Sell in May and go away? How to think about this pattern in 2020

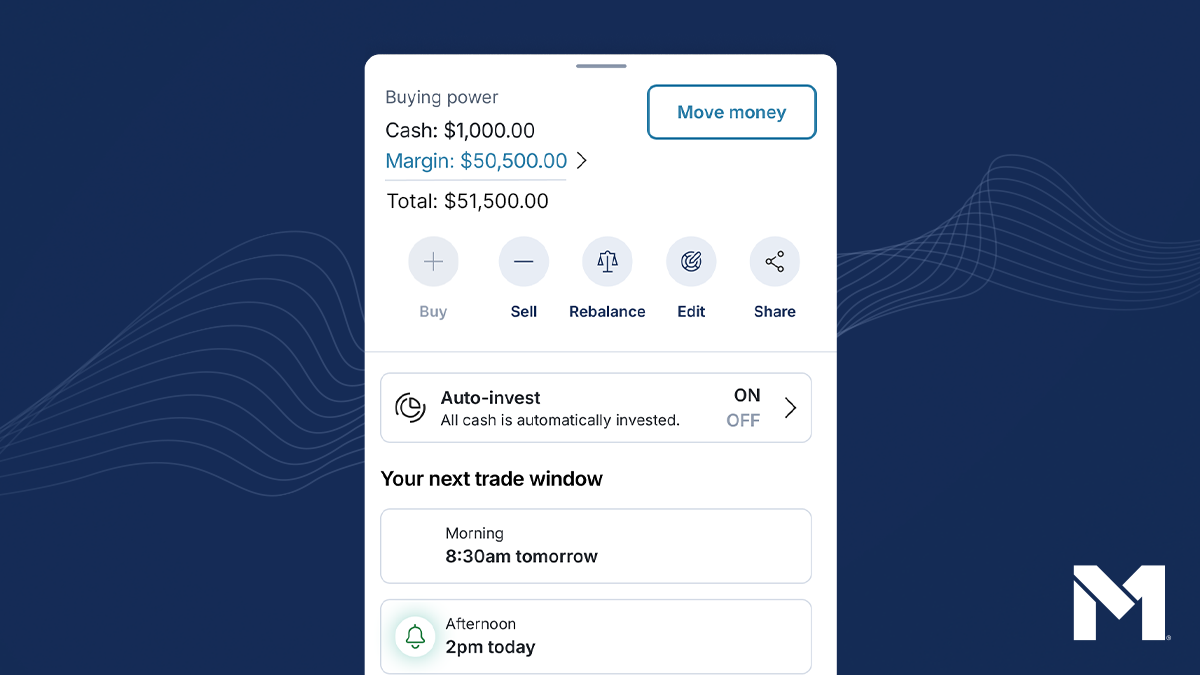

You may have heard the old “sell in May and go away” adage. (In case you need a refresher, this refers to a pattern where due to the assumption that stocks would tend to perform better in the wintery months than in the summery months—specifically the period between May and Halloween—investors would only be in the market during those summery months).

But why does this pattern exist, and does it even apply anymore?

And if people are taking a break, it makes sense the market would too, right? As it turns out, there are some historical patterns that can make this adage ring true.

But just like past performance doesn’t guarantee future performance, the global pandemic and state of the world’s economies can throw patterns like these out the window.

From 1950 to 2013, the Dow Jones Industrial Average posted lower returns between May and October when compared to the months November through April. Specifically, over a long run of historical data, returns tend to be 4-5% lower during the May to October period.

Data like that might be appealing, especially now. Investors are on edge, and many of us are looking for strategies that may help us weather the storm and come out okay on the other side. But before you go off making changes to your investing strategy to try to capitalize on this pattern, you may want to take some things into considerations.

- This is a pattern, not a rule. Just because it’s happened in the past, doesn’t mean it always has, or that it will continue to happen in the future. For example, following the market crash in 2008, this pattern reversed. The Dow fell 12.4% from November 2008 through April 2009 and gained 18.9% in the following six months.

- Lower returns don’t necessarily mean negative returns. Even though you may not get the highest returns in the summer, your returns may still be positive. If you sell in May expecting to avoid losses, you could be giving up potential gains.

- Timing the market is not typically a strategy that works for most investors. We believe in the tried and true strategy of making habitual investments over a long period of time. You should make it a point to reassess your investing strategy periodically, making note of your objectives and tolerance for risk, but research shows that individual investors who trade actively and speculatively without a diversified portfolio lose money over time.

- Moving in and out of your stock positions could have tax consequences. The capital gains taxes you may pay when you sell positions in your taxable accounts could negatively impact your results. This may not necessarily derail your strategy but is certainly worth considering.

- Does any of this even apply anymore? We’re currently in uncharted waters, so what will happen to the stock market in the next six months is anyone’s guess. With the current market volatility, a couple of days of market moves may result in a 4-5% return differential. So like we’ve said before (and we’ll say again), choppy markets happen, and it’s important to be prepared. Take this opportunity to reassess your strategy, and make informed, level-headed decisions.

- Categories

- Invest