Employee stock options explained

Employee stock options are a form of compensation that some companies offer to their employees. They give employees the right to purchase company shares at a predetermined price, known as the strike price. This gives employees a stake in the company’s success.

In employee stock options, there are three times the stock is valued: the strike price, the fair market value, and the sale price.

Stock options glossary

Stock options have several important terms to understand.

Options Grant

An options grant is the specific amount of stock options given to an employee. This allows them to exercise these options at a predetermined price called the strike price, within a given timeframe, after the options contained within the grant have vested.

Strike Price

The strike price, also known as the exercise price, is the pre-agreed price at which the stock can be bought or sold when the option is exercised.

Vesting Schedule

The vesting schedule is a timeline that outlines when employees are granted their options and when they can exercise them. Some companies vest bi-weekly, monthly, quarterly, or yearly. Vesting encourages retention and performance. Options may be vested for employees who have been with the company for a set period or as a part of a raise or compensation package.

Fair Market Value

The fair market value (FMV) is the estimated value of a stock if it was trading on an open market. This is used in employee stock options to estimate what non-public stocks could be trading at.

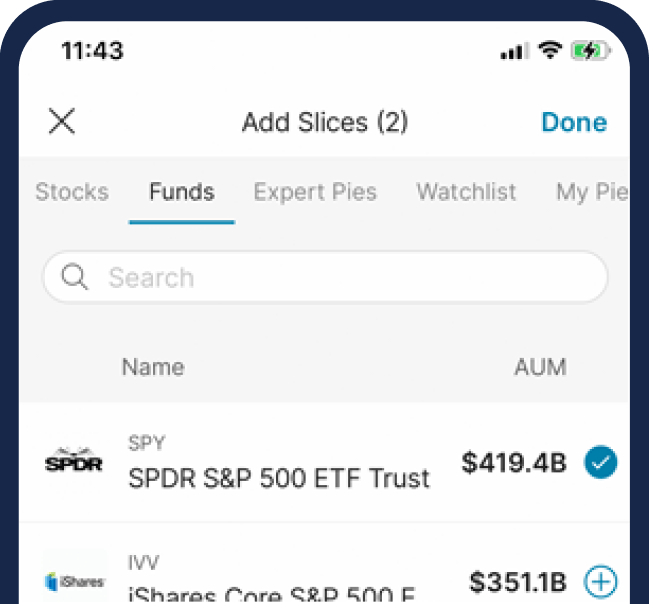

While you can’t buy employee stock options on M1, you can still invest in a variety of equities. See how you can put your money to work.

Types of employee stock options and their tax considerations

The two types of employee stock options are non-qualified stock options (NSOs) and incentive stock options (ISOs). They are for different types of employees and are taxed differently.

Non-qualified Stock Options (NSOs)

NSOs are typically for those who work with the company such as board members. There are a few instances where you may pay taxes.

If the fair market value exceeds your strike price, you may pay taxes at your ordinary income rate.

When you sell the stock and have a capital gain, then short-term and long-term capital gains taxes may apply. If you sell the stock within a year, short-term capital gains taxes apply at your ordinary income rate. If you sell the stock after a year, long-term capital gains taxes apply, although the rates could potentially be lower than the standard income tax rates.

Incentive Stock Options (ISOs)

These are typically employee stock options for those who work for the company. Along with having a stake in the company, these are often granted as a part of an employee’s compensation package, after a promotion, or for retention at the company. However, every company is different.

There are a few instances where you may or may not be taxed.

You aren’t taxed on ISOs when you exercise, which is one way they’re advantageous over NSOs.

Once you own the exercised shares, you won’t be able to liquidate them unless the company goes public, or its shares are purchased in a buyout.

When you sell the underlying stock, your earnings could be taxed as a capital gain. If you sell the stock within a year, short-term capital gains taxes apply at your ordinary income rate. If you sell the stock after a year, long-term capital gains taxes could apply, but typically at more favorable rates than the standard income tax brackets.

You can be taxed if you hold exercised shares and the fair market value increases so much that your net worth exceeds the alternative minimum tax exemption. AMT is a separate tax for high-income earners that accounts for total net worth.

Granting employee stock options

A company will grant its employees a certain number of stock options as outlined in a stock option agreement. Some companies will sometimes grant more stock options as a form of promotion or bonus. A grant doesn’t necessarily mean you have received stock options as they may still need to vest over time.

Vesting employee stock options

The vesting schedule is the length of time before options are awarded. Typically, an employee must work for a company for a certain period before their options fully vest. Only vested options can be exercised.

Exercising employee stock options

Once an employee’s options are vested, they have the choice to exercise. This involves purchasing the company’s shares at the predetermined strike price. An employee can exercise at any time during their employment. They typically have a period of time after leaving the company to exercise their options; otherwise, the options may expire. Check with your human resources or finance department for specific rules on your options.

Selling your shares

Employees cannot sell shares until the company is public. Some people get stuck with shares they can’t sell because the company never goes public or gets bought out at a low valuation. Before a company goes public, the fair market value of the shares is really just an estimate. It is not until the company goes public that you can know the market value of the shares.

If the company is acquired, it will typically agree to sell its outstanding shares to the acquiring company at an agreed-upon price. In that case, you could potentially receive a payment for the value of your shares at whatever the agreement states, which may or may not exceed the strike price.

You can’t sell your shares until the company goes public. Even after the company goes public, current employees could face a lockup period, often lasting three to six months or even more, during which they’re legally prohibited from selling their shares.

In the event that the company doesn’t go public, you may find yourself holding shares that are essentially illiquid and without value.

The M1 line

M1 does not offer private stock options on our platform. For questions on your own employee stock options plan, reach out to your company.

Employee stock options can be expensive when exercised. Start saving on M1 so you can afford to exercise your shares when the timing is right. You can also reinvest any of your potential earnings on the M1 platform.

20231019-3178899-10080586

DISCLOSURES:

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.