Types of investing strategies: Which are right for you?

Investing is one of the most effective ways to build your wealth and it all starts with strategy. Your investment strategy is a set of principles unique to you and your goals.

Dividend investing offers the potential for consistent income streams, while dollar-cost averaging can help reduce the impact of market fluctuations on investment returns. Value investing emphasizes buying undervalued stocks, while growth investing focuses on stocks with high growth potential. Quality investing prioritizes investing in companies with strong financials and competitive advantages, while index investing offers broad market exposure and diversification with relatively low fees and minimal effort.

These strategies are flexible, can be used together, and can be changed at any time.

In this article, we’ll explore the six most popular investment strategies so you can decide which may be right for you:

- Dividend investing

- Dollar-cost averaging

- Value investing

- Growth investing

- Quality investing

- Index investing

M1’s features enhance each of these investing strategies through automatic investing, dynamic rebalancing, and fractional shares.

Dividend investing

Dividend investing is a strategy that involves investing in stocks that pay regular dividends to their shareholders. Dividends are a portion of a company’s earnings that are distributed to its shareholders as a part of owning the stock. Companies that pay dividends are typically well-established and financially stable, so dividend-paying stocks have been historically less volatile than non-dividend stocks. That makes them a popular choice among investors who prioritize stability and income generation.

Investors can choose to reinvest the dividends they receive back into the same stock, which is known as a dividend reinvestment plan (DRIP). This can help to compound the returns over time and potentially increase the total return on the investment.

M1 has its own version of DRIP called Auto-Invest. If you earn dividends, they can be paid out into your cash balance. You can set a minimum cash balance and once it reaches that amount, the cash balance is automatically invested into your pies at the percentages you specify. This is one way your entire portfolio could benefit from your dividends.

Advantages

- Stable income: Dividend investing can provide a stable stream of income for investors.

- Potentially lower volatility: Dividend-paying stocks have been historically less volatile than non-dividend-paying stocks, which can help to reduce overall portfolio risk.

- Long-term mindset: Companies that pay consistent dividends are often well-established and have a track record of long-term growth potential.

Disadvantages

- Limited growth potential: Companies that pay dividends could have reinvested that cash back into the business, which can limit their growth potential compared to non-dividend-paying companies.

- Dependence on company performance: Dividend payments are not guaranteed and are dependent on the company’s financial performance. If the company experiences a downturn, it may be forced to cut or suspend its dividend payments.

- Tax implications: Dividend payments may be subject to taxes, which can reduce the overall return on the investment.

Dollar-cost averaging

Dollar-cost averaging, or DCA, is a strategy that involves spreading out your stock or purchases equally over time, regardless of market conditions, price, and volatility.

The idea is that this strategy allows you to buy more shares when the stock price drops and fewer shares when the stock price rises. Over time, this strategy can potentially lower your average cost, build your position in investments you believe in, and leverage the power of compounding to grow your money.

Let’s run through an example.

Say you wanted to invest $10,000 into BLBRY. You’ve done your research. BLBRY fits into your plan and long-term goals, but you’re not sure which way the price will go in the short term.

Instead of guessing, you decide to invest $250 into BLBRY every Tuesday, until you hit your goal of $10,000. You do this no matter the price or market conditions on any given Tuesday, because you know you’re focused on the long run.

But say BLBRY’s part of your M1 portfolio, and you don’t really have a cap in mind when it comes to that position. You can invest that $250 in your Pie on the same schedule, with the same guidelines. That would be considered perpetual dollar-cost averaging.

Advantages

- Reduces the impact of market volatility: By investing a fixed amount of money at regular intervals, dollar-cost averaging can help to smooth out the impact of market volatility on an investor’s portfolio.

- Disciplined approach to investing: DCA encourages a disciplined approach to investing and can help to minimize emotional biases that may lead to poor investment decisions.

- Potential for higher returns: Over the long term, dollar-cost averaging can potentially generate higher returns than trying to time the market.

Disadvantages

- Potential opportunity costs: Dollar-cost averaging may result in missed opportunities if the market experiences a significant upswing and the investor is not fully invested.

- No guarantee of profit: Like any investment strategy, dollar-cost averaging does not guarantee a profit and can result in losses even in the long-term.

Value investing

Value investing is an investment strategy that involves identifying stocks that are undervalued by the market and investing in them with the expectation that their price will eventually rise to reflect their true value. Value investors seek out companies that have solid fundamentals but are currently trading at a discount to their intrinsic value, as determined by measures such as price-to-earnings ratios, price-to-book ratios, and many others.

This approach requires conducting thorough fundamental analysis of a company’s financial statements, management team, competitive landscape, and industry trends to determine its intrinsic value.

