Nvidia is a stock market darling 30 years in the making

We’re only two months into the year, and Wall Street has identified its current crown jewel. Nvidia, a company that once focused on giving gamers top-quality graphics cards, is leading the way in artificial intelligence (AI) and computing hardware innovation.

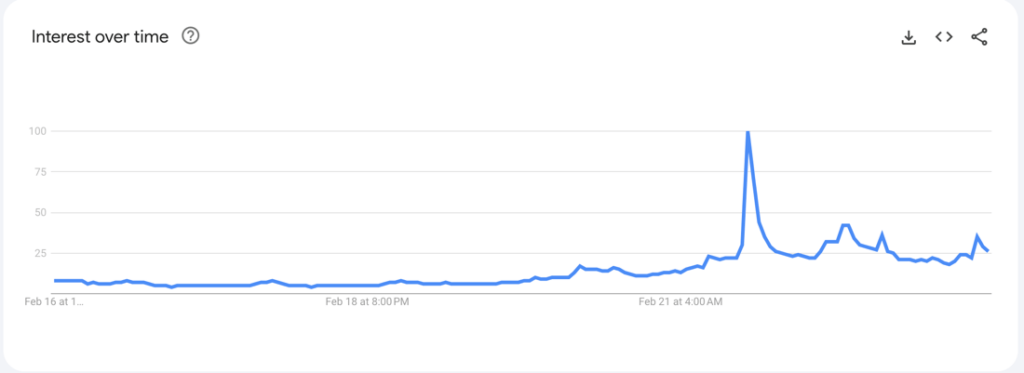

And here’s the irony: many people have no idea what Nvidia does. While Nvidia’s share price was going gangbusters following its most recent earnings report, the phrase “what does Nvidia do” was also soaring on Google Trends.

So far this year, the stock has rocketed 64%. In the past year: 249%. In the last five years: 1,925% (numbers as of Feb. 29). This rally sent the total market cap to roughly $2 trillion, surpassing Amazon, Alphabet, and Meta.

But what’s causing this frenzy? How did a company once focused on a relatively niche market—gamers with strong opinions about their computer builds—have this meteoric rise in value? And why are some saying this stock could potentially go even higher?

Here’s the who, what, where of this seemingly under-the-radar computer chip company that has taken the stock market by storm, with insights from our very own Patrick McCarron, a staff iOS engineer and longtime Nvidia customer and Richard Whaling, Director of Data Engineering.

Who is Nvidia? What do they make? How did we get here?

Nvidia is one of the dominant forces in the computing industry.

Started in 1993, Nvidia is an American semiconductor company and a leading manufacturer of high-end graphics processing units (GPUs). Let’s break down both parts.

Imagine semiconductors as tiny traffic controllers inside electronic devices. They decide when and where the electricity should go, helping devices like your cell phone, digital camera, medical equipment and TVs work properly. Without semiconductors like the one pictured below, none of these devices would be able to function.

Source: Bermix Studio via Unsplash

If you drive a Tesla, play video games on a Nintendo Switch, or use ChatGPT, you’re likely using an Nvidia chip.

But now, the recent excitement and demand has been focused on AI-based chips, which are essentially the next step above central processing units (CPUs). To simplify it, put two workers together (all else being equal) and one worker can only do one task at a time (CPU) while the other can do multiple tasks at once (AI chip). The AI chip can simply outpace and outplay CPUs, and manifests in much more efficient processing. And this development could quickly make CPUs less and less useful, according to the Georgetown University Center for Security and Emerging Technology.

And while AI chips are now hitting mainstream attention, Nvidia has long been building the technology this moment. They have been innovating in deep learning since 2012 when researchers used GPUs to achieve humanlike accuracy in tasks such as recognizing a cat in an image. And the company’s CEO, Jensen Huang, said that he turned “every aspect of our company to advance this new field.”

This company-led focus has manifested in substantial market dominance. 70% of AI chips sales are Nvidia chips, beating competitors like Amazon Web Services and Meta. What’s more is that even Meta is spending billions on Nvidia chips. Analysts estimate Nvidia is charging between $25,000 to $30,000 for each of its H100 cards. However, they can cost over $40,000 a piece on secondary markets like Amazon and eBay. And the recent boom rocketed profits by 580% in the last year.

