One platform, unlimited possibilities

At M1 Finance, we know everyone manages their money differently.

But back in 2016, we realized that while technology had made huge strides in the way people find information, navigate the globe, and even shop online, it seemed the world of personal finance had yet to catch up. Fees and commissions kept investing out of arm’s reach for many, and high interest rates encouraged a cycle of debt that made it impossible for many individuals to build wealth at all. Even aside from the costs, many tools proved too restrictive or cumbersome to offer individuals the freedom to manage their money exactly how they wanted.

So we set out to rethink the tools of personal finance altogether.

We talked with investors, listened to stories of debt, and learned all the ways people wish they could manage their money. And then we went to work, putting our heads together and gathering a team of super-talented individuals to build a solution that would empower people, not limit them. The result? A powerful yet easy-to-use platform that can be customized to fit seamlessly into your entire life — a tool that makes managing your money and building wealth easier (and more you) than ever.

Of course, it’s a bit difficult to explain one way to use M1 when everyone uses it just a bit differently. After all, the way people invest, borrow, save, and spend their money depends on so many unique factors, from financial goals, to income, to age and personality. So instead of showing you one theoretical way to use M1, we decided to share the real stories.

Outside of his checking account and emergency fund, Thomas invests in a 401(k) through his employer, maxes out his traditional IRA each year, and regularly invests in a taxable brokerage account. Before finding M1, Thomas used TD Ameritrade for years — he liked that he could choose his own stocks and funds and invest in his favorite companies, but the whole process was more manual and expensive than he wanted.

After a friend recommended M1, Thomas decided to try it out. He built a portfolio of his 10 favorite tech and healthcare companies, including IBM, Pfizer, and Abbott Laboratories, then set up scheduled deposits to invest $200 each week into his stock picks. He likes that he can invest with fractional shares so his cash never sits idle in his account, and with each trade costing him $0, he can invest as often as he likes without fees and commissions eating into his returns.

“I really just want to be consistently putting money into companies I think have a solid business model that will stand the test of time. The nice thing about M1 is that I can choose what I invest in and do it automatically without the extra work of manual rebalancing, calculating how many shares I can buy, and all that.”

Thomas uses the Watchlist function to keep track of other stocks he may want to add to his portfolio at some point, but the rest of the time he’s happy to let M1 automatically invest his money in his stock picks.

“M1 gives me everything I need to invest exactly how I want, while still making the whole process super simple. This is exactly what I was looking for.”

Amanda prides herself on her retirement planning. She knows exactly how much to invest each month to meet her goal of retiring by 2035, and she automates her contributions to her 401(k) and IRA to ensure she’s always on track. But when it comes to her taxable brokerage account, Amanda prefers a more hands-on approach.

“My other investment accounts are where I get to have a bit more fun and take a bit more risk, especially since I’m more conservative with my retirement accounts.”

Before she found M1, Amanda had investment portfolios with a few different brokerages. She refers to her strategy as the core satellite approach: for 80% of her portfolio she has designated a mix of passive Vanguard ETFs, and for the remaining 20%, she invests directly in her current stock picks including AMZN and NFLX. Before M1, she categorized all her investments in her head, but in order to group and track them separately, she had to organize everything in an excel spreadsheet.

After learning about M1 through one of her favorite finance podcasts, Amanda created an account and built a portfolio of multiple Custom Pies to organize, track, fund, and manage groups of securities individually. She has one Custom Pie for her “Core” portfolio of passive etfs and one called “My Picks.” Amanda can view performance of each Custom Pie individually, tracking the value, return, and gains of each. She has even started to share her “My Picks” Pie with friends and family.

“This is hands down the best way to invest — and I’ve tried a lot of the tools out there. I love the clean design and being able to build Pies and track the performance of each individually so I don’t have to calculate everything by hand any more.”

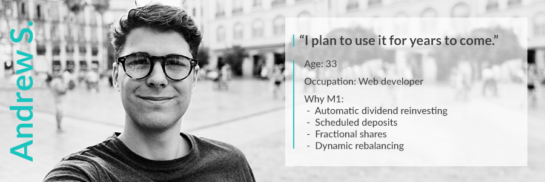

Andrew’s employer doesn’t offer a 401(k), so he invests for retirement exclusively in an IRA. He also invests in a taxable account, using dividend investing to help him earn a bit of passive income. He previously used Capital One ShareBuilder for his dividend portfolio so he could automate his investing by setting up scheduled deposits to his account. He also liked that the platform allowed him to buy fractional shares of stocks, which was especially handy when it came to reinvesting his dividends and specifying a dollar amount to invest rather than a number of shares.

But when he found out Capital One Investing sold to E*Trade and he would no longer be able to invest with ShareBuilder, he decided to try out M1 to continue investing with many of the same features: fractional shares, automatic investing, and the choice between automatically reinvesting dividends or holding them as cash.

“When I found out my old investing account was moving to another brokerage, I was worried I wouldn’t find a tool that checked all the same boxes. Turns out it was a blessing in disguise! M1 has everything I loved about ShareBuilder and more.”

