Managing and Monitoring a Margin Account

Managing a margin account can be a powerful tool for investors seeking to leverage their investments for potentially higher returns. However, it is essential to understand how to effectively manage and monitor a margin account to avoid potential pitfalls, such as margin calls, which can lead to unexpected financial stress. This expanded article covers crucial topics related to the management of margin accounts, offering a guide that every investor should know to maximize the benefits and minimize the risks associated with margin trading.

Understanding margin account balances

The first step in effectively managing a margin account is understanding how to read and interpret margin account statements. These statements provide critical information about your account status, including available buying power, margin balances, and equity. Knowing how these aspects are calculated will empower you to make informed investment decisions.

- Available buying power: This represents the total amount of funds you can use to purchase securities without exceeding your margin limits. It is calculated based on the current value of your portfolio and your margin requirements.

- Margin balances: This section reflects the amount you have borrowed from your brokerage to buy securities. It is crucial to keep track of this balance to ensure you can repay it when required.

- Equity: This refers to your net worth in the margin account and is calculated as the total value of securities minus the amount borrowed. Maintaining a healthy equity level is essential to help prevent margin calls and sustain your investment strategy.

Familiarizing yourself with these elements helps you understand your financial position within your margin account, enabling strategic decision-making.

Daily margin account monitoring

Daily monitoring of your margin account is vital to maintaining control and avoiding margin calls. A margin call occurs when your equity falls below the required maintenance margin level, prompting your broker to demand additional funds or securities to cover the shortfall. This can lead to forced selling of your securities at an inopportune time, resulting in potential losses.

To help prevent margin calls and maintain financial stability, consider the following practices:

- Regularly check your margin balances: Ensure that your margin balances remain above the required maintenance level by reviewing your account statements and any real-time updates provided by your brokerage.