Demand is outpacing how fast the company can manufacture these chips. Huang stated in the company’s most recent earnings that “demand is surging worldwide across companies, industries and nations.” In a post earnings call, he also stated that it’s not possible for the company to “reasonably” keep up on demand in the short term as they work to ramp up production.

The other large part of Nvidia’s business is their GPU production. GPUs are designed to make the rendering of graphics on a computer screen as fast and crisp as possible. This makes them perfect for gaming and other image-intensive tasks like film editing and graphic design. Also, because these cards can perform mathematical computations at an accelerated rate, it makes them perfect for mining cryptocurrency like bitcoin.

When I asked Richard, our director of data engineering, about Nvidia’s dominance in AI, he explained that it was partly due to the GPU’s proprietary programming interface, CUDA. This means that companies who build AI training algorithms on top of CUDA are “locked in” to Nvidia hardware. Richard compares it to how Microsoft dominated the commercial software industry by controlling the operating system and the platform—Windows—that all other software was built on.

And Patrick, our staff iOS engineer, said he’s been buying GPUs since the 1990’s for gaming and video encoding work. He claims that Nvidia has long set the standard as the crème de la crème of GPUs, and the numbers don’t lie. Patrick says Nvidia gets you the most frames per second, up to 20% more in some cases.

The success of its AI initiatives and products is largely what sent the stock up in past weeks. And as more companies, both tech and non-tech, are focusing on integrating AI, Nvidia’s products could continue to generate further demand.

These numbers were released on the February 22nd earnings call. The company’s revenue is up an astounding 22% from the previous quarter and 265% year-over-year. The following day, Nvidia’s market cap soared $277 billion, a new record.

Where is this projected to go?

It’s safe to say that Nvidia is crushing it. Some analysts say the share price could continue upward to the four-figure mark. Nevertheless, past performance doesn’t guarantee future results, even in an industry as exciting as this one.

But what’s next for this booming tech company? Huang is known to always play forward instead of basking in the moment. And the next hill he wants to climb is sovereign AI.

“Sovereign AI refers to a nation’s capabilities to produce artificial intelligence using its own infrastructure, data, workforce and business networks,” the company said on its blog this week. When Huang spoke at the World Government Summit recently, he noted the importance of countries’ ownership over their own data. He urged leaders to not be “mystified”, but rather embrace the new shifts to deep learning models. And India is already getting ahead of the sovereign AI game with its own Digital Public Infrastructure initiative by partnering with none other than Nvidia.

The company is also leaning heavily into another billion-dollar business unit going forward: enterprise software. This part of Nvidia helps large businesses with their AI software stacks by optimizing and automating information architecture, so companies can focus on their own product. Nvidia’s CEO doesn’t mince words about the power of this: he believes that “every enterprise in the world” will run on this platform.

And our own Patrick doesn’t believe this train will stop anytime soon, especially as AI becomes more useable for the public. He did note that the dangers of AI are yet to be seen, and that is something to be mindful of.

Smaller scale threats that we’ve seen and experienced include job elimination, deepfakes [PDF], lack of data privacy, and even lack of accuracy. What role Nvidia will play in helping society safely and responsibly manage the transition remains to be seen.

The bottom line

AI has been called many things, including the fourth industrial revolution, and that level of comparison has garnered massive attention from business leaders and investors. And where attention goes, money flows. OpenAI CEO Sam Altman wants to raise $7 trillion to increase global chip manufacturing. Apple is “investing significantly” in generative AI as well. But it’s not just tech companies talking about this, as nearly every industry and sector is taking part in this next shift. Though it seems to be happening fast, like all good things in life – it will take time.

While Nvidia is in the spotlight for now, and deservedly so, Richard summarized what consumers and investors should consider: “Big tech firms have enough capital and talent to design their own AI chips as well, so Nvidia’s continued dominance is by no means assured,” he explained.

But for now, Nvidia and its shareholders seem more excited than ever about what the future of technology may hold.

20240304-3423961-10881164

- Categories

- Invest