With M1, Andrew can choose to reinvest his dividends in individual stocks and funds or in his entire portfolio. He usually opts to reinvest in his entire portfolio, so his dividends can be distributed among his holdings to align with the targets he set for each. Andrew also loves M1’s Dynamic Rebalancing feature as a way to maintain his asset allocation without any manual calculations or manual rebalancing, allowing him to avoid additional tax consequences.

“Honestly, there’s nothing not to love about this app. I plan to use it for years to come.”

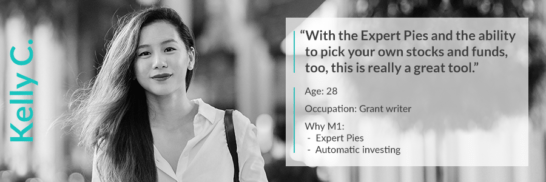

Kelly knows she should invest her money so it can grow over time. However, her investing experience is fairly limited. She’s always socked enough money away in her 401(k)s at work to get the full company match, but she recently decided to open her own brokerage account to invest a bit in hopes of saving for a down payment on a home. She researched her options only to find many self-directed platforms seem overly expensive and complicated.

“I was looking at all these different options that required you to go in and calculate the cost of every single trade you were placing, and then on top of that you had to pay all these commissions to even buy everything. I felt a bit out of my league.”

In late 2017, Kelly read that M1 had cut its fees to offer free investing. After learning that M1 offers professionally designed portfolios, she decided to try it out.

Kelly prefers to leave picking stocks and funds up to the experts — that’s why she opts to invest primarily in M1 Model Portfolios, specifically the Moderately Aggressive General Investing Pie and the Responsible Investing Pie. Together, these Pies make up 90% of her overall portfolio. The other 10% she invests in a few of her favorite companies, such as Amazon and Apple.

“I love the Pie concept M1 uses for organizing all your investments. With all the available Model Portfolios and the ability to pick your own stocks and funds, too, this is really a great tool.”

Kelly checks on her M1 account from time to time, but primarily relies on recurring deposits to automatically invest in her portfolio. She set up two deposits of $100 to her account each month to align with her paydays and relies on M1’s intelligent automation to handle the rest.

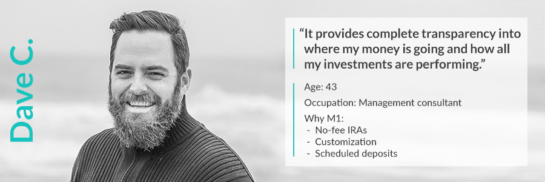

Dave is self-employed and serious about saving for retirement. He contributed to a 401(k) through previous employers, but transitioned to a SEP IRA when he began working for himself.

Dave used to rely heavily on a financial advisor. He often felt he didn’t have enough control over the money flowing into his retirement accounts and the fees and commissions he paid to invest ate into his returns significantly.

“I was always frustrated after talking to my financial advisor about my retirement accounts. I felt like my money disappeared into a black hole, and I never knew exactly what I was investing in or what I was being charged for.”

While researching options for low-fee retirement accounts, Dave ran across M1. He was amazed he could invest for free through the platform while building a custom retirement portfolio to align with his risk tolerance and target retirement date. He opened an IRA and set up his account to invest $450 each month to ensure he maxed out the account by the end of the year.

Dave also recently decided to roll over his old 401(k) using M1’s Rollover Concierge. The transfer was simple and saved him from any additional paperwork. Now, Dave knows exactly where every penny of his retirement savings is invested and never has to worry about confusing costs or hidden fees cutting into his returns.

“The team was great to work with during my rollover and kept me updated throughout the process so there was never that feeling that my money was in limbo. The whole experience really just provides complete transparency into where my money is going and how all my investments are performing.”

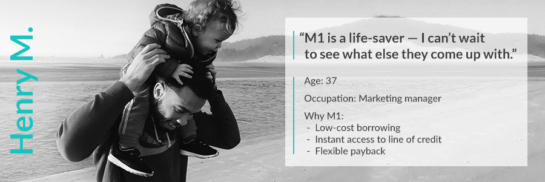

Henry has been automating his investing with M1 for a little over a year. He’d also been saving money on the side for home renovations, not wanting to withdraw the cash from his investment portfolio and reduce his potential for returns. He considered taking out a personal loan, but after crunching the numbers, realized it would increase the total price of the renovations by more than 25 percent.

“I have good credit and I consider myself pretty responsible when it comes to investing and saving for me and my family. It just seemed like paying an extra several thousand dollars for the renovations was over the top.”

When M1 Borrow launched in June 2018, Henry decided to borrow against his portfolio to fund the renovations beyond what he’d already saved. Aside from the much lower rate, he said the flexible payback gives him more space to pay back the loan on his schedule.

“Obviously my wife and I would like to pay it back sooner, but when you have kids you just never know exactly what last-minute costs are going to come up. It’s nice to know that if we need the extra time, it’s not a big deal. I honestly can’t believe a line of credit that’s this inexpensive and easy to use even exists. M1 is a life-saver — I can’t wait to see what else they come up with.”

Of course, these are only a few of the many stories — we’re excited to hear yours! Share your story on Twitter with the hashtag #MyM1Story for a chance to be featured on our blog!

- Categories

- M1