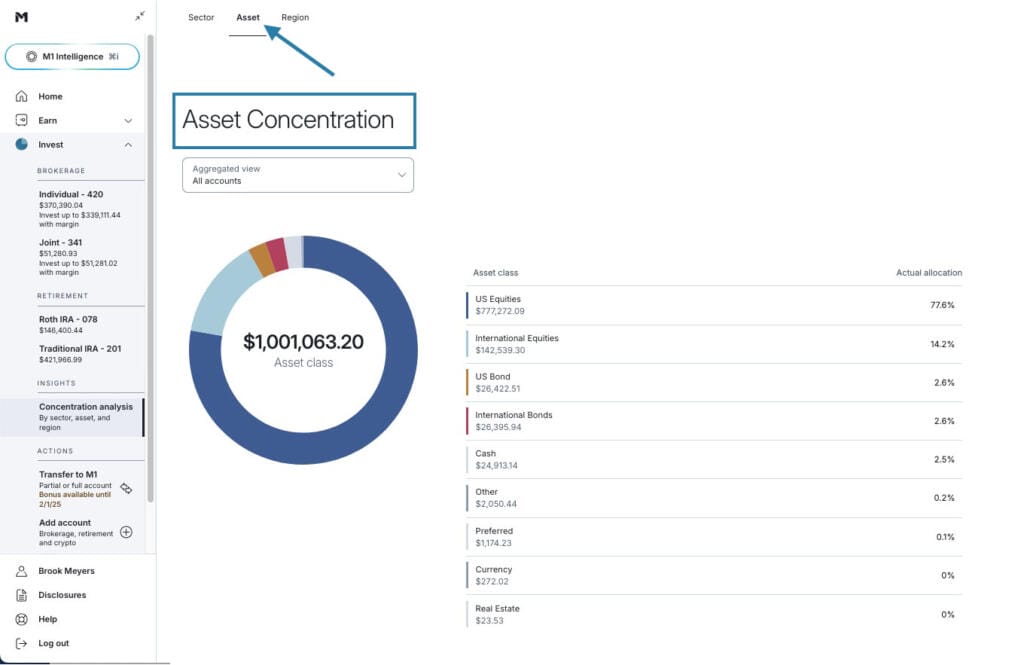

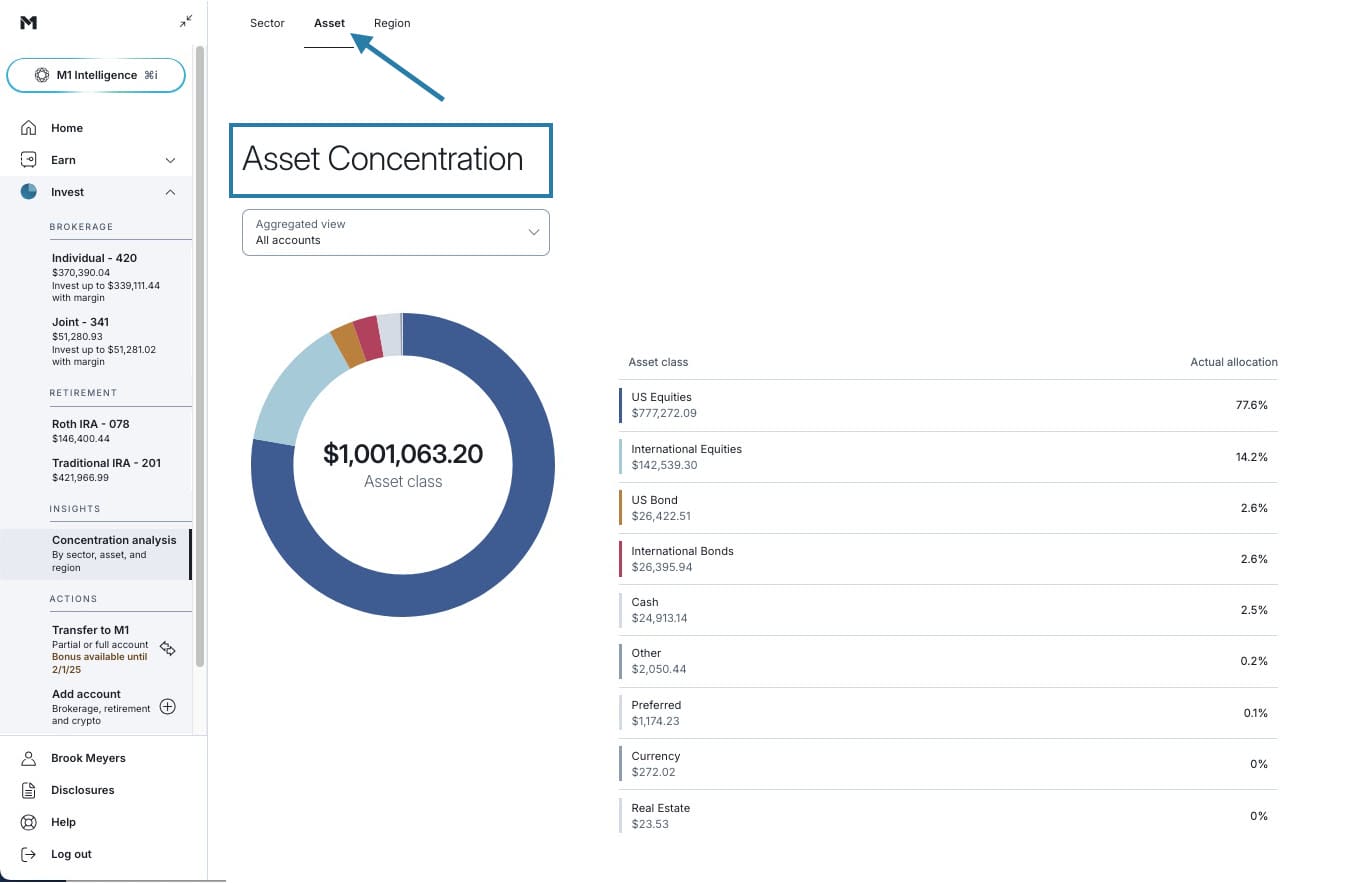

- Asset Classes: Understand your mix of U.S. and International Equities, Bonds, Cash, Real Estate, Commodities, etc.

