What is a line of credit and how does it work?

A line of credit is a borrowing arrangement between you and a financial institution, such as a bank or credit union. To get a line of credit, you must apply with an institution that is offering it, and you will likely go through an underwriting process where they will check your credit score and other factors to determine your eligibility.

The institution will qualify you for a specific amount of funding that you can choose to draw from, and then you will pay your outstanding balance back over a specified period of time.

This type of lending can be helpful for someone who needs additional funding but is unsure of the exact amount they will need over a duration of time.

Here’s what you need to know, and how you could potentially use it in your financial life.

Personal line of credit: Here’s how it works

A line of credit is essentially a crossover between a credit card and a personal loan. It gives you the flexibility of use like a credit card with the immediately upfront cash sum of a personal loan. Additionally, the APR can potentially be much lower than a credit card, which could reach nearly 30% APR.

Once you’re approved, you will have the ability to pull cash out of the line of credit to spend as you please for a specific amount of time. This is known as the draw period, which can vary widely in duration. During this time, you’ll need to make monthly payments against the balance, but you can choose to make interest- only payments — keeping your total out- of- pocket costs on the lower side during the beginning stages of your line of credit. You can also opt to pay down your principal as well. And you will only make payments on the balance you have used, not the entire line of credit balance. So if you have a $100,000 line of credit and only utilize $25,000 of it, you will only pay interest on the $25,000.

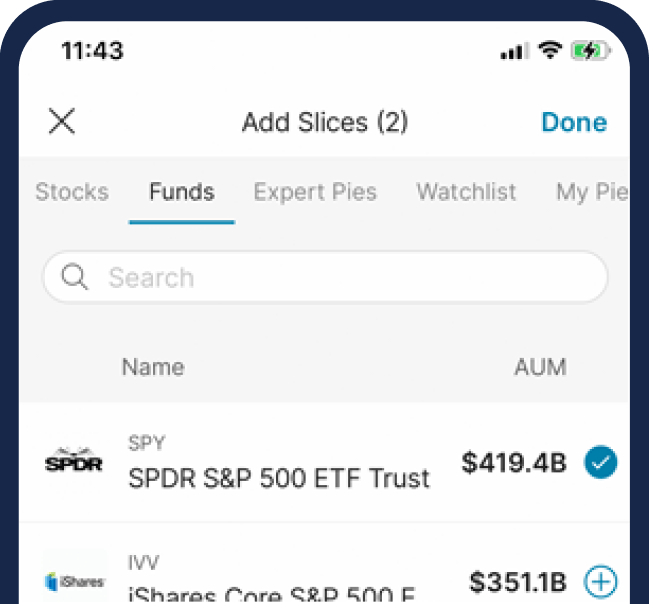

Beginning to invest can be an intimidating step. But M1 makes it easy to navigate your different options and put your money to work.

Once your draw period is over, you won’t be able to draw any more money from the line of credit and you will be moved into your repayment period. At this point, you will begin making monthly payments on both principal and interest until your entire line of credit is paid off.

Home equity line of credit (HELOC): Here’s how it works

There is another line of credit product available for homeowners called a HELOC. This allows you to get funding based on how much equity you have in your home.

Typically, a HELOC comes with a variable interest rate. Specifically, your APR can go up or down as the market adjusts, meaning that your borrowing costs could potentially go up or down throughout the life of the loan. Additionally, some HELOCs require borrowers to pay principal and interest — leading to a potential balloon payment which is one large payment all at once during the repayment period.

However, it’s important to remember that in a HELOC, your home serves as the collateral. So in the worst-case scenario where you’re unable to pay the lender back, the lender could potentially foreclose on your home. Also, if you decide to sell your home, you will owe the entire balance of the HELOC immediately. The advantage of a HELOC over a line of credit is that interest rates are typically lower for HELOCs as they are considered secured loans, while most personal lines of credit aren’t.

What to use a line of credit for

A line of credit is a flexible way to borrow as you can begin making decisions with cash in your pocket. Many people will use a line of credit to remodel their home, purchase an investment property, or even consolidate debt from several other places.

However, there may be alternative products, such as a 0% APR credit card that could better suit your needs. But a line of credit product could be a better solution in a case where you need cash versus making a purchase with a credit card, so be sure to research multiple options to find the best solution for you.

The bottom line

In 2021, I got a personal line of credit to consolidate the remainder of my student loans and a car loan, along with having the flexibility for upcoming home repairs after I purchased my home.

A line of credit gives you access to a pool of money over time, without the pressure of immediately having to begin paying back the principal. This can be a better structure than a credit card or personal loan that typically require you to begin paying back on the principal. However, just like any debt, it should be used carefully and with a plan to avoid any negative financial fallout.

20230825-3054746-9769504