Lessons from a strange market, circa June 2020

Did you see our recent blog about choppy markets? In it, we covered how to think about them, why you shouldn’t be surprised by them, what your potential responses could be and why we’ve created the tools we have to help you in these times.

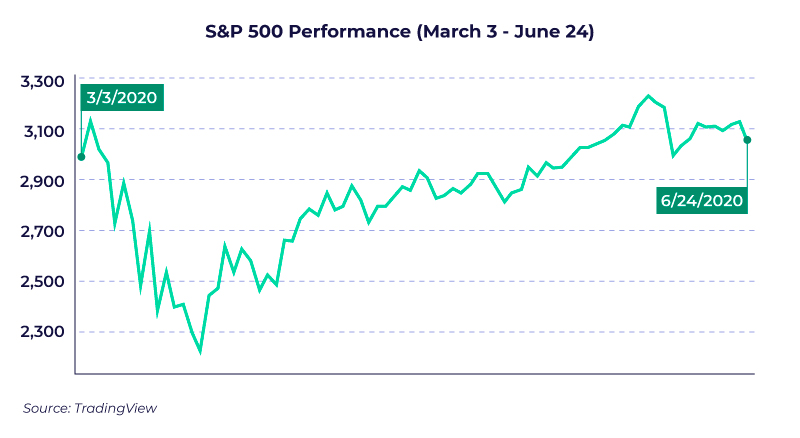

And in case you want a refresher of the past couple of months, here are some of the recent choppy market moves:

- On March 3 (the day we wrote the last blog post) the S&P 500 had fallen about 10% to 3,003 from its high in late February of 3,386 (with several wild daily swings in between those dates).

- On March 23, the market bottomed out at 2,237 as it proceeded to fall another 25%.

- On June 8, just 77 days after, the S&P closed at 3,232—up 44% from the bottom.

- But on June 11, the market fell to 3,002, down another 7% in a few days.

- And after climbing back up, the S&P 500 saw a single-day loss of 2.6% on June 24.

So, what can we take away from this experience? Here are a few thoughts:

1. Don’t try to predict what the market’s going to do

Many “market prognosticators” and well-known investors made predictions about the future direction of the market in mid-March that were 100% incorrect. Here’s one example. On May 12, Stanley Druckenmiller, one of the most well-known investors and hedge fund managers and chairman of a family office that oversees more than $2.5 billion, said:

“The risk-reward for equity is maybe as bad as I’ve seen it in my career.”

Druckenmiller’s fund has returned 3% since mid-March. The S&P is up over 40%.

Mountains of financial literature have covered the inevitable downsides of timing the market and making stock market moves driven by negative emotions, panic or hubris. What’s next for the market? Who knows?

Lesson: Stay humble. Plan. Stick to you plan. Don’t predict. Trying to predict and time the market consistently is a fool’s game. Even the best of best professional investors can’t do it. And anytime anyone says, “This time is different,” don’t fall for it. It’s not.

2. Reflect on your reactions and adjust your plan if necessary

We get it. It’s hard to watch your portfolio shrink by 30%+ in a matter of weeks and stay the course of your plan.

If you found yourself making drastic changes to your portfolio when the market was in free-fall in March, ask yourself if these moves are part of your intentional plan. If your answer is no, or “What plan? I don’t have a plan,” then you may need to reevaluate and adjust (or even create) your plan to suit your objectives.

Think about it this way. Had you fallen asleep on January 1 and woken up on June 8, you would have found your portfolio in the same spot. And your stress level probably would have been a lot less.

Fortunately, the past 77 days have given you an unprecedented opportunity for a do-over. It’s finance’s version of a mulligan.

The market will exhibit both downturns and upturns over time, but you can’t predict the future and you don’t know when the next downdraft will happen. So, to repeat the lesson above, stick to your plan.

Lesson: Take the second chance. Evaluate your short-term and long-term objectives and create a diversified, low-cost portfolio that suits your needs, risk profile and ability to keep your emotions in check. Read: Sleep well at night no matter what the market is doing.

3. Remove the human element from your plan and automate

Having a good financial plan and diversified portfolio that aligns with your goals and profile is the first necessary step.

For most people that’s not enough. Building sustainable long-term wealth requires sticking to your plan, and that typically requires many repeated, regular and habitual contributions to a diversified and balanced portfolio over many years or decades. These actions can be time-consuming, mind-numbingly boring and susceptible to frequent change, emotions or non-execution.

If you’re struggling to stay the course of your plan because you feel like you have to do something, you can keep your emotions in check by automating your actions. (Check out more research about emotional investing).

Start with your paycheck. If part of your plan includes an employer-sponsored retirement account and/or a health savings account, you can have these contributions pulled automatically from your paycheck. You’ll adjust your lifestyle to your net pay, and your contributions will be made whether the market’s up, down or sideways, minus all the angst.

Post-paycheck, automate your all your other contributions. Have your net pay deposited directly into a high-yield savings or checking account to get the most out of that money. (We have a few thoughts about this, if you’re in the market 😊). Build your emergency savings there. Once that’s done, and if you’re fortunate and able to participate in the market outside of retirement accounts, automate your contributions out of that account.

What’s all this automation going to do for you? It will help conquer two obstacles: 1) repetition friction and 2) irrational decision-making.

Lesson: Automate your actions and commitments as much as possible so that you can spend time on creating and improving your plan.

Bottom Line

The market in 2020 has been predictably unpredictable. You could probably say that about every market, every year. If there’s an overarching lesson for any year’s market, it’s this:

Have a well-diversified portfolio that’s part of a broader financial plan. Expect upturns and downturns, and adjust your plan to work for you in both scenarios. Take advantage of automation for as many actions as possible to stay the course.

- Categories

- Invest