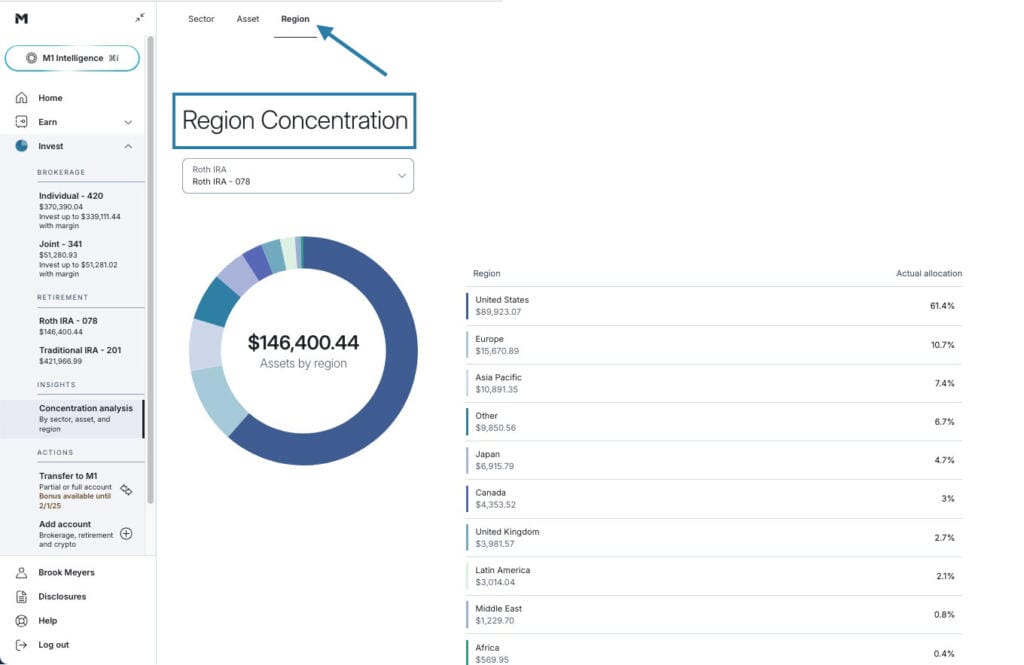

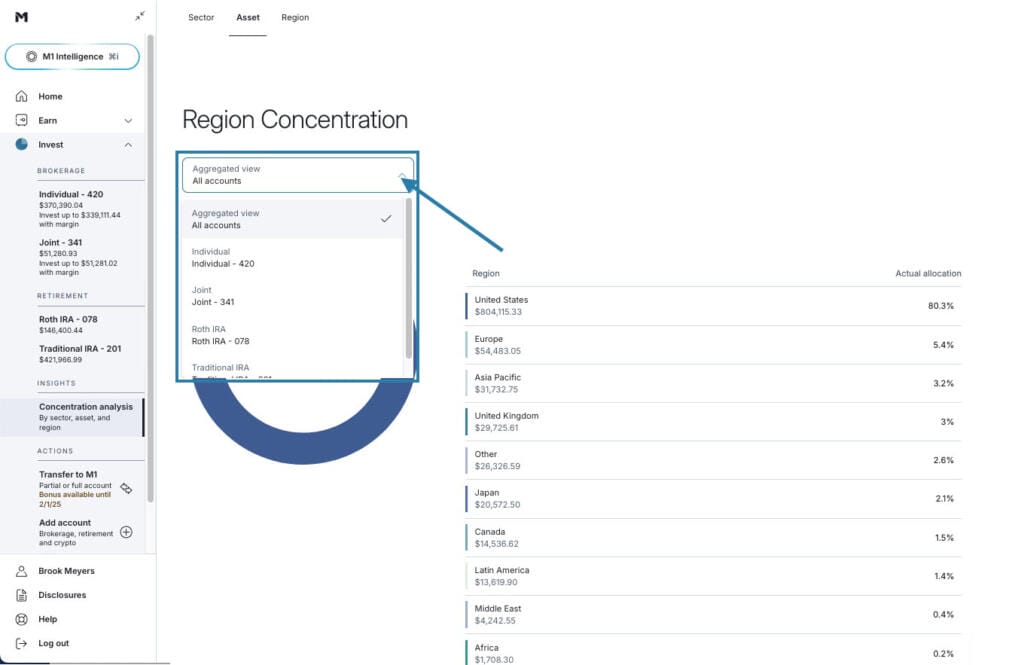