Once a value investor has identified an undervalued stock, they will typically hold onto it, waiting for the market to recognize the stock’s true value and drive up its price.

Advantages

- Potential for high returns: Value investing can potentially generate high returns if the investor is able to identify undervalued stocks and hold onto them until their price rises to reflect their true value.

- Focus on fundamentals: Value investing is based on the principle of investing in companies with solid fundamentals, which can help to reduce overall portfolio risk.

- Long-term mindset: Value investing is a long-term investment strategy that encourages investors to focus on the intrinsic value of a company rather than short-term market fluctuations.

Disadvantages

- Limited growth potential: Companies that are undervalued by the market may be struggling to grow or facing other challenges that limit their growth potential.

- Difficulty in identifying undervalued stocks: Identifying undervalued stocks requires a high level of skill and expertise in financial analysis and valuation, including the amount of time it takes to thoroughly understand the fundamentals underlying a company’s growth potential.

Growth investing

Growth investing is an investment strategy that focuses on investing in companies that are expected to grow at a faster rate than the overall market or their industry peers. Growth investors seek out companies that are innovative, have strong management teams, and are operating in industries with high growth potential. These companies may reinvest their earnings into research and development, acquisitions, or expansion, rather than paying out dividends to shareholders.

Some examples of growth investing are:

- Early-stage Venture Capital: Venture capital firms invest in startups with high growth potential by providing capital and support for scaling. They target companies with innovative ideas, disruptive technologies, or unique business models.

- Growth Equity: Investors provide capital to companies that have shown significant revenue growth and want to expand further. They take minority stakes and fuel growth through organic expansion, acquisitions, or new market entry.

- IPO Investing: Participating in initial public offerings (IPOs) involves buying shares at the IPO price. Successful post-IPO growth can lead to significant appreciation, but it comes with risks as not all newly public companies perform well.

- Sector or Theme-based Investing: Investors focus on specific sectors or themes expected to experience significant growth, such as emerging technologies or renewable energy. By investing in companies operating in those sectors, they aim to benefit from anticipated growth.

- Growth Stock Mutual Funds or ETFs: Mutual funds or ETFs that concentrate on growth stocks allocate their portfolios to companies with high growth potential. Managers use criteria like revenue growth or market share expansion to identify and invest in growth stocks.

Growth investors often prioritize revenue growth over profits, as they believe that a company’s revenue growth is a key indicator of its long-term potential. They may be willing to invest in companies that are not currently profitable but are expected to generate significant profits in the future.

Advantages

- High growth potential: Growth investing focuses on companies that investors hope will experience high growth in the future, which can potentially result in high returns for investors.

- Innovative companies: Growth investors often invest in innovative companies that are operating in emerging industries or have developed new products or services.

- Short-term focused: Growth investing can have huge swings in stock prices but not necessarily long-term viability since infinite growth may not be sustainable.

Disadvantages

- High volatility: Growth stocks can be highly volatile, and their prices may fluctuate significantly in response to changes in the market or the company’s financial performance.

- High valuation: Growth stocks may be priced at a premium compared to the overall market or their industry peers, which can make them more susceptible to market downturns.

- Limited dividend income: Many growth companies reinvest their earnings into research and development, acquisitions, or expansion, rather than paying out dividends to shareholders, which can limit income for investors.

Quality investing

Quality investing is an investment strategy that focuses on investing in high-quality companies with strong fundamentals and a track record of consistent earnings growth. Quality investors prioritize companies with sustainable competitive advantages, strong management teams, and a focus on long-term growth rather than short-term gains.

There are five criteria for examining a company in quality investing:

- Market positioning: Quality investing emphasizes companies with a strong market position, indicating a competitive advantage, higher market share, and pricing power. Investors look for firms with unique products or services, a loyal customer base, and a great brand presence.

- Business model: This outlines how a company creates, delivers, and captures value. Quality investing seeks companies with scalable and sustainable business models that generate consistent revenue and profit growth.

- Corporate governance: Corporate governance refers to the rules and practices governing a company’s direction and control. Quality investing stresses strong governance to ensure oversight, transparency, and accountability. Investors value companies with independent and competent boards, ethical practices, and a commitment to shareholder rights.

- Financial strength: Financial strength evaluates a company’s ability to generate cash flow, maintain a healthy balance sheet, and withstand economic challenges. Quality investors examine key financial metrics like revenue growth, profitability, debt levels, and liquidity.

- Attractive valuation: Attractive valuation assesses whether a company’s stock price reflects its intrinsic value. Quality investing considers companies trading at reasonable or undervalued prices relative to earnings potential and growth prospects.

