Who sets interest rates? Understanding the Federal Funds Rate

Interest rates are a key indicator of an economy’s health and performance. These rates determine the amount a lender charges a borrower for capital to open businesses, purchase a home or vehicle, or access cash. Whether rates go up or down depends on the Federal Reserve, the central bank who sets interest rates.

To help you understand why interest rates change, we’ll cover how rates are set, how the economy affects the rise or fall, and how an interest rate hike or cut impacts your M1 accounts.

The Federal Reserve sets interest rates

The Federal Reserve, specifically the Federal Open Market Committee (FOMC), adjusts the Federal Funds Rate—also called the target interest rate. The change is reflected in basis points, a financial term for 1/100th of a percent. So, if the Fed raises rates by 75 basis points, they increase rates by 0.75%.

Banks use the target rates when borrowing and lending their reserves overnight in order to meet liquidity requirements before each business day. This process lets banks balance each other out by lending when they have extra cash or borrowing when they need it.

When the Federal Reserve raises or lowers the cost of lending between banks, it affects everyone. The target rate trickles down to every consumer and business in the economy. Banks and brokerages adjust their interest rates based on the Fed’s target rate, passing the change along to clients.

It’s important to note that the Federal Reserve gives a range for the Federal Funds Rate, not an exact number. The banks typically settle near the middle of this range.

Why interest rates go up

When interest rates rise, so does the cost of debt. This discourages borrowing, slows consumer demand, and drains liquidity from the market.

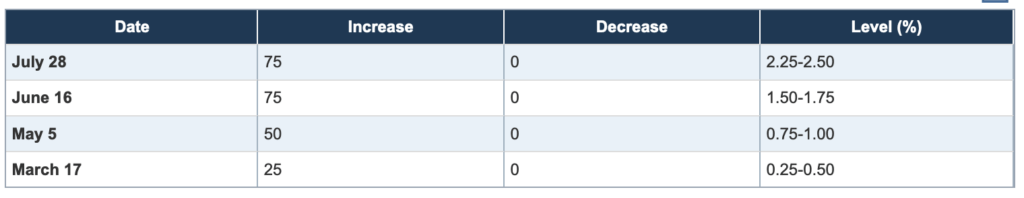

Rate hikes are often viewed in a negative light, but they can be a useful tactic to curb inflation. In 2022, the Federal Reserve raised interest rates multiple times.

FOMC’s target federal funds rate or range, change (basis points) and level

Rising rates kicked off a period of quantitative tightening as the Fed began to shrink its balance sheet. By increasing the Federal Funds Rate, the Fed hoped to curb inflation that skyrocketed during the COVID-19 pandemic due to low interest rates and easy monetary policy.

Why interest rates go down

The economy is often stimulated during periods of low interest rates. Businesses and people are more likely to borrow money, spend, and invest when rates are low. This quantitative easing stimulates the economy and injects capital and liquidity, leading to economic expansion.

Since 2009, the U.S. economy has enjoyed historically low interest rates and a bolstered economy. In 2020, the Federal Reserve lowered rates to near zero, pulling the economy out of a short-lived pandemic-induced recession and creating a nearly unprecedented bull market.

The downside? Low interest rates can create demand for goods and services that leads to higher production costs and prices, which can cause inflation.

How interest rates impact you

When interest rates change on the broader market, they typically change at every financial business and bank account. Banks and lenders calculate interest rates based on the Federal Funds Rate, as well as the health of their business, the market, or economic events such as the COVID-19 pandemic.

That’s why you may see changes to mortgage interest rates, annual percentage yield (APY), adjustable-rate loans, and more. Here’s how interest rates impact different financial products:

Loan interest rates

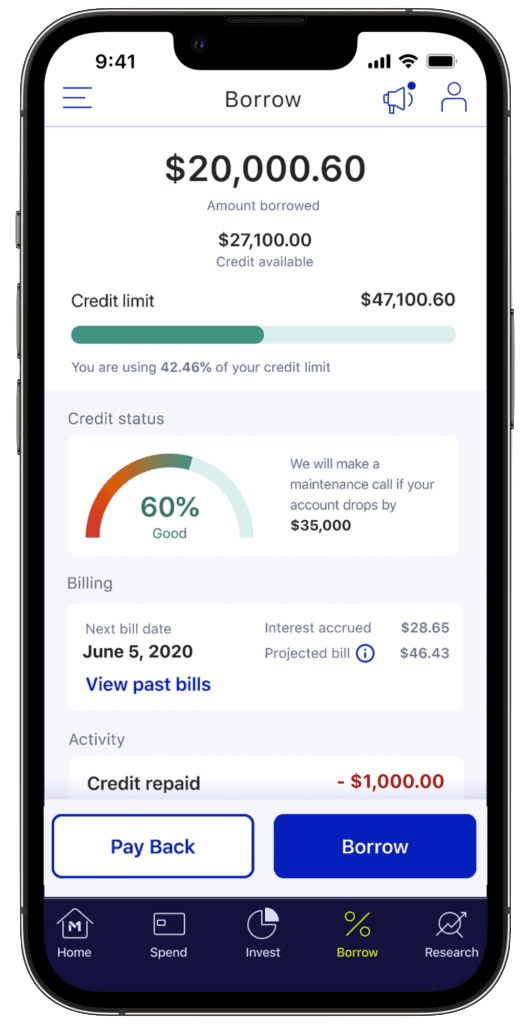

The cost of borrowing money can increase or decrease during interest rate changes. Higher interest rates and yields are good for saving money, but not so great for borrowing.

Rate changes don’t impact any fixed-rate products, such as mortgage, car loans, or student debt. They do, however, affect new long-term fixed-rate loans.

When interest rates hovered near zero during the pandemic, the housing market experience a boom. If you bought a house during the pandemic, you won’t see a change in your monthly payment if you have a fixed-rate mortgage. But if you buy a house now, you’ll have to sign a mortgage with the current, higher interest rate.

Check out current Borrow rates >>

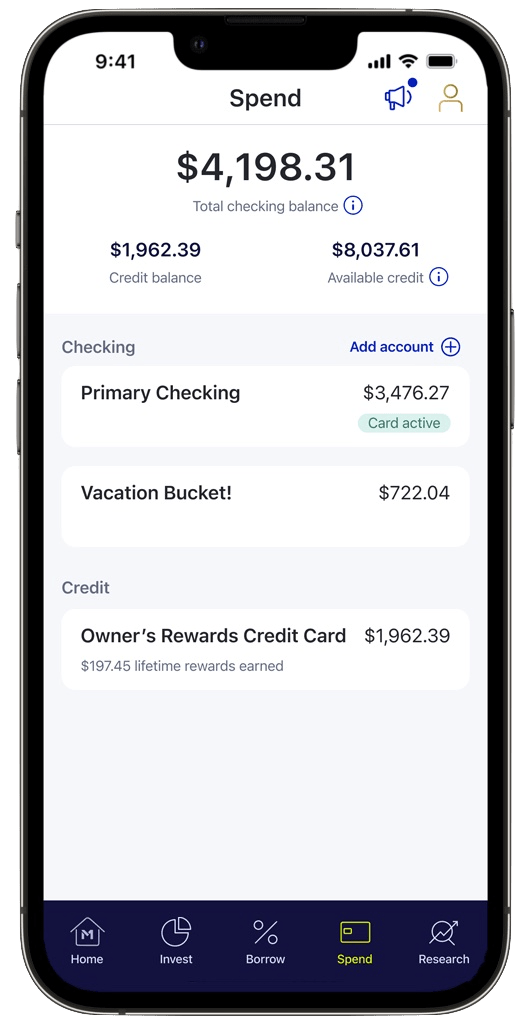

Credit cards and APY rates

Short-term loans, like credit card interest rates, can change alongside the Federal Funds Rate. But these rates are also impacted by individual factors, like your credit score and history. Someone with a high credit score may receive a lower interest rate, while a borrower with a low credit score may receive a higher interest rate.

A Federal Funds Rate increase also impacts the annual percentage yield (APY) in your checking accounts. Banks and lenders calculate this variable rate based on factors like the target interest rate, the health of their business ecosystem, or economic events like the COVID-19 pandemic. So when you see the APY for checking accounts rise or fall, you’ll know it’s a reflection of the Federal Reserve’s economic outlook.

See our current Checking APY rate >>

The Federal Reserve maintains a target interest rate that financial institutions use to set interest rates for mortgages, margin loans, and checking and savings accounts. Ultimately, the Federal Funds Rate, coupled with the supply and demand for loans and credit in the market, determines the interest rate over time.

- Categories

- Earn