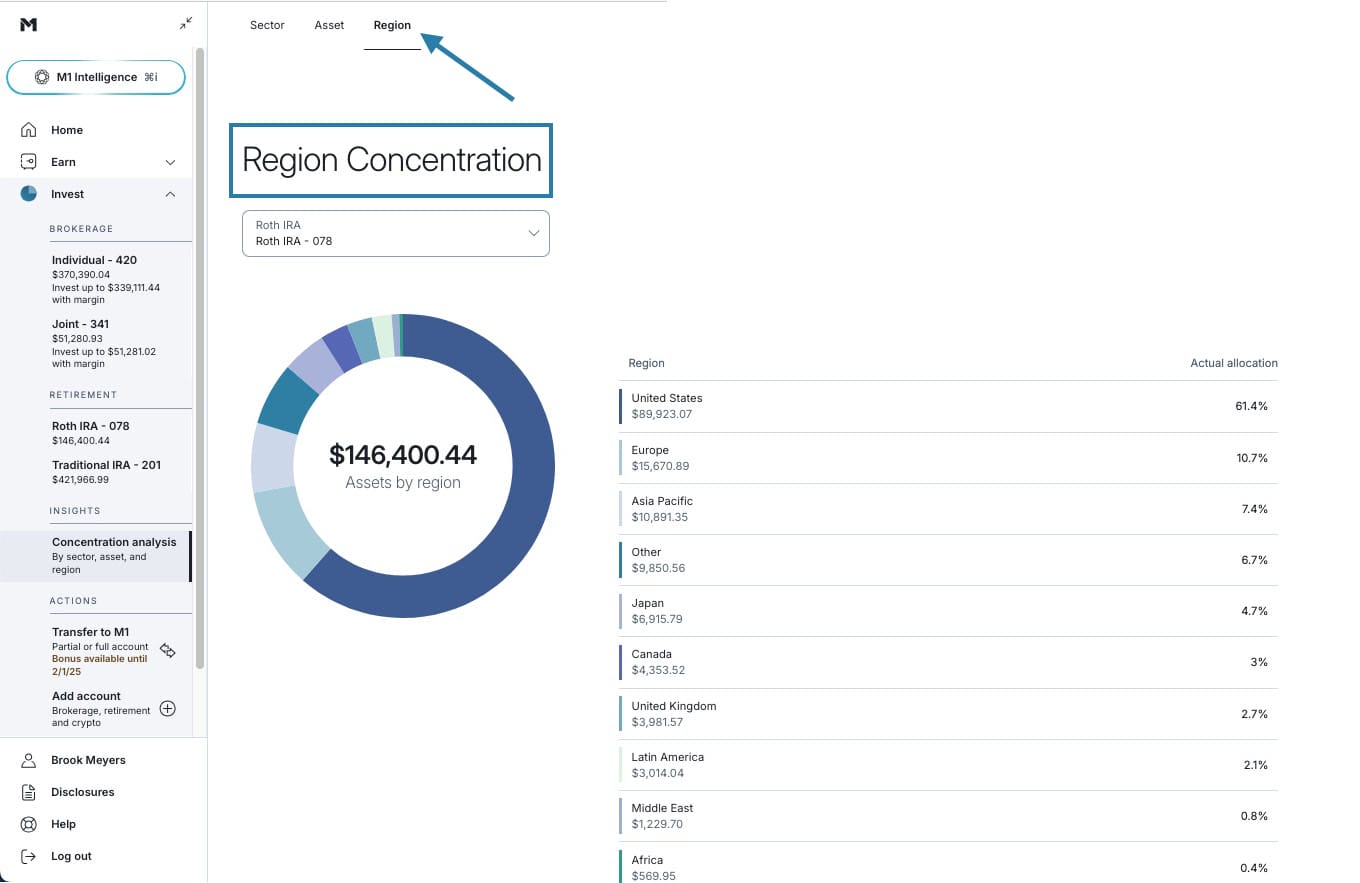

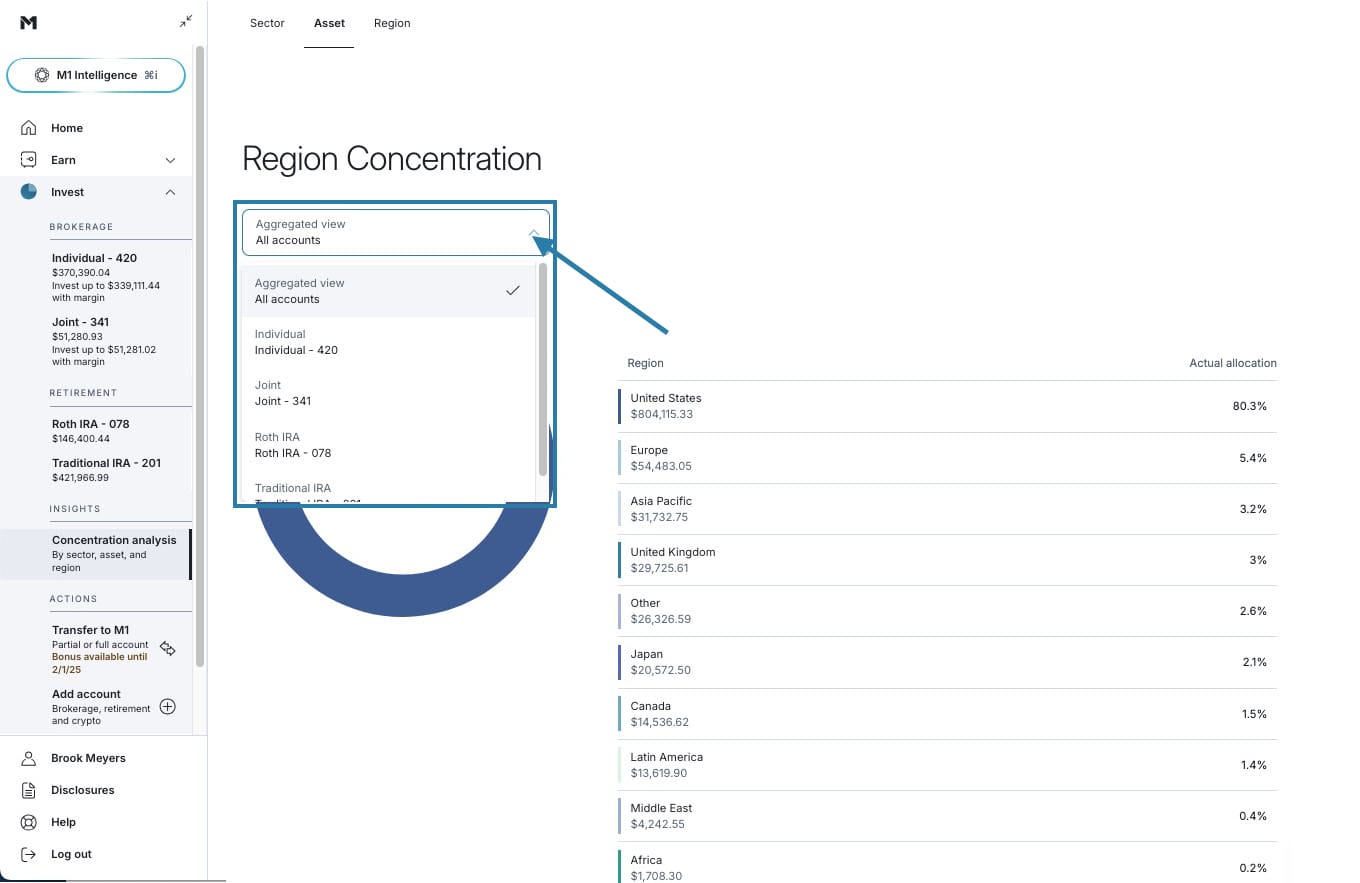

- Regions: View your geographic distribution across the United States, Europe, Asia Pacific, and beyond.