Quality investors typically hold onto their investments for the long term, as they believe that high-quality companies with strong fundamentals will continue to perform well over time. They may also prioritize dividend income, as high-quality companies with a consistent track record of earnings growth may be more likely to pay out dividends to their shareholders.

Advantages

- Focus on quality: Quality investing focuses on high-quality companies with strong fundamentals and a track record of consistent earnings growth, which can help to reduce overall portfolio risk.

- Long-term mindset: Quality investing is a long-term investment strategy that encourages investors to focus on a company’s fundamentals and potential for long-term growth rather than short-term market fluctuations.

- Potential for dividend income: High-quality companies with a consistent track record of earnings growth may be more likely to pay out dividends to their shareholders, which can provide a steady stream of income for investors.

Disadvantages

- Limited growth potential: Quality investing may not generate the highest returns compared to other investment strategies that prioritize high growth potential.

- Limited exposure to emerging industries: Quality investors may miss out on emerging industries or innovative companies that have not yet established a track record of consistent earnings growth.

- Difficulty in identifying high-quality companies: Identifying high-quality companies with strong fundamentals and a track record of consistent earnings growth requires a lot of time and a high level of skill and expertise in financial analysis.

Index investing

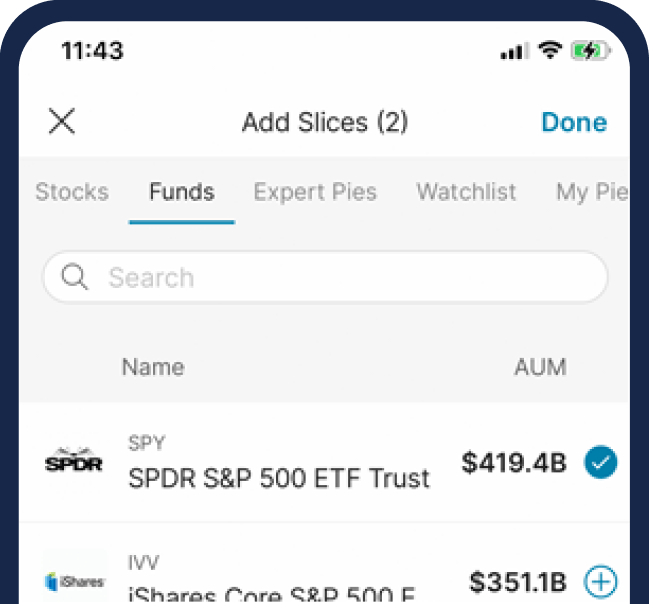

Index investing is a passive investment strategy that typically uses exchange-traded funds (ETFs) or mutual funds to gain broad market exposure to the market index, such as the S&P 500 or the Dow Jones Industrial Average. Rather than attempting to beat the market through active stock picking, index investors seek to match the performance of the market as a whole by investing in a diversified portfolio of stocks that mirrors the makeup of the chosen index.

For example, an investor seeking to replicate the performance of the S&P 500 would invest in a portfolio of stocks that reflects the weighting of each stock in the index. As a result, index investors can achieve diversification with relatively low fees and minimal effort.

Advantages

- Diversification: Index investing offers broad market exposure and diversification, as investors gain exposure to a wide range of stocks across multiple sectors.

- Potential consistent performance: Historically, index investing has usually offered consistent performance over the long term, as the average performance of the market as a whole tends to trend upwards over time.

- Passive investing: Investors do not have to constantly manage their portfolio.

Disadvantages

- Limited upside potential: Index investors are limited to the performance of the market as a whole, and they may miss out on the opportunity for higher returns from individual stocks that outperform the market.

- Little opportunity for active management: If an investor chooses to only focus on index investing, they may miss opportunities in active management. Index investing may need to be combined with other investing strategies.

- Exposure to market fluctuations: Investing in market indexes such as the S&P 500 or the Dow Jones Industrial Average exposes investors to market fluctuations and downturns, which can result in temporary losses.

The M1 line

There are a variety of investment strategies available to investors, each with its own set of advantages and disadvantages.

Dividend investing offers the potential for consistent income streams, while dollar-cost averaging can help reduce the impact of market fluctuations on investment returns. Value investing emphasizes buying undervalued stocks, while growth investing focuses on stocks with high growth potential. Quality investing prioritizes investing in companies with strong financials and competitive advantages, while index investing offers broad market exposure and diversification with relatively low fees and minimal effort.

Ultimately, the choice of investment strategy or strategies will depend on your individual goals.

20230613-2947892-9367782

DISCLOSURES:

M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance .