Understanding Portfolio Rebalancing: A Guide for Investors

Imagine tending a financial garden where each plant represents a different investment. Over time, some plants grow faster than others, changing your garden’s landscape. Just as a gardener prunes to maintain the desired shape, you may need to adjust your financial garden. This process, known as portfolio rebalancing, is an important aspect of investment management.

What is Portfolio Rebalancing?

Portfolio rebalancing is the process of potentially realigning the weightings of assets in an investment portfolio. It typically involves periodically buying or selling assets in an attempt to maintain an investor’s originally desired level of asset allocation or risk.

Potential Benefits of Regular Portfolio Rebalancing

Regular portfolio rebalancing may offer two primary potential benefits:

- Risk Management: Rebalancing may help keep your portfolio’s risk level in check, potentially aligning it with your investment goals and risk tolerance.

- Potential for Improved Returns: By following a disciplined approach of selling relatively high and buying relatively low, rebalancing may potentially lead to improved returns over time, though this is not guaranteed.

However, it’s important to note that rebalancing isn’t without its challenges:

- It may trigger taxable events in non-retirement accounts

- Frequent rebalancing can lead to higher transaction costs

- It can require discipline to sell well-performing assets and buy underperforming ones

Despite these challenges, many long-term investors consider the potential benefits of rebalancing to outweigh the potential drawbacks.

Understanding Asset Allocation: The Foundation of Your Strategy

Asset allocation is a key component of an investment strategy. It determines how investments are spread across different asset classes like stocks, bonds, and cash. But what might this look like in practice?

Here’s a quick comparison of potential different asset allocation strategies for various hypothetical investor profiles:

- Aggressive (Young investor): 80% stocks, 20% bonds, 0% cash

- Moderate (Middle-aged): 60% stocks, 35% bonds, 5% cash

- Conservative (Retiree): 40% stocks, 50% bonds, 10% cash

These allocations are hypothetical examples only. They are not recommendations. Investors should consult with a financial professional to determine the appropriate asset allocation for their individual circumstances.

Key Takeaway: Your asset allocation should reflect your personal financial goals, risk tolerance, and investment timeline.

How to Implement a Rebalancing Strategy

There are several approaches to portfolio rebalancing. Let’s compare them:

Time-Based: Rebalance at set intervals (e.g., annually, quarterly)

- Pros: Simple, consistent

- Cons: May rebalance unnecessarily

Threshold-Based: Rebalance when allocation drifts beyond a set percentage

- Pros: Responds to market movements

- Cons: Requires more monitoring

Combination: Mix of time-based and threshold-based

- Pros: Balances consistency and responsiveness

- Cons: More complex to implement

The effectiveness of these strategies may vary depending on market conditions and individual circumstances.

The 5% Guideline in Threshold-Based Rebalancing

Some investors use a guideline known as the 5% rule, which suggests rebalancing when an asset class deviates by 5 percentage points or more from its target allocation. For example, if your target stock allocation is 60% but has grown to 66%, you might consider rebalancing back to 60%. This is not a universal rule and may not be appropriate for all investors or market conditions.

Implementing Portfolio Rebalancing: Your Step-by-Step Guide

If you’re considering putting rebalancing into action, here are some steps you might follow:

- Review your current asset allocation

- Compare it to your target allocation

- Determine which assets to buy or sell to realign your portfolio

- Execute the necessary trades

When rebalancing, consider these potentially tax-efficient strategies:

- Use new contributions to rebalance

- Focus rebalancing efforts in tax-advantaged accounts like IRAs and 401(k)s

- Consider tax-loss harvesting strategies when appropriate

- Time rebalancing to coincide with other tax-efficient moves

Consult with a tax professional regarding your specific situation.

Common Pitfalls to Consider: Navigating the Rebalancing Process

As you consider your rebalancing approach, be aware of these common challenges:

- Emotional decision-making: For example, panic-selling during a market downturn and disrupting your rebalancing strategy.

- Ignoring transaction costs: Frequent trading can potentially increase fees, which may impact your returns. Consider these costs when deciding how often to rebalance.

- Neglecting the big picture: Consider how each rebalancing decision may affect your overall portfolio allocation and risk level across all your accounts.

- Overlooking tax implications: Be mindful of potential tax consequences, especially in taxable accounts. Consider using tax-advantaged accounts for rebalancing when possible.

- Failing to adjust your strategy: As your financial situation changes, your rebalancing strategy may need to evolve. Regularly review and adjust your approach as needed.

This list is not exhaustive. Investors should carefully consider their individual circumstances and consult with financial professionals as needed.

Rebalancing in Practice: Key Considerations

Let’s address some common questions about rebalancing:

How often to rebalance portfolio?

While annual rebalancing can work well for many investors, the ideal frequency depends on your personal situation and chosen strategy. Some may prefer quarterly checks, while others might use threshold-based approaches.

Can rebalancing improve your investment returns?

While rebalancing is primarily about risk management, it may potentially improve returns by enforcing a disciplined approach. However, there are no guarantees of improved performance.

Should you rebalance your 401(k)?

It’s generally considered important to rebalance all of your investment accounts, including your 401(k), to maintain your overall target asset allocation. Many 401(k) plans offer automatic rebalancing features be sure to check if yours does.

Can you rebalance too often?

Yes, rebalancing too frequently can potentially lead to unnecessary transaction costs and potential tax implications. It’s about finding the right balance for your situation. Remember, the goal is typically to stay reasonably close to your target allocation, not to hit it perfectly at all times.

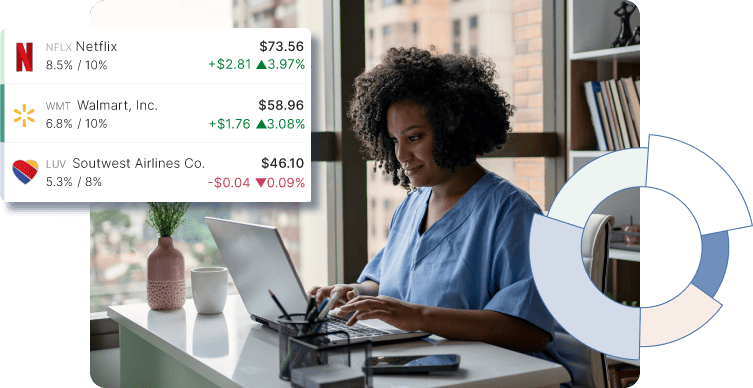

Portfolio Rebalancing Tools and Apps

For those looking to streamline their rebalancing process, various investment platforms offer automated features to help maintain your desired asset mix.

Automated rebalancing tools may offer features such as:

- Continuous rebalancing with each new contribution

- “Set it and forget it” functionality

- Potential for improved tax efficiency by using new contributions to rebalance

- Removal of emotional decision-making from the process

However, these tools may have limitations in terms of customization and may not be suitable for all investors.

The effectiveness of automated rebalancing tools may vary. Investors should carefully review the features and limitations of any investment platform before use.

Conclusion: Your Guide to Rebalancing

Understanding portfolio rebalancing is an important part of managing your investments. Whether you choose a time-based or threshold-based approach, the key is to develop a rebalancing strategy and implement it consistently.

As you consider your rebalancing approach, remember these key points:

- Regularly review your asset allocation

- Choose a rebalancing strategy that fits your needs

- Consider tax implications when rebalancing taxable accounts

- Look at your entire portfolio across all accounts when making decisions

- Stay disciplined and avoid reacting to short-term market movements

With practice and the right tools, you may find that rebalancing becomes a natural part of your investing routine, potentially helping you navigate the markets and keep your financial plan on track.

Are you ready to review your portfolio’s balance? Consider starting by reviewing your current asset allocation, then choose a rebalancing strategy that fits your needs. You might explore automated rebalancing tools like M1’s platform to potentially simplify the process and help keep your investments aligned with your goals.

The views expressed in this article are those of the author and do not necessarily reflect the views of M1 or its affiliates.

Investing involves risk, including the potential loss of principal. M1 is a registered broker-dealer, not an investment advisor. This article is for informational purposes only and does not constitute a recommendation for any particular investment strategy.

This content was generated using artificial intelligence and is intended for informational and educational purposes only. While reasonable efforts are made to ensure accuracy, AI-generated outputs may omit key context and should not be construed as financial, investment, legal, or tax advice. Users should independently verify all information and consult a qualified professional before making any financial decisions.

SAIF-12102024-azj4o7mr