Depending on your approach to investing, specific views may be more useful to you. For example:

- An investor who is approaching retirement age may focus on asset class allocation (e.g., % of stocks vs. bonds), so they can manage their path to retirement.

- Region may be more important for investors seeking greater international diversification amid uncertainty in domestic markets.

- Sector may be useful to investors with a mix of stocks and ETFs that want to be broadly diversified across sectors—or investors who feel a strong conviction toward investing in a specific sector.

This knowledge may help you re-evaluate your Pie’s allocations and make the appropriate adjustments to get back to your desired sector exposure. If you have auto-invest turned on, simply tweak the allocation percentages of your Pie to align with your strategy—then M1’s Dynamic Rebalancing can tax-efficiently drive your portfolio closer to your targets over time.

Why Concentration Analysis matters for your portfolio

Some investors aim to build a broadly diversified portfolio and minimize being too concentrated in any given investment to help manage risk. Some investors prefer to have higher concentration in certain sectors, regions, or asset classes.

They may be comfortable with higher concentration because they have high conviction that their concentrated strategy could outperform with a long-term buy-and-hold strategy.

Other investors may have a more specific vision for their investment strategy: say, 70% equities and 30% bond exposure. With Concentration Analysis on M1, you can drill down even deeper and see how specifically that’s broken up.

Concentration Analysis gives you the real data to:

Identify hidden concentrations. What’s your desired mix of equities vs. bonds, US vs. international, sector exposure? How closely does your portfolio match this? Are you more or less concentrated than expected?

Make informed decisions. Now you can be sure your portfolio aligns with your long-term goals and make tweaks if your strategy changes. No need to rely on guesswork or estimates—and no more spreadsheets to toil over. This does the work for you, so you can spend more time on strategy and less time tallying up numbers yourself.

See the full picture. Concentration analysis allows you to zoom out and see an aggregate view of all your accounts. If you’re trying to optimize your asset location across all your accounts—taxable and tax-advantaged—this gives you a holistic view.

Why diversification matters for long-term investors

For long-term investors, diversification is about sustainable wealth building. It can help you stay invested through market cycles, avoid emotional decision-making during downturns, and compound returns steadily over time. Of course, diversification won’t eliminate risk entirely, but it’s one of the tried-and-true principles that helps reduce risk over time.

At the same, there are many reasons an investor may want to be highly concentrated in specific investments. It all depends on your level of risk tolerance and your personal investing strategy. Your goals and convictions may lead you to a more highly concentrated portfolio—this tool simply gives you the data to understand what that looks like. It helps answer the question: “How much risk am I taking on? Is that aligned with my personal risk tolerance?”

Where to find Concentration Analysis on M1

- Navigate to Invest

- Select Concentration Analysis from the side rail menu

- Select which account you’d like to look at OR select “all accounts” for an aggregate view.

- Here, you’ll see your estimated dollar exposure to each category. Tap any category to drill down and see exactly which holdings contribute to that exposure—and by how much. We designed this feature to make these insights as actionable as possible, so it’s easy for you to figure out:

- Where is my exposure? Does this match my intent?

- What holdings would give me this exposure if I want to make a change?

- Which accounts do I need to adjust to match my intent?

Concentration analysis M1: Built for long-term investors

At M1, we believe informed investors are successful investors. Concentration Analysis gives you the clarity and insights you need to build a portfolio based on tried-and-true wealth-building principles. That’s what M1 is all about: helping investors with a long-term vision to build sustainable wealth.

Get started today

Ready to see what’s really in your portfolio? Log in to your M1 account and explore Concentration Analysis now.

Questions? Check out our Help Center article for detailed definitions, FAQs, and examples.

SAIF-12182025-dr3x7vg4

Concentration analysis is for informational purposes only and is not a recommendation to buy or sell any security. M1 does not guarantee the accuracy or completeness of third-party data. A concentrated portfolio may be subject to higher risk and volatility. Diversification does not eliminate the risk of loss.

Values shown are estimates based on the latest available data and may not reflect real-time prices. Data may be subject to reporting lags, changes in fund holdings, corporate actions, and rounding. Sector, asset class, and region exposure values are based on re-scaled long position of the holdings.

Utilizing the Moving Slices feature may cause trades to take place in other accounts you use the same Pie in. Please visit our article on Moving Slices when Pies are used in more than one account for further information.

All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. M1 does not provide any financial advice.

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.