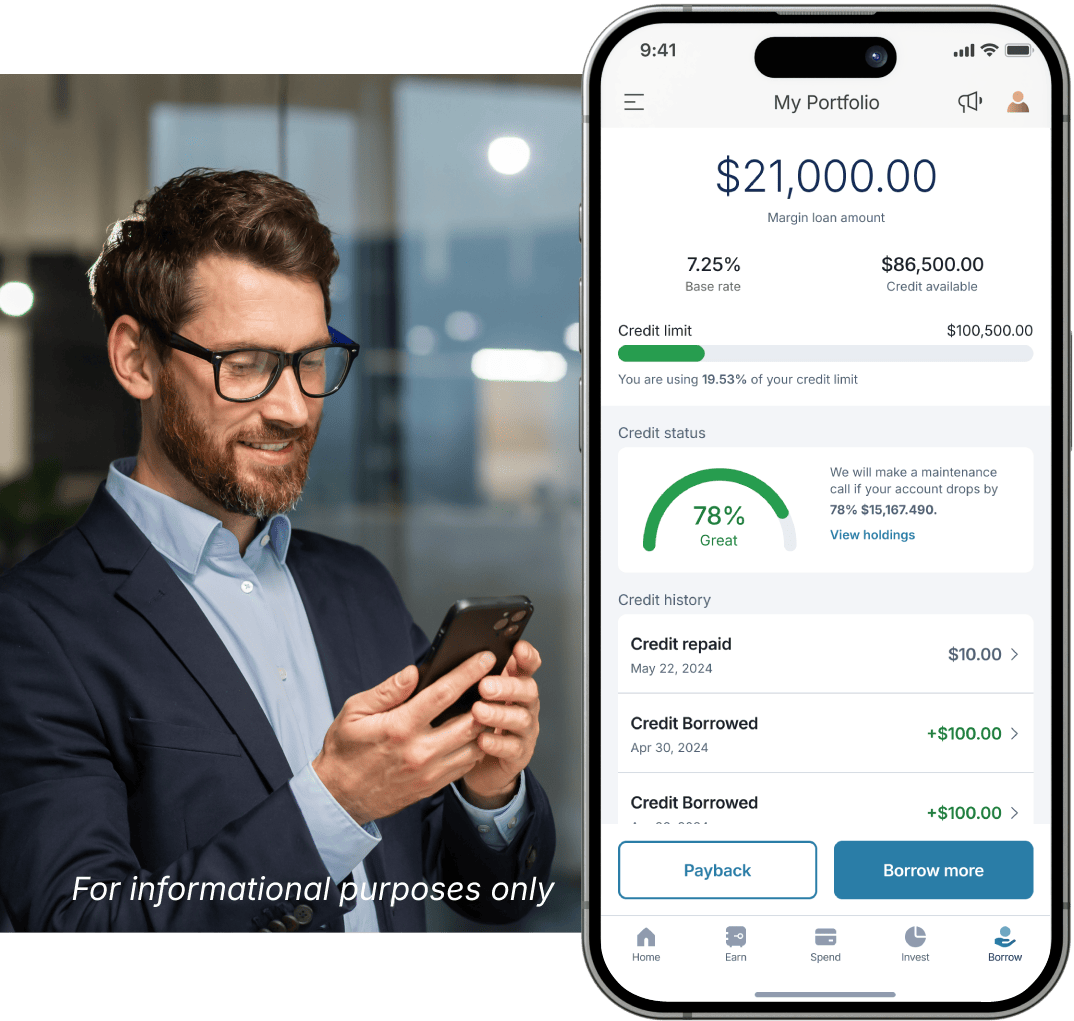

- Utilize tools and resources: Take advantage of available tools and resources for real-time monitoring of your account to keep track of your financial standing. Many brokerages offer mobile apps and online platforms that allow you to set alerts for when your account approaches maintenance margin levels.

Consistent monitoring allows you to act swiftly should your account approach the margin threshold, minimizing the risk of margin calls and maintaining your investment strategy’s integrity.

Interest calculation and costs

Borrowing funds through a margin account incurs interest, which can significantly impact your overall investment returns. Understanding how this interest is calculated and how it affects your portfolio is crucial for effective margin account management.

- Interest calculation: Interest on borrowed funds is typically calculated daily based on the outstanding balance and is compounded monthly. This ongoing interest accrual can increase the overall cost of your investment, making it vital to understand the implications for your strategy.

- Impact on returns: To gauge the true profitability of your investments, consider these interest costs when planning your strategy. High interest rates can erode potential gains, so it’s essential to factor them into your profit calculations and adjust your plans accordingly.

Being aware of interest implications ensures that you manage your investments more efficiently and avoid unexpected costs that could negatively impact your returns.

Avoiding margin calls

Avoiding margin calls is essential for maintaining financial stability in a margin account. Here are some strategies to help prevent margin calls and safeguard your investments:

- Maintain a buffer: Keep a buffer of cash or easily liquidated securities within your portfolio to quickly meet margin requirements if needed. This financial cushion can help you respond promptly in the event of a margin call, preventing forced sales of your investments.

- Regular portfolio reviews: Conduct regular reviews and stress testing of your portfolio to anticipate potential margin calls. By assessing your risk tolerance and adjusting your positions accordingly, you can reduce the likelihood of encountering a margin call.

- Diversify your investments: Diversifying your investment portfolio can help spread risk and stabilize your equity levels, making it less likely that a sudden market downturn will trigger a margin call.

By proactively managing your account and incorporating these strategies, you can stay ahead of margin calls and maintain a stable investment environment.

Conclusion

Successfully managing a margin account involves a comprehensive understanding of margin balances, diligent daily monitoring, careful consideration of interest costs, and strategic planning to avoid margin calls. By following these guidelines and educating yourself about the intricacies of margin trading, investors can leverage their margin accounts, potentially enhancing their investments while managing associated risks. Whether you are new to margin trading or an experienced investor, continual learning and thoughtful management are key to achieving your financial goals. While these risks can be managed, margin trading can never be completely risk-free. Please assess your financial circumstances and risk tolerance before trading on margin.

This content was generated using artificial intelligence and is intended for informational and educational purposes only. While reasonable efforts are made to ensure accuracy, AI-generated outputs may omit key context and should not be construed as financial, investment, legal, or tax advice. Users should independently verify all information and consult a qualified professional before making any financial decisions.

53414946-07e8-781b-6970-34346a727069