M1 RETIREMENT ACCOUNTS

Live for today. Invest for tomorrow.

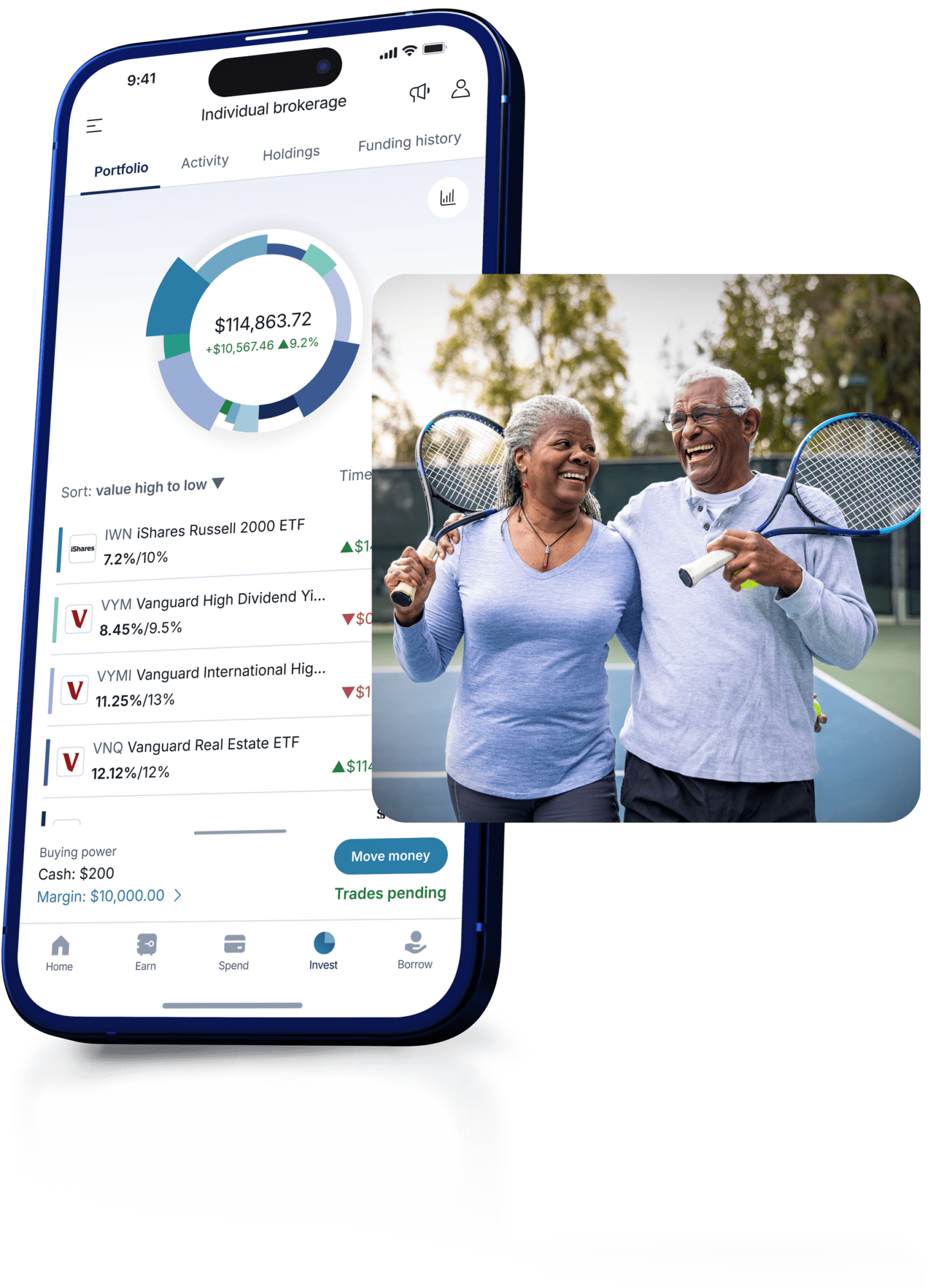

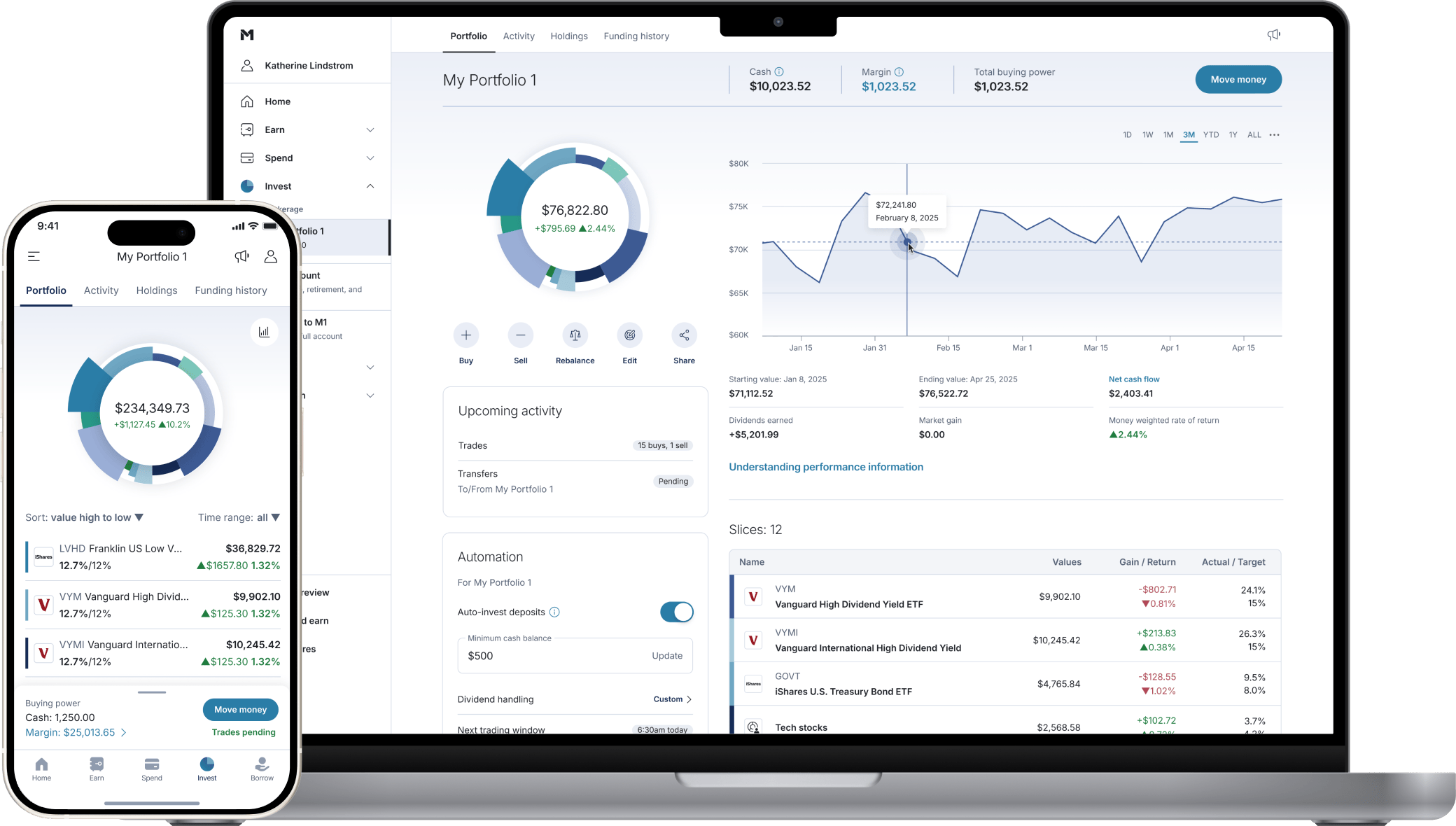

Build wealth for retirement with an M1 IRA. Manage your own investments, automate contributions, and take control of your future.

Build your nest egg, your way

Move your retirement account to M1

Manage your accounts in one place.

Have a 401(k) from an old job? Or maybe a few? Moving your employer-sponsored retirement plan into an M1 IRA lets you keep the tax advantages of your old account.

If you want to consolidate and manage your portfolio in M1, we make it easy to track your progress. It only takes a few steps to transfer an IRA from another brokerage to M1.

A rollover is not your only option. Talk to a financial expert before making changes to your retirement savings.

Which IRA is right for you?

An individual retirement account (IRA) is an investment account that can help you save money for retirement with tax-free growth or on a tax-deferred basis. M1 offers 3 types of IRAs.

Traditional IRA

Contributions to a Traditional IRA are usually tax-deductible. If you contribute pre-tax, you’ll need to pay taxes on your contributions and earnings later, when you withdraw from this account.

Roth IRA

Contributions to a Roth IRA are not tax-deductible. But when it’s time to withdraw, you’ll be able to put every qualified dollar to use, tax-free.

SEP IRA

SEP (Simplified Employee Pension) IRAs are available to those who are self-employed, own a business, employ others, or earn freelance income. You may need to pay taxes on funds you withdraw from this account.

Use time to your advantage

Investing for retirement sooner, rather than later, can help you compound your earnings.

Hypothetical example for illustrative purpose only. Calculations assuming the following constraints: (a) an initial investment of $1000, (b) an annual rate of return of 10%, (c) no taxes, fees, inflation, or withdrawals. The assumed rate of return is not guaranteed as investing involves risk of loss. Source: Investopedia.com

Your retirement account questions, answered

Join the next wave of long-term wealth building

SAIF-01222025-tbyjlvse