Tech Q1 earnings, the Twitter takeover, and a beverage challenge

Today’s weekly roundup includes earnings calls from tech giants, with a splash of beverage reports.

You’ll also see:

- Musk’s Twitter takeover

- GM’s big investment in electric vehicles

- The NBA all-star creating cannabis millionaires

News

Twitter’s big shakeup

Unless you took a social media detox this week, you likely heard the world’s richest person bought Twitter. Twitter (TWTR) accepted Elon Musk’s $44 billion offer after a change of heart from executives and board members. If the deal goes through, it will take the company private and offer investors $54.20 per share.

Although the question of ownership is resolved, investors and users are still uncertain about Twitter’s future. Will there be paywalls? A subscription service? A crackdown on bots? What will Musk tweet about? Uncertainty remains as the social media giant enters its Musk era.

Coke vs. Pepsi

Investors got their first taste of CPG earnings for the year with reports from Pepsi (PEP) and Coca Cola (COKE). Both beverage staples exceeded Wall Street estimates for first-quarter earnings and revenue. In the spirit of the famous Pepsi Challenge, can you guess which earnings are which? (See the answer below).

Company A

- Earnings per share: $1.29 adjusted vs. $1.23 expected

- Revenue: $16.2 billion vs. $15.56 billion expected

Company B

- Earnings per share: $0.64 adjusted vs. $0.58 expected

- Revenue: $10.5 billion vs. $9.83 billion expected

Tech earnings

Earnings season is roaring on. As you’re reading this, investors are taking a hard look at numbers released by tech giants Meta (FB), Apple (AAPL), and Amazon (AMZN), who all released earnings on Thursday.

Alphabet (GOOGL) and Microsoft (MSFT) kicked off the week by announcing earnings on Tuesday. Microsoft blew past projections and saw revenue increase by 18% YoY, which may have something to do with the $68.7 billion acquisition of Activision Blizzard. Alphabet might be turning to Google for some answers after missing expected earnings by over a dollar per share.

Quick hits

- The former NBA star building a $100 million team of cannabis entrepreneurs

- Union vote begins at second NY Amazon warehouse

- GM amps up with electric Corvettes and boats

- Why Musk is buying Twitter, and how he might change it

Pepsi vs Coca-Cola Challenge

If you guessed PepsiCo is Company A, you’re correct! Its expansive line of goods (including Lay’s, Cheetos, and Quaker) helps boost its bottom line, even though Coca-Cola wins at brand recognition.

M1verse

TRANSFERS ARE EASIER THAN EVER

We’ve upgraded M1 with our new Transfer Wizard. With just a few steps, you can request and execute the full account transfer process from right inside our app for a convenient, seamless experience.

Transfer my account →

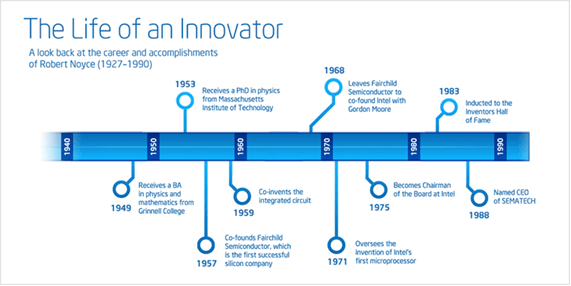

This week in finance history

April 25, 1961

Robert Noyce, nicknamed the “Mayor of Silicon Valley,” received a patent for an integrated circuit. Noyce later co-founded Intel Corporation (INTC) with Gordon Moore and forever changed the microprocessor (and tech) industry.

“M1” refers to M1 Holdings Inc., and its affiliates. M1 Holdings is a technology company offering a range of financial products and services through its wholly-owned, separate but affiliated operating subsidiaries, M1 Finance LLC and M1 Spend LLC.

M1 newsletters reflect the opinions of only the authors who are associated persons of M1 (Member FINRA / SIPC ) and do not reflect the views of M1 Holdings Inc. or any of its subsidiaries or affiliates. They are for informational purposes only and are not a recommendation of an investment strategy or to buy or sell any security in any account. They are also not research reports and are not intended to serve as the basis for any investment decision. Prior to making any investment decision, you are encouraged to consult your personal investment, legal, and tax advisors. Any third-party information provided therein does not reflect the views of M1 Holdings Inc., or any of their subsidiaries or affiliates.

All investments involve risk including the loss of principal and past performance does not guarantee future results. Brokerage products and services offered by M1 Finance LLC, Member FINRA / SIPC.

© Copyright 2022 M1 Holdings Inc.

- Categories

- Plan