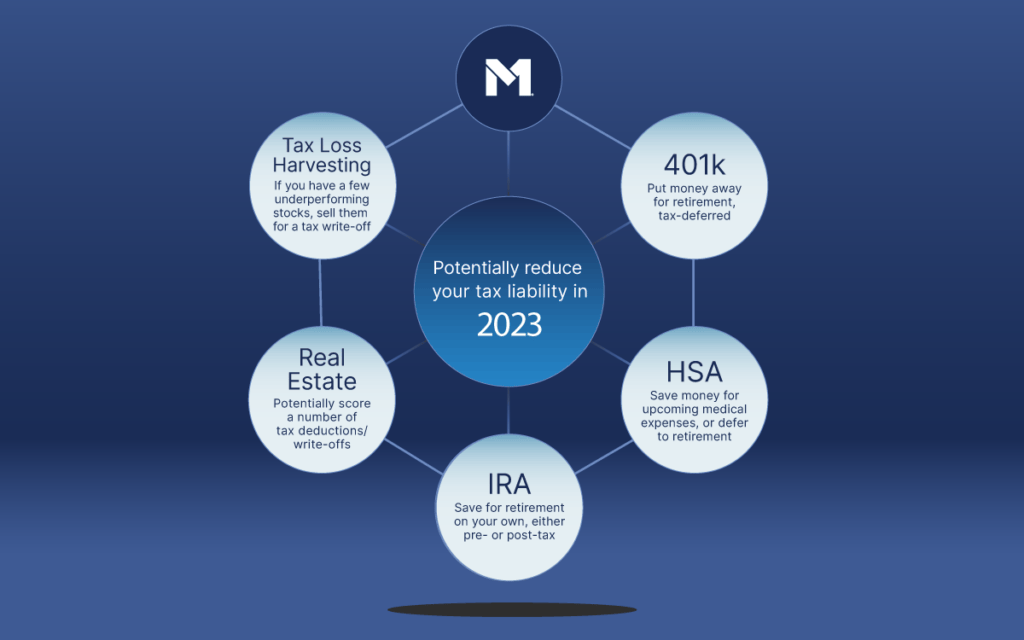

5 ways to invest to potentially reduce your tax liability in 2023

Investing for the future comes with several benefits, but one sometimes overlooked benefit is reducing your tax liability. By investing for the future in tax-advantaged accounts, you can potentially reduce your overall tax bill — while continuing to bury money away for your post-working years or other long-term savings goals.

Keep in mind that taxes can become complex, and it may be beneficial to discuss the best tax strategy for your situation with a licensed tax professional.

Here are five ways to potentially reduce your tax liability through investing in 2023.

Invest in an employer-sponsored retirement plan like a 401(k)

Putting money away directly from your paycheck is a great way to get started on your investing journey — and it can provide valuable tax benefits if you qualify for them.

Some of the most common types of employer-sponsored retirement accounts include the 401(k), 403(b) (retirement plan for public school and non-profit employees), SIMPLE IRA (plan for self-employed or employees of small businesses), or 457(b) (plan for government employees), to name a few. Those working in the federal government, including military service, have access to the TSP to save for retirement as well.

With a 401(k), you have the ability to invest pre-tax dollars for your retirement. By contributing these dollars now, you could reduce your taxable income for the year. However, when you begin taking distributions, you will pay income tax on those funds at that time. This is beneficial because you have more dollars invested and “working” for you to build up your nest egg.

This strategy can be even more beneficial if you plan on having a lower income later in life. This is because you will be taxed based on your income bracket at the time you take the distribution. However, contributing to a 401(k) is limited to those with an annual income under $330,000.

Additionally, the maximum that can be contributed to your 401(k) in 2023 is $66,000 (or $73,000 with catch-up contributions) — including both your individual contribution limit of $22,500 and employer contributions. Note that the IRS updates the maximum contribution each year. Some years the limit increases, and other years it may remain the same.

Tip: If you have multiple 401(k) plans from former employers laying around, consider consolidating them into a traditional IRA to avoid losing track of them.

Invest in a health savings account (HSA)

A health savings account (HSA) is where you can put money away for future medical expenses. However, the great part of the account is that you can invest the funds and get up to a triple-tax advantage. Here’s how it works:

You’re eligible to use an HSA if you have a high-deductible health plan (HDHP) either through your employer or your own private health insurance. To be considered a HDHP, the minimum annual deductible of the policy needs to be at least $1,500 for self-only coverage and $3,000 for family HDHP coverage in 2023.

If your plan meets this qualification, you can deposit $3,850 (self-only) or $7,750 (family coverage) away in your HSA.

Next, you can choose to keep those dollars as cash to pay for medical expenses, or you can invest those dollars within your HSA into securities like stocks, bonds, mutual funds, or ETFs. Some HSA providers have a mandatory amount you must keep liquid, but you can invest your remaining funds without any taxation. Invested funds grow federal tax-free.

Here’s where the magic really happens: Any distributions taken out of the account for qualifying medical expenses are also considered tax-free.

With an HSA, if you wait until you’re 65, you can take the entire balance out for any reason. However, these distributions will be taxed at ordinary federal income tax rates. You can also keep the funds in the HSA and continue to use them to pay for qualified medical expenses tax-free, because, unlike with some retirement accounts, you don’t need to make required minimum distributions (RMDs) at any age.

The HSA is helpful for anyone as nearly everyone will have medical expenses at some point in the future. Even simple expenses like bandages and cold medicine can be considered HSA-eligible expenses, so it’s a great way to plan ahead.

Some investors treat their HSA as another retirement account. If you’re maxing out your employer-sponsored retirement plan and an IRA, you may not need to use the funds for your retirement. But if you continue investing in the account and wait until you’re 65 to use the funds, it can be a valuable supplement to your retirement fund and potentially reduce your tax liability.

Invest in an IRA

An IRA (individual retirement account) is a retirement account that comes in several different forms. Each has its own tax structures, but the two of the most common are the traditional IRA and Roth IRA.

The traditional IRA is an investing account that you can open separately from your employer- sponsored plan. With a traditional IRA, you only pay taxes when you make a withdrawal from the account, but you will be able to deduct the income you deposit in the account. Once you reach 59-and-a-half years old, you can take distributions from the account where you will pay income tax and avoid a 10% early withdrawal penalty. However, the government requires traditional IRA investors to begin taking mandatory distributions at 73 years old.

A Roth IRA allows you to invest money that has already been taxed and there is no tax deduction for these contributions. However, unlike the traditional IRA, once you reach 59-and-a-half years old, you can withdraw the funds without any additional taxation. This means that the full balance is completely yours at retirement — making it a solid choice to have tax-free funds in your post-working years.

However, if you need to access the funds before you turn the age threshold, there are a number of exemptions where you can dive into the funds. As long as your account is more than five years old, you can withdraw funds to pay for education expenses, a first-time home purchase and other qualifying events.

Invest in real estate

Investing in real estate can potentially reduce your tax liability. Whether it’s purchasing a primary residence or purchasing property to rent out, there’s a long list of potential deductions and tax write-offs you can earn through real estate investing.

You may be able to deduct the following costs: mortgage interest, property taxes, property insurance, property management costs, building maintenance/repairs, property depreciation, and more.

This is not an exhaustive list, and each one may fall under a different tax incentive, so be sure to contact a licensed tax professional to create a strategy that works for you.

Bonus: Sell your underperforming stocks to reduce your tax liability

If you regularly buy securities, you may have a few that haven’t performed well. You may potentially be able to use a strategy called tax-loss harvesting to sell those stocks at a loss for a tax write-off.

If you qualify, you can claim a tax deduction for up to $3,000 in capital losses per year. And if your capital losses exceeded $3,000 for that tax year, you may be able to potentially roll over the excess amount into a tax deduction for the following tax year.

Here’s an example:

Let’s say you bought one share of Tesla stock at $150 sometime during the year, and it’s now at $120 per share. You can potentially sell that stock and be able to write off that $30 loss on your taxable income.

However, if you plan to repurchase Tesla shares, it must be 30 days after the sale. If you repurchase within 30 days, this is considered a wash sale — and you won’t be able to write off the loss on your taxes.

Disclosures:

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

All investing involves risk, including the risk of losing the money you invest. Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc.

M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance.

All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. M1 does not provide any financial advice.

20230411-2821194-8995878

- Categories